Faced with a significant incident by “colleague” Aave final week, Compound Finance speedily took the needed precautions.

Users of Compound Finance lending platform accepted the proposal to restrict lending to a highest of ten tokens on the protocol. The proposal, floated by fiscal modeling company Gauntlet, was accepted by a vast majority vote on Nov. 28, though complete voter participation represents much less than seven% of COMP tokens in circulation.

In this proposal, notably, big DeFi tokens this kind of as Uniswap (UNI) and COMP decreased their lending limits from eleven.25 million and 150,000 to 550,000 and 18,000, respectively.

Other illiquid altcoins on Compound had been also substantially impacted, this kind of as Yearn.finance (YFI), which decreased its lending restrict from one,500 to just twenty. Ethereum’s model of on-chain Bitcoin is Wrapped Bitcoin (WBTC) , which previously had no lending restrict on Compound, is down to one,250.

Proposal 135 was accepted with a quorum. ✅

Proposal 135 establishes loan limits for 10 Compound v2 markets.

The proposal will be implemented in two days. https://t.co/JvlEPJZrgp

— Compound Governance (@compgovernance) November 28, 2022

According to Gauntlet, the proposal will keep away from the threat of liquidation default, value manipulation and the danger of shorting or longing an asset when taking benefit of Compound lending, resulting in regulatory results of significant dimension relative to the circulating provide of that asset. assets.

The over trouble is most evident in the latest collapse of the Aave lending protocol. On Nov. 22, it was exposed that Avraham Eisenberg, who had been concerned in hacking rumors of the Mango Markets platform, had attempted to target Aave by bulk marketing Curve (CRV), an illiquid token. . However, slippage was discovered to be considerably reduce than anticipated, and Eisenberg is explained to have misplaced about $ten million just after shorting CRV.

For an overview of this incident, please study the particulars by means of the report beneath:

While the incident in query was not right talked about, Gauntlet also performed the threat evaluation and modeling for Aave. Gauntlet then proposed freezing 17 Ethereum tokens on Aave at threat of currently being hacked due to lack of liquidity.

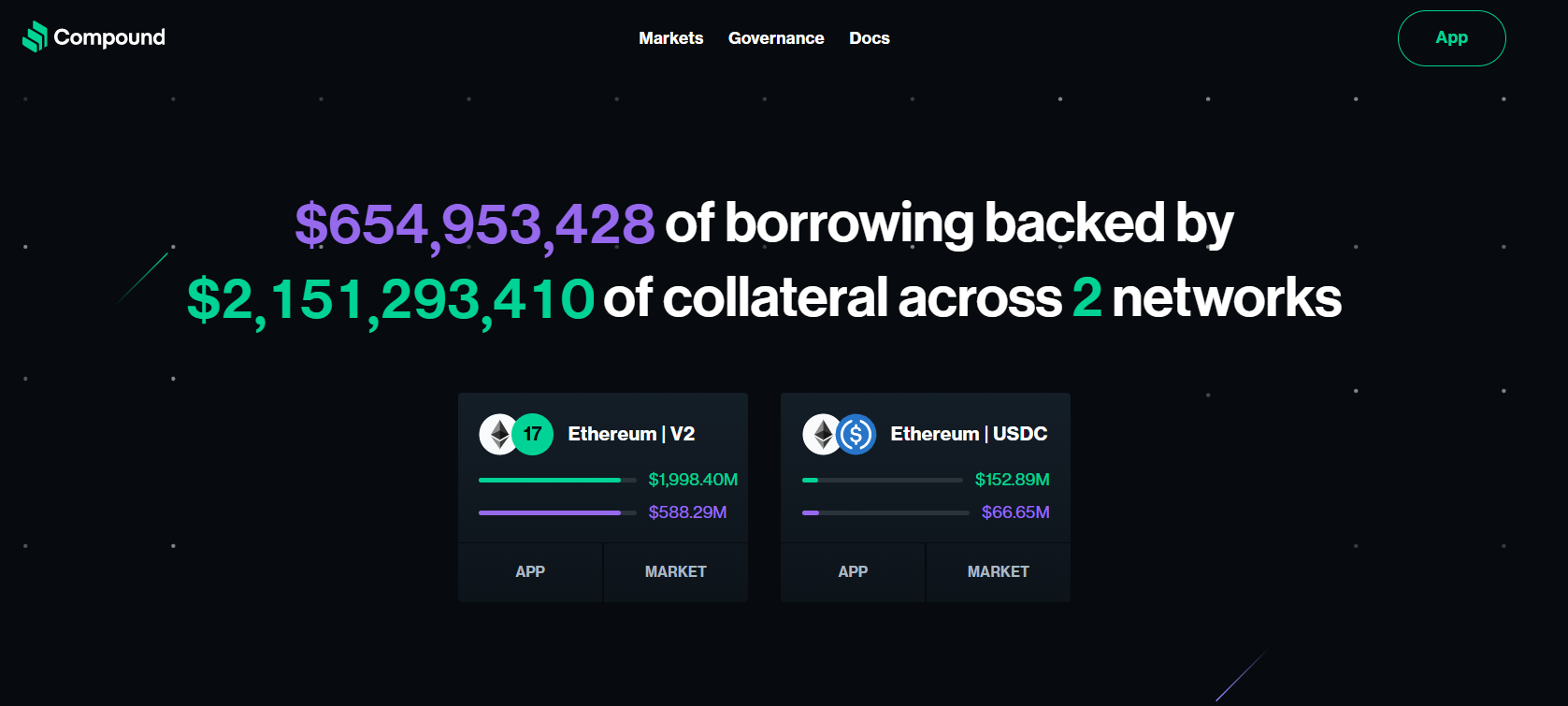

Overall, the most up-to-date proposal from Compound Finance is the needed action of the protocol towards the vulnerability just left by Aave. Because in accordance to existing estimates, Compound Finance acts as the 2nd greatest lending platform in the marketplace, 2nd only to Aave and has a complete loan of $654.seven million collateralized with assets among $654.seven million and $ two.15 billion.

Synthetic currency68

Maybe you are interested: