[ad_1]

Bitcoin trading is falling rapidly as the crypto market continues to decline since its recent peak.

The global cryptocurrency market lost $200 billion overnight to the morning of June 8, bringing the weekly loss to $300 billion. The decline has pushed down global market capitalization since Bitcoin (BTC) hit a recent high in April, followed by altcoin peaks in early May. Following a $1.1 trillion loss Since then, last quarter’s growth has been completely wiped out across the entire crypto space.

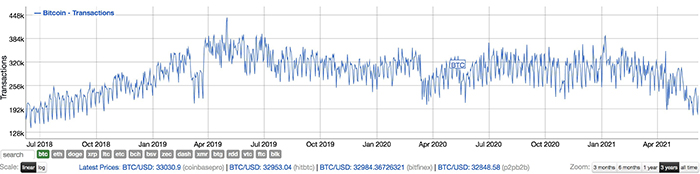

The recent price drop comes at the same time as a marked decline in trading volume on the Bitcoin blockchain. On May 30, the number of daily Bitcoin transactions dropped to as low as 175,000 – a nearly three-year low stretching back to September 2018, according to data from Bitinfocharts.

The number of Bitcoin transactions reached 392,000 in January 2021 and remained fairly stable until April 15 – two days after the BTC price peaked. Since then, both have declined, with trading volume down more than 50% throughout May.

The same goes for Ether, where daily transactions dropped from 1.6 million on May 11 (the same day ETH price peaked), to 1 million on June 6 – a 37.5% loss.

The number of on-chain transactions doesn’t paint the whole picture for Bitcoin or Ether, though, due to the former’s use in the Lightning Network and the latter’s use by its own myriad of Layer 2 protocols.

The dollar value of these coins locked in the Lightning Network has also plummeted since reaching an all-time high of $76 million on April 14, dropping to $47 million at press time.

Maybe you are interested:

Join our channel to update the most useful news and knowledge at:

According to CoinTelegraph

Compiled by ToiYeuBitcoin

[ad_2]