[ad_1]

The cryptocurrency market generally and Bitcoin particularly will seemingly proceed to expertise promoting stress within the coming weeks. However, the information has indicated many factors that this bear market could also be brief lived.

Bitcoin is in a TEMPORARY bear market

Bitcoin (BTC) is taken into account a consultant forex of the complete cryptocurrency market. Bitcoin Dominance BTC.D (Bitcoin dominance) is an indicator that reveals BTC’s share of the whole market capitalization of the complete cryptocurrency market. Currently this index is round 46.65%.

To assist readers higher perceive how “awful” Bitcoin’s share within the cryptocurrency market is, Coinlive will present an instance of the inventory market as follows:

Apple, a expertise big with a market capitalization of $ 2.2 trillion, is taken into account the corporate with the most important market share within the S&P 500 group, with a complete capitalization of practically $ 35.58 trillion. So, if Apple’s market share within the S&P 500 had been the identical as Bitcoin within the present cryptocurrency market, the corporate would have a brand new market cap of $ 16.6 trillion.

From the instance above, it may be seen that each one returns within the cryptocurrency market generally are strongly correlated with Bitcoin.

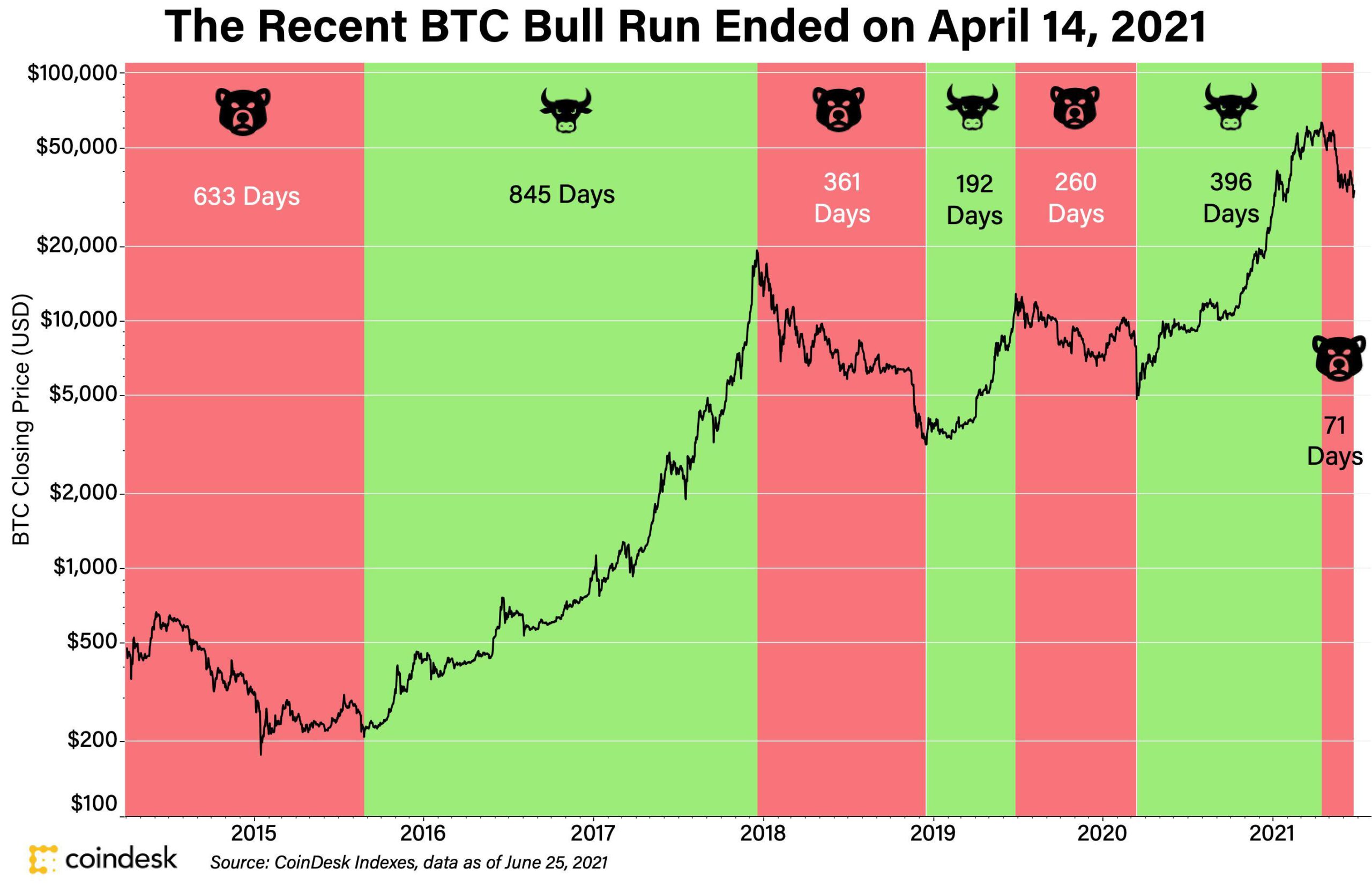

For Bitcoin, a 20% drop is comparatively frequent in a bull run. At the start of the second quarter of 2021, web page CoinDesk offered a easy technique for figuring out whether or not the market has really entered a part downward pattern (or bullish pattern), in addition to answering the query of whether or not a brand new market pattern will open.

It is predicated on the extent of change 20% within the CoinDesk Bitcoin Price Index (XBX), offered then kiện no less than 90 days Bitcoin doesn’t return to its earlier excessive (or low).

The graph above of CoinDesk monitor the rise / fall of the cryptocurrency market over time and likewise makes use of the above technique. As a end result, the XBX index hit an all-time excessive on April 14, 2021, when Bitcoin and Ethereum hit new worth highs, respectively. By April 22, BTC was down greater than 20% and hit $ 50,500.

From this level on, BTC continued its decline to $ 28,825. As of June 28, it is nonetheless coming 23 days throughout the 90 day threshold that the strategy of CoinDesk quote.

CoinDesk predicts that the value of Bitcoin won’t return to $ 65,000 within the subsequent 3 weeks.

