- Kaiko reports crypto liquidity concentrating on select platforms, posing risks.

- Binance central to concentration risks without MiCA license compliance.

- Altcoin market depth declines due to liquidity shifts and concentration.

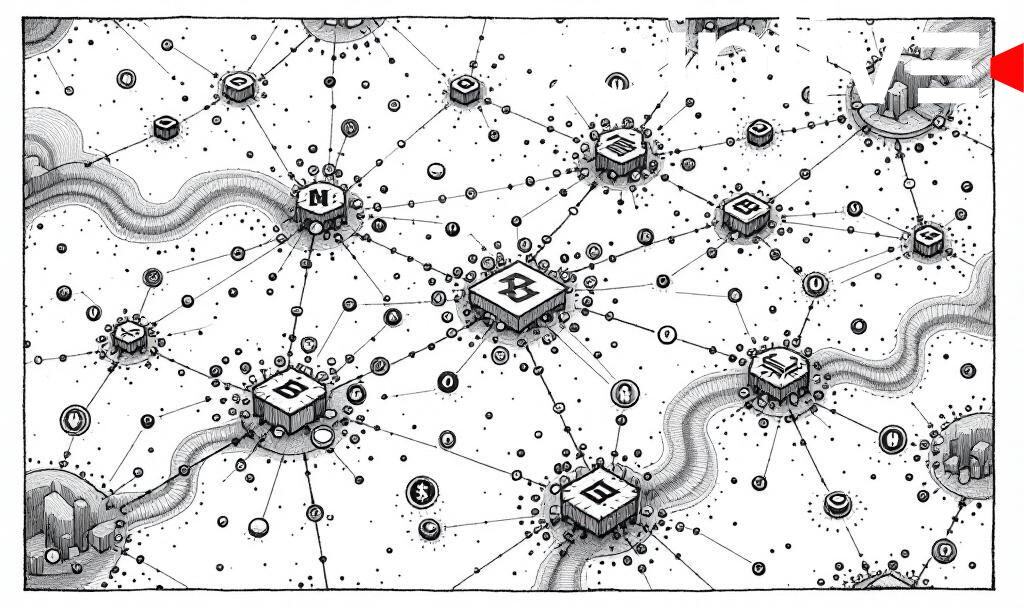

Kaiko’s report from November 11, 2025, highlights the increasing concentration of crypto market liquidity on a few platforms, notably Binance, emphasizing operational and legal risks.

The concentration poses significant risks, with potential implications on market stability and trading dynamics, particularly affecting altcoin liquidity as observed earlier in 2025.

The concentration of crypto liquidity on platforms such as Binance is raising concerns, as highlighted by Kaiko’s latest report. With Binance lacking a MiCA license in Europe, the risks are further compounded, affecting altcoin market stability.

Concentration Risks and Binance’s Role

Kaiko’s latest report highlights a trend in crypto market liquidity becoming increasingly concentrated on a few platforms such as Binance, which poses operational and legal risks. This trend is part of a broader market shift observed earlier. As Adam Morgan McCarthy, Author, Kaiko, states:

“The Crypto Liquidity Concentration Report highlights that market liquidity is increasingly concentrated on a few platforms, particularly Binance, leading to potential operational and legal risks.” – Kaiko Report

Binance emerges as the central player in this scenario, with substantial spot and derivatives volumes but lacking a crucial MiCA license in Europe. The lack of official reactions from exchange leaders further complicates the narrative.

Impacts on Altcoin Market Depth

The immediate impact includes a stable BTC market depth on regulated exchanges, while altcoin depth has seen a decline. These shifts contribute to market volatility and tighter trading conditions globally. Financial implications involve potential access restrictions leading to liquidity concentration on compliant venues, resulting in wider spreads and higher slippage, especially impacting the average altcoin trader.

Leadership Statements and Regulatory Compliance

An absence of leadership statements from prominent industry figures like CZ and others leaves room for speculation on leadership strategies. Regulatory compliance remains a central issue moving forward. The report underscores the need for regulatory clarity, highlighting potential historical parallels to past events like the FTX collapse. Continuing to monitor these trends is crucial for anticipating future market scenarios, as detailed in the Q1 2025 Quarterly Report.