The volume of capital invested in cryptocurrency startups in the third quarter of 2023 reached just underneath $two.one billion, the lowest degree recorded due to the fact late 2020.

Crypto capital mobilization hits a three-yr lower. Photo: Drop Studio

Crypto capital mobilization hits a three-yr lower. Photo: Drop Studio

According to the hottest analysis from the Messari platform, the cryptocurrency winter had a substantial effect on capital raising actions in the third quarter of this yr.

THE STATE OF CRYPTO FUNDRAISING Q3

The downward trend continues

After peaking in the initially quarter of 2022, cryptocurrency funding has declined precipitously in terms of funding volume and variety of trades. The third quarter of 2023 marked amounts not noticed due to the fact the fourth quarter of 2020.

The $two.one billion invested in 297 bargains in the third quarter… pic.twitter.com/F5mnO95ZUP

— Messari (@MessariCrypto) October 5, 2023

The volume of capital raised by cryptocurrency providers final quarter was just underneath $two.one billion, with a complete of 297 bargains. This is the lowest variety recorded due to the fact the fourth quarter of 2020.

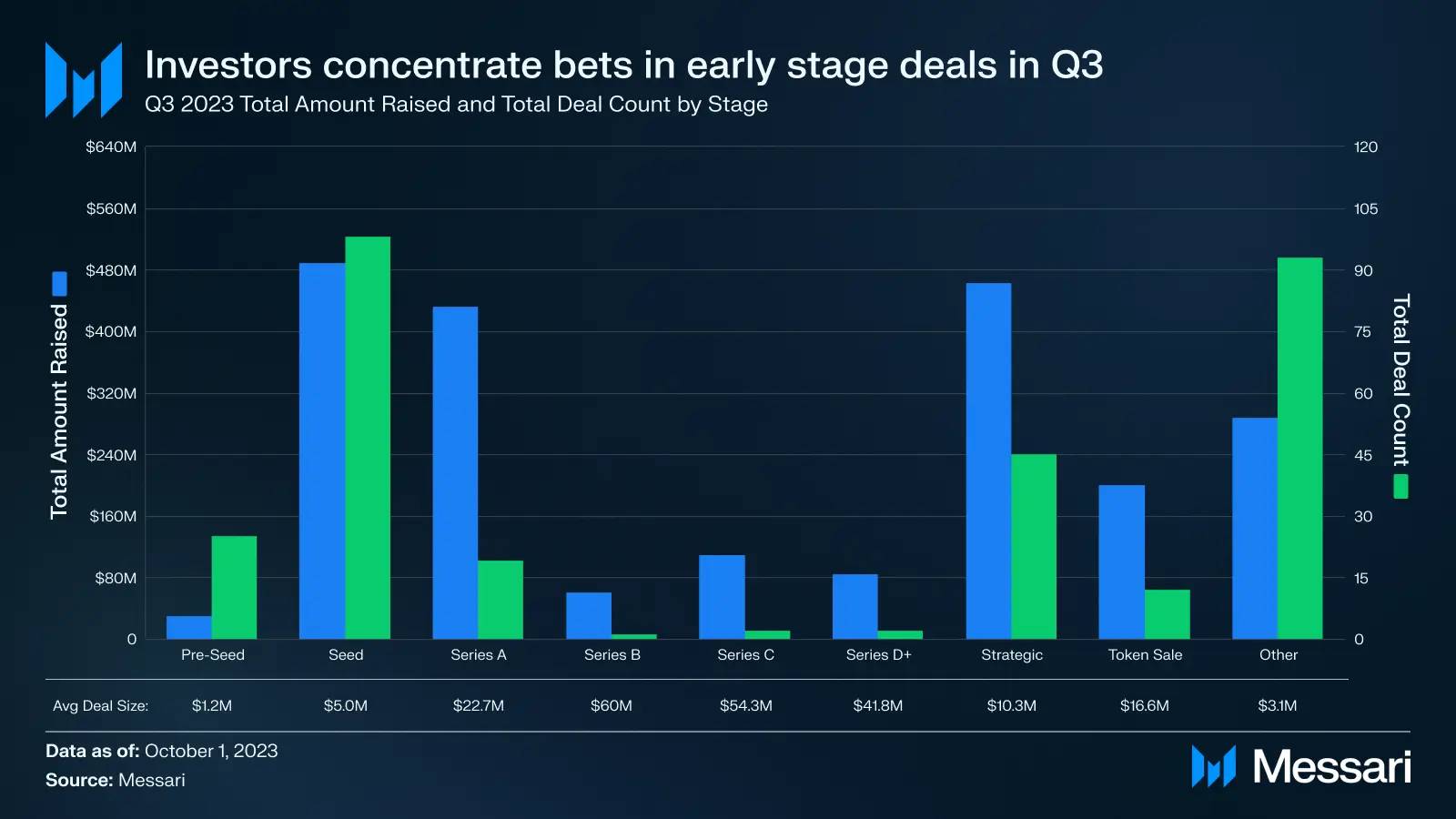

Seed capital raising led the funding receipt group, with $488 million in 98 bargains. In contrast, Series B and later on rounds account for just one.four% of bargains.

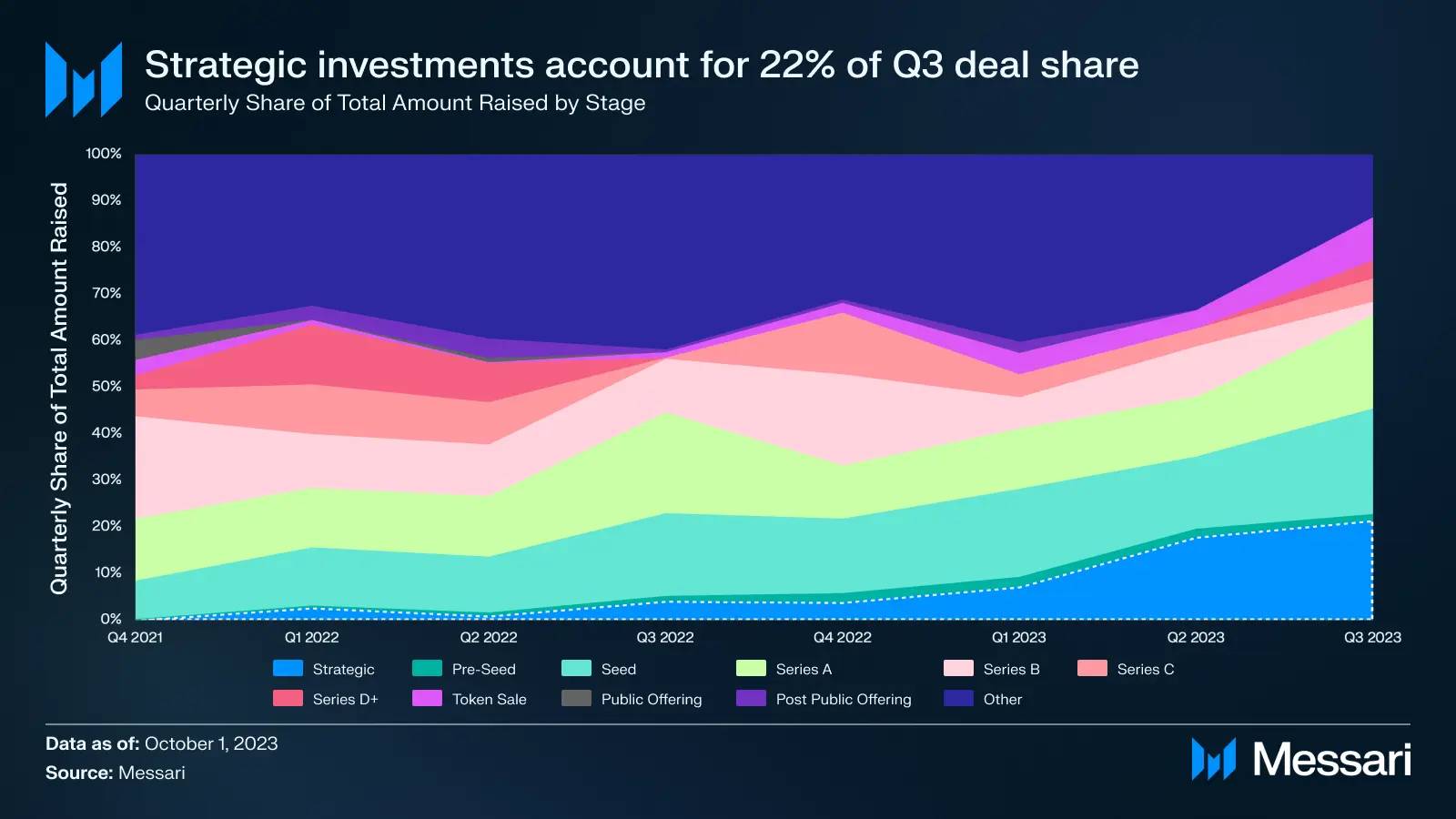

The strategic round enhanced appreciably from .two% in Q4 2021 to contribute up to 22% in Q3 2023.

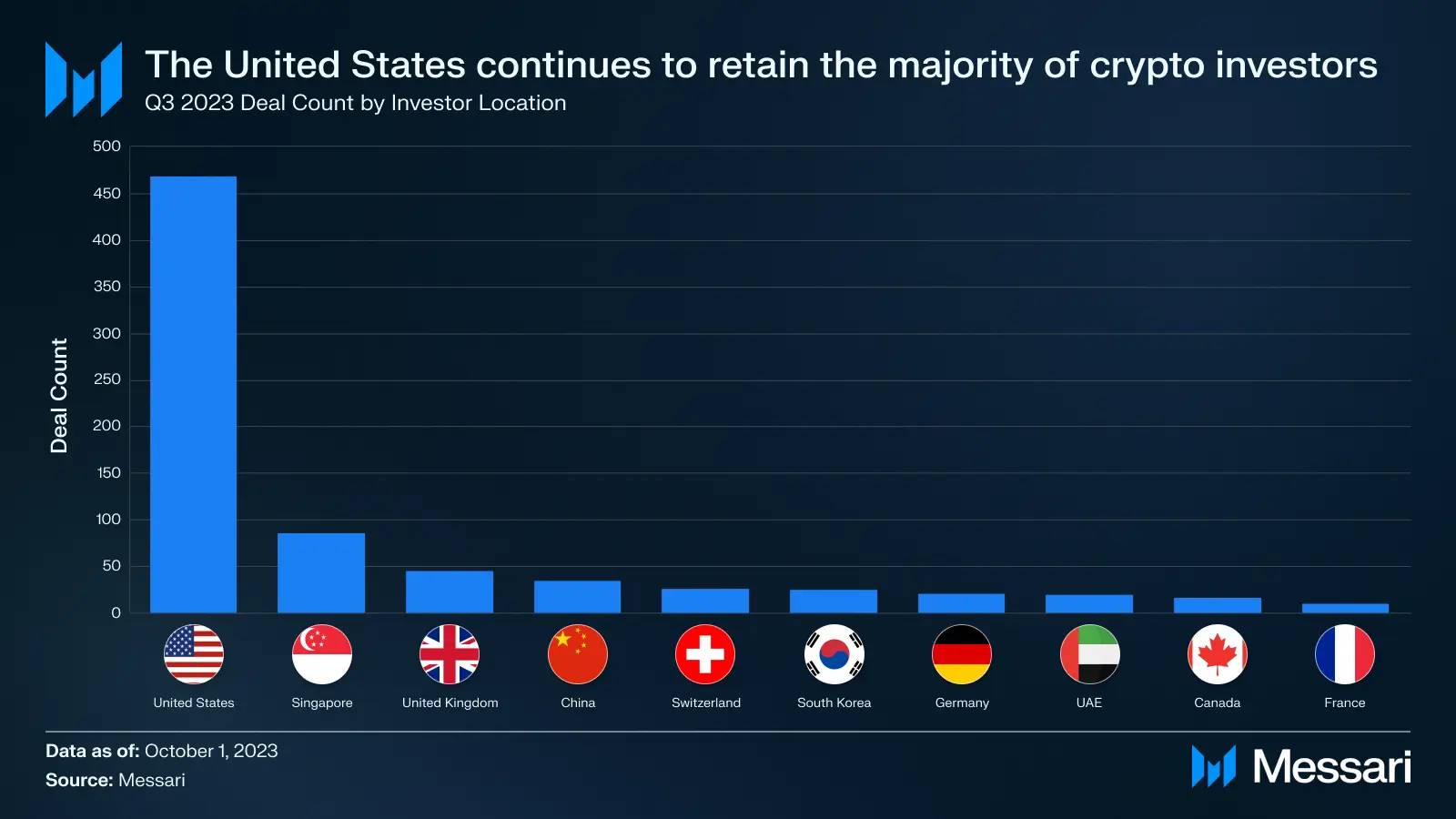

Despite the stringent regulatory landscape, 54% of energetic venture capital entities originate from the United States, even extra than the rest of the globe.

Investment appetite is focusing on early-stage tasks and infrastructure, rather than consumer-dealing with applications as just before.

