[ad_1]

Recently, details appeared on Twitter that a member of the DeFi Education Fund had offered all the UNI tokens he had acquired. Especially soon after the fund acquired funding following a Uniswap on-chain governance proposal. So what precisely this incident is and why the Uniswap neighborhood is rather angry with the over move, let us locate out as a result of the post under !!!

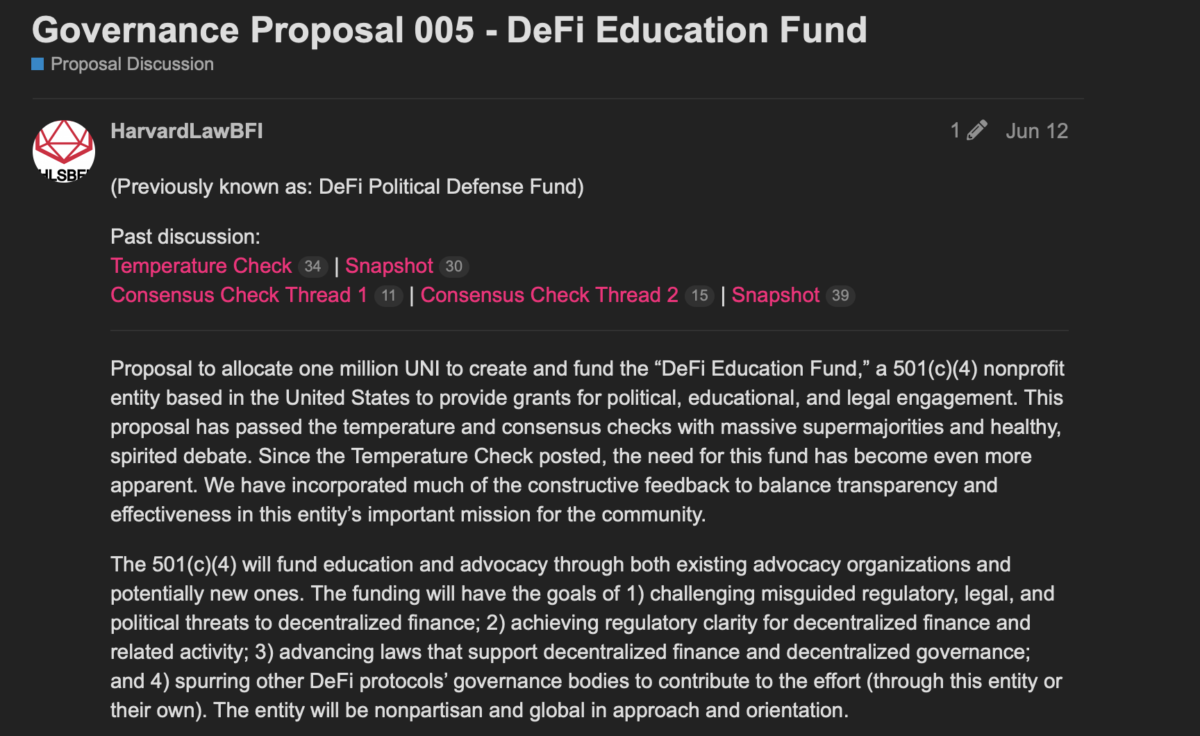

Before we get into the aforementioned UNI token release, let us rewind the proposed time for DeFi Education Fund.

Sponsorship proposal

Specifically, on July twelve, the uniswap neighborhood proposed to donate one million UNI tokens (equivalent to about twenty million bucks) to the DeFi Education Fund. This fund aims to assistance the management of legal defi arrears, as effectively as assistance make the basis for this new technological innovation field.

Suspicious move to promote UNI

In the most current tweet from Igor Igamberdiev (researcher at TheBlock), Larry Sukernik (vital member of the DeFi Education Fund) made a decision to promote UNI tokens just prior to $ ten million was deposited on the marketplace.

one/three

Larry Sukernik, one particular of the multi-signatories to the $ twenty million DeFi training fund, seems to have left UNI 5 hrs prior to the $ ten million OTC sale. pic.twitter.com/JWlxZC2L4Q

– Igor Igamberdiev (@FrankResearcher) July 13, 2021

Larry Sukernik is a effectively-recognized investor in the cryptocurrency marketplace and a vital custodian of the DeFi Education Fund.

three/three

Consider 4 transactions:

– Larry acquired UNI from UGP handle (18 hrs in the past)

– sent .05 ETH to the handle of the DeFi training fund (sixteen hrs in the past)

– traded UNI on $ 50k applying Uni v3 (15 hrs fifty five minutes in the past)

– executed the $ ten million OTC deal (ten hrs and 45 minutes in the past) pic.twitter.com/PSdsulSx6g– Igor Igamberdiev (@FrankResearcher) July 13, 2021

“four precise transactions:

. Larry acquired UNI from UGP handle (the handle of UNI’s proposed administration) 18 days in the past.

. Deposit .05 ETH to the DeFi Education Fund (sixteen hrs in the past).

. Exchange 50.00 USD for UNI (15 hrs in the past)

. Execute OTC orders really worth $ ten million (ten hrs in the past). “

Immediately, the proprietor of the over transaction responded and explained the incident.

The on-chain timeline does not inform the complete story

one. The UNI I offered to my handle came from a grant a group of us acquired a couple of weeks in the past. * I just * observed we acquired it, so we offered it for USDC to send to people today

two. The UNI for DEF had by now been offered at the time of the over sale

– Larry Sukernik (@lsukernik) July 13, 2021

“History can’t be explained in a chain

one / The quantity of UNI I offered was acquired by our workforce a couple of weeks in the past. The emphasis is on getting, so promote USDC so we can send it back to every person.

two / The UNI of the DeFi Education Fund had been also offered prior to the aforementioned time period “.