But their analysts say the bear market is short-lived.

Factors stopping Bitcoin from rallying

To have 3 components is lowering the shopping for stress within the spot market (find), Including:

GBTC shares are ready to be downloaded

GBTC shares (Trust Bitcoin Grayscale) of Grayscale – the most important Bitcoin fund immediately – has been trading on a downtrend from its internet asset worth since February 2021. This is unlikely to vary when a lot of this fund’s shares are about to be launched in July 2021. an occasion predicted by JP Morgan that might trigger BTC to promote till the tip of the 12 months. 25,000 USD.

Grayscale can not redeem unlocked GBTCs. However, traders are more likely to benefit from this decline for bottom-fish BTC.

Impact of the mining ban in China

China’s crackdown on Bitcoin mining has been materialized by many drastic actions. Mining corporations throughout China have needed to shut down.

This results in a scenario the place a lot of Bitcoin mining tools stays unused. Recently, Bitmain additionally introduced that it’ll briefly cease accepting new orders within the context of the present “old miner” surplus.

As of now, it’s unclear whether or not extra miners in China might be moved to North America or different nations. However, the non permanent impact of this incident was moderately adverse.

The market has no incentive to purchase

The worth rally thanks to purchasing from retail traders in April 2021 helped the trading quantity of Altcoins, together with meme in regards to the coin corresponding to Dogecoin (DOGE), which “overwhelms” the quantity of Bitcoin transactions. However, in the mean time, the buying energy of retail traders has decreased considerably.

Meanwhile, institutional holding measures, corresponding to quantity on LMAX Digital and curiosity in CME Bitcoin futures, present no signal of institutional “precipitation” as costs drop to switch retail traders.

You can perceive that nobody is sitting within the place of “making the price” of the market proper now!

But “fundamental analysis” says in any other case

According to CoinDesk, the potential of a brief bear market nonetheless exists between two massive bull markets. More network knowledge supported this evaluation.

Bitcoin doesn’t have a real “fundamental principle”, which accurately implies that Bitcoin doesn’t signify a requirement for money stream. However, Bitcoin and different cryptocurrencies have numerous indicators that present exercise on the network.