VCs seem to be cautious with fewer bargains and regular investment sizes turning out to be a great deal smaller sized.

“However, this trend may not last long as investors will gradually realize that without the creation of user-oriented crypto applications, infrastructure investments will also lose meaning.”, commented the Messari analysis crew.

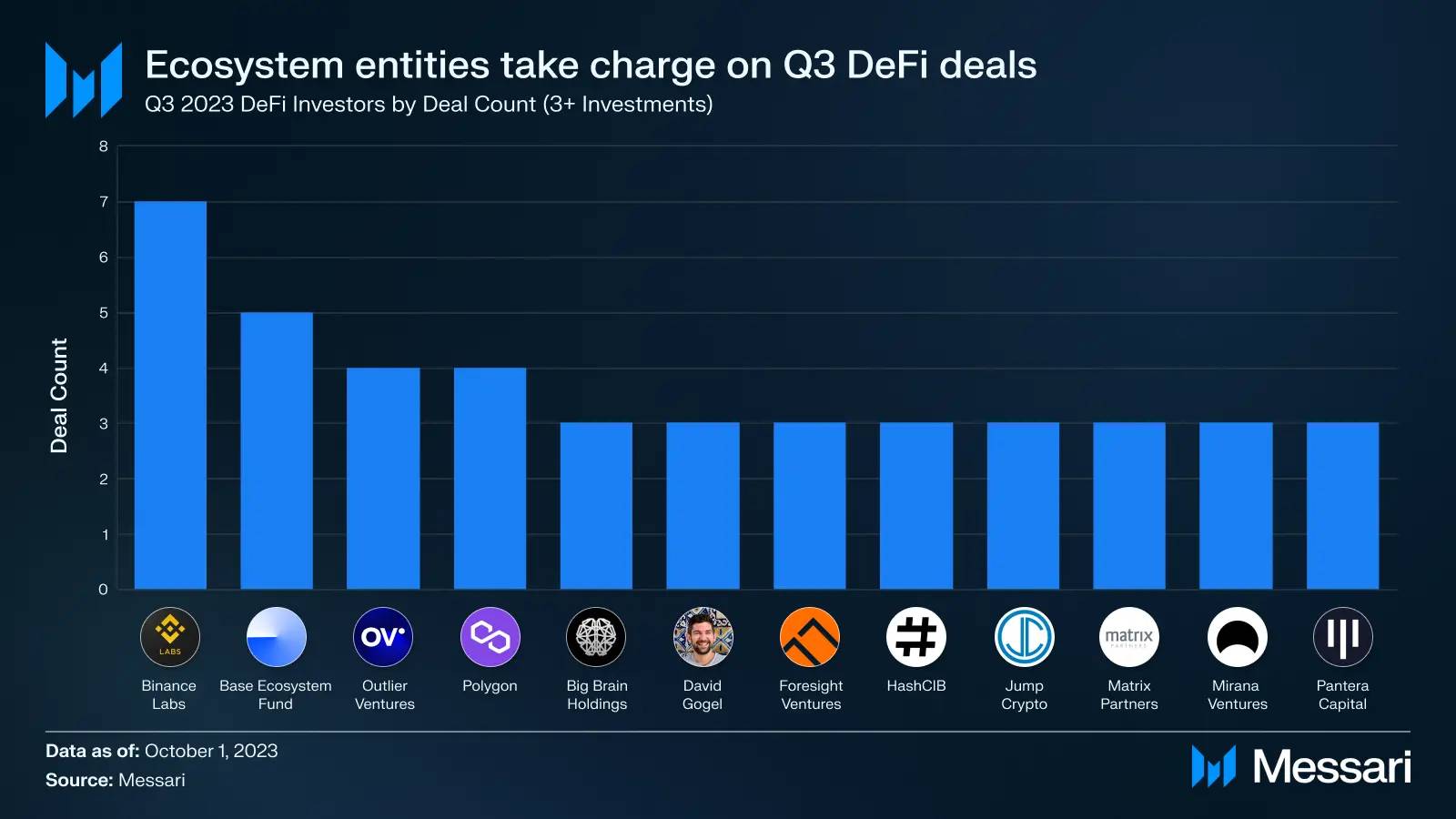

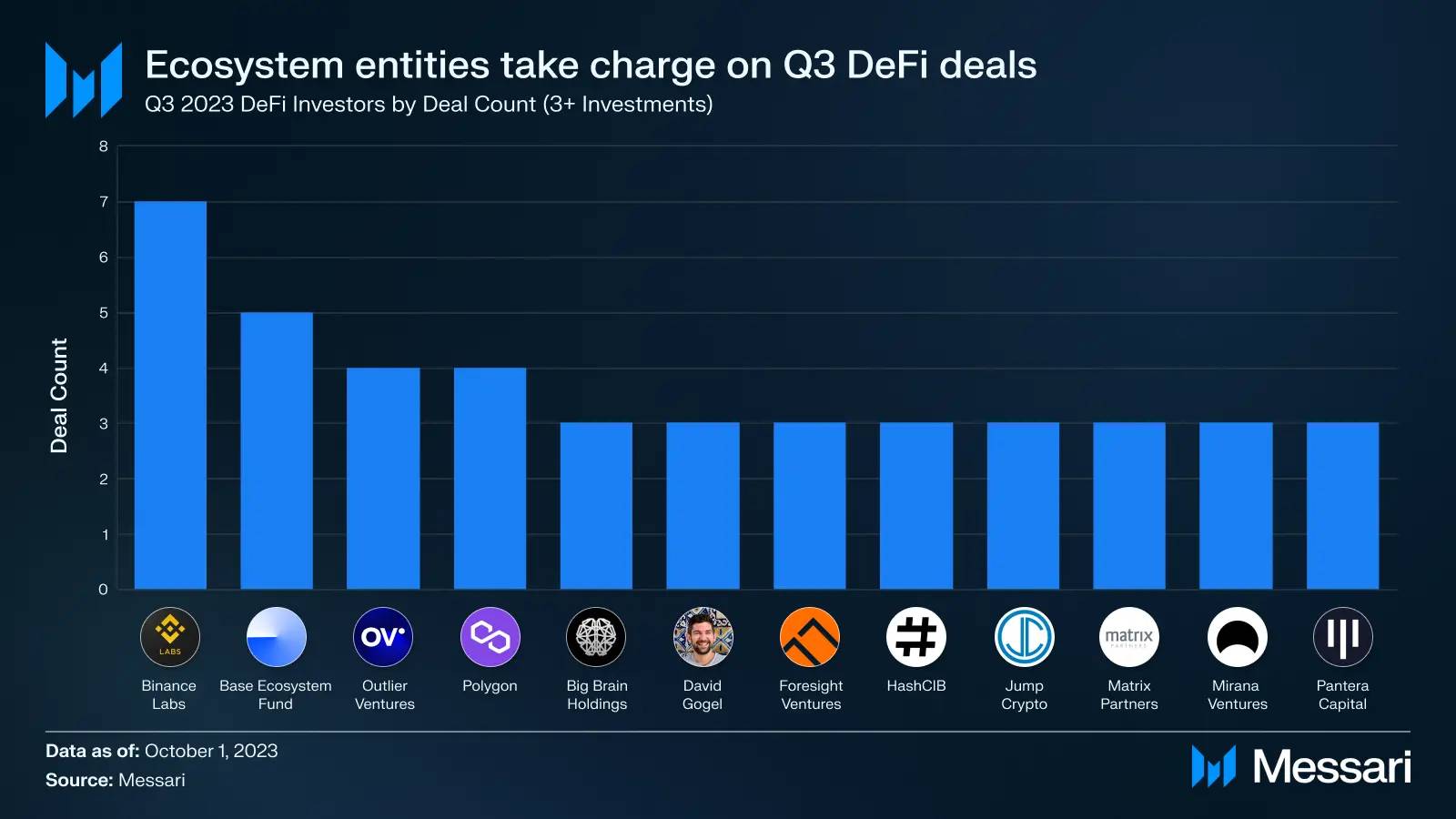

Binance Labs is the most energetic investor in DeFi, followed by Base and Polygon.

Meanwhile, the cryptocurrency marketplace noticed up to $17.five billion in capital mobilized across 900 bargains in the initially quarter of 2022. However, earnings started to decline immediately after a series of scandals during the yr this kind of as the horrible collapse of the Terra ecosystem (May) or the FTX empire (November)…

Entering the initially two quarters of 2023, the cryptocurrency capital raising section is even now holding at a secure degree, with a complete of around $seven.five billion from 200 transactions, all-around the fourth quarter of 2022. However, the efficiency of sponsorships continued to decline in the third quarter and suffered a 36% reduction.

Coinlive compiled

Join the discussion on the hottest problems in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!