This was followed by a series of back and forth, when Igor argued that the quantity of UNI through the USDC sale was not transparently made use of on the chain. Meanwhile, Larry explained that this quantity of UNI is ideal made use of when offered on the OTC marketplace.

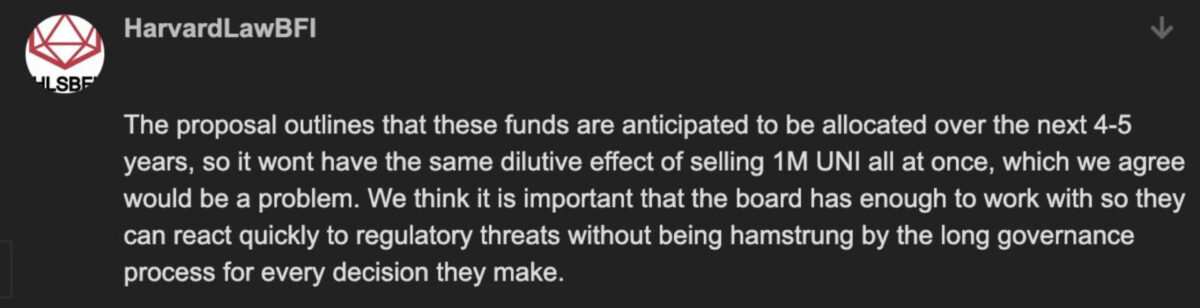

However, this heated debate ended when Account Noah posted a screenshot of the explanation from HarvardLawBFI, and it practically went towards Larry’s arguments.

“This proposal foresees that the over money will be allotted in four-five many years, so there is no want to liquidate one million UNI tokens at a time. We also agree that this is unquestionably the trouble. We also think that the council need to also have sufficient income to perform, react to fast legal modifications with out obtaining to wait as well lengthy from the cumbersome administrative course of action. “

Is on-chain governance definitely decentralized?

Immediately, this situation acquired a good deal of suggestions from the neighborhood. The criticism revolves all-around the situation of centralization in governance when a proposal is authorized but there is no precise strategy and roadmap.

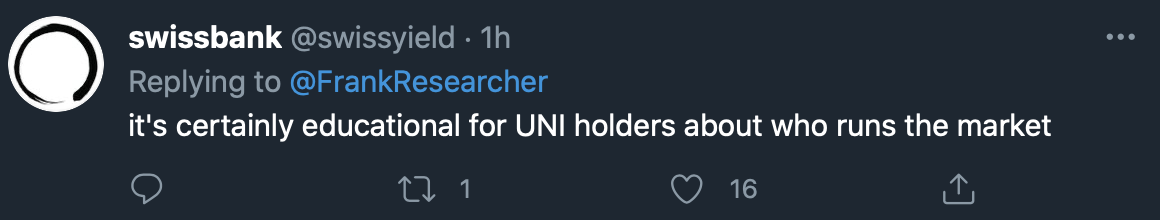

“This education fund will allow UNI holders to know who the community is really controlled by.” – The swissbank account is sarcastic.

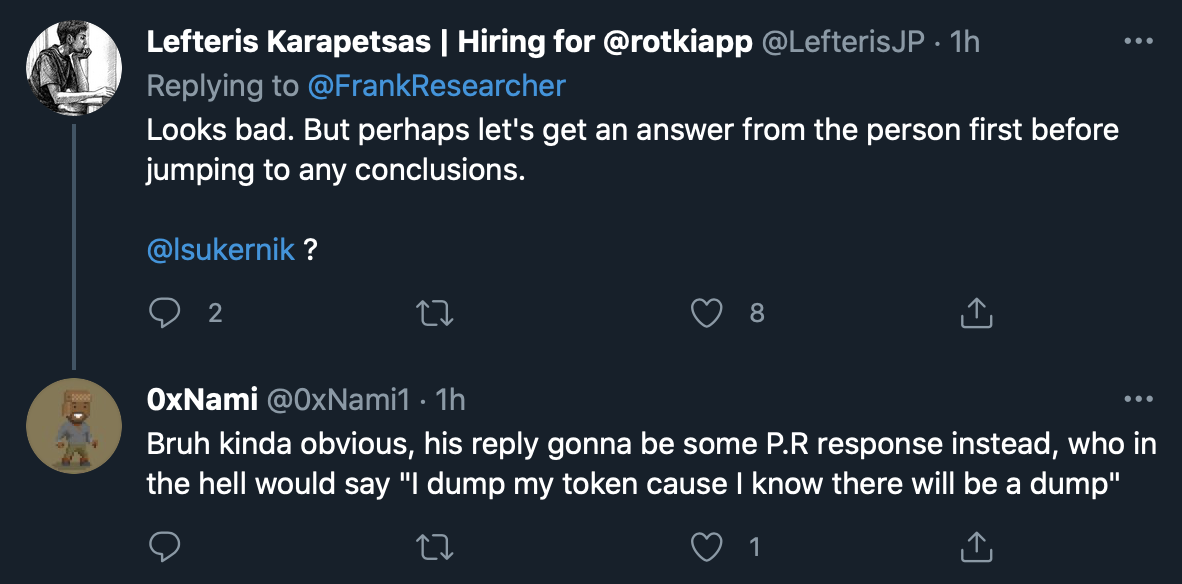

While lefteris (a reasonably lively contributor to the Ethereum developer neighborhood) suggests that every person calmly awaits explanations, the neighborhood is even now pretty outraged by the aforementioned token release.

“Of course, his answer is just a PR disguise, which really went to confirm that” I launched the token simply because I know this token will be launched quickly soon after. “

Synthetic currency 68

Maybe you are interested:

.

[ad_2]