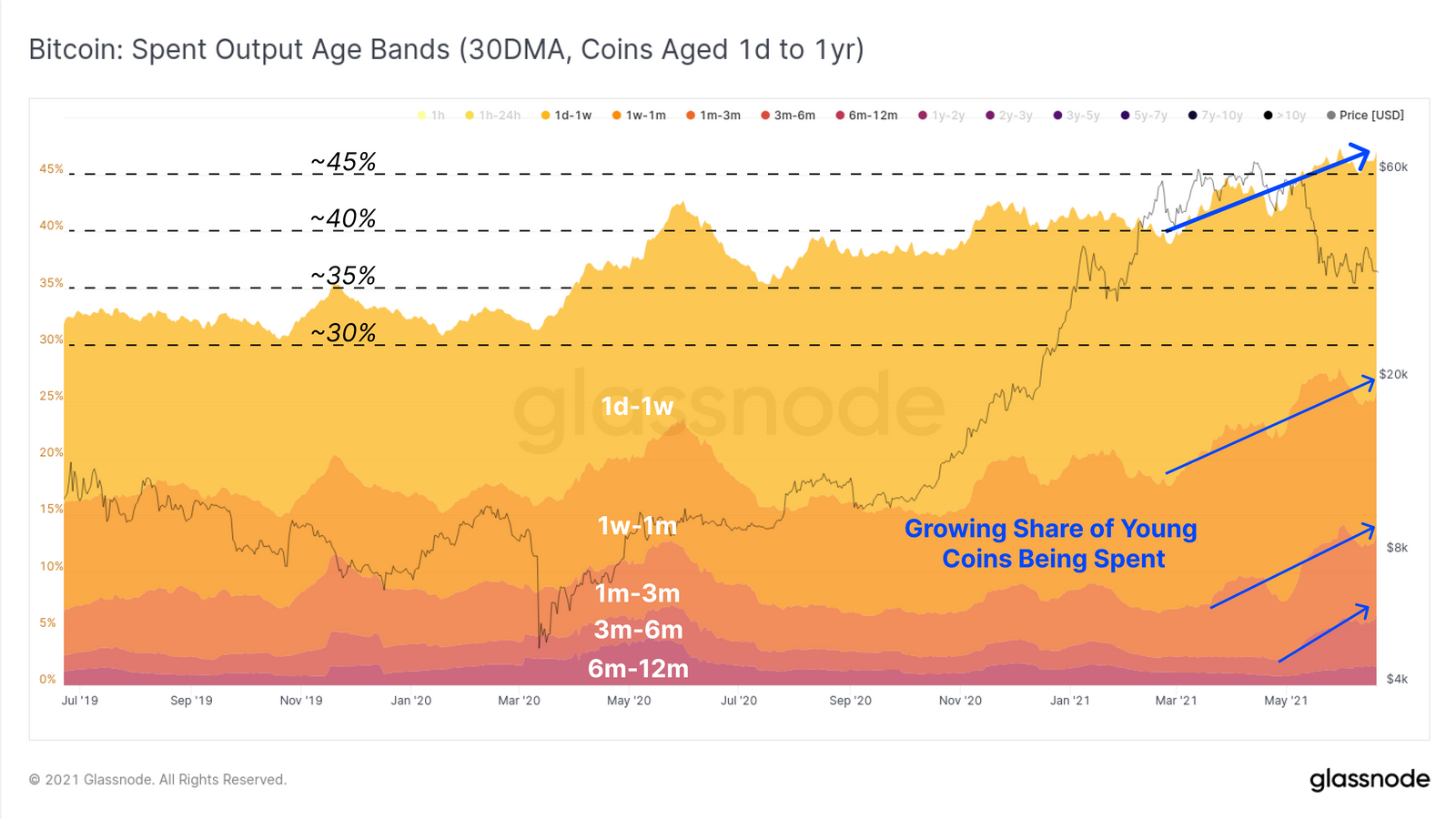

Word chart

On June 28 it confirmed that a considerable amount of Bitcoin that was moved throughout the latest sell-offs are “nascent coins”. These are BTCs which were trading and rotating constantly for the previous 6 months.

This states that:

Short-term traders are promoting and long-term traders are nonetheless ready.

According to a notice from Coin Metrics’ Lucas Nuzzi, the unrealized “hodler” good points have but to achieve the anticipated stage within the face of main Bitcoin crashes.

Synthetic forex 68

Maybe you have an interest:

.

[ad_2]