The cryptocurrency market saw a significant decline, wiping out more than $850 million in liquidations. This event took place after the Federal Reserve announced its decision to reduce the basic interest rate by 25 points.

Although markets had anticipated a mild rate cut, signals from Chairman Jerome Powell of a cautious approach to adjusting interest rates in 2025 caused widespread uncertainty and selling.

Bitcoin’s Wave of Drops Liquidates Nearly 300,000 Cryptocurrency Traders

During the press conference, Powell noted that while inflation was falling “steadily,” the pace of decline was “slower than expected.” As a result, the Fed revised its inflation forecast for 2025 to 2.5%, hinting at the possibility of tightening economic conditions that could limit liquidity in financial markets, including cryptocurrencies.

“Inflation has made progress towards the Committee’s 2% target but remains quite high. The economic outlook is uncertain, and the Committee is mindful of risks to both sides of its dual mandate,” Federal Reserve said in the press release.

This monetary policy change led to a sharp decline in Bitcoin, falling below $99,000—down more than 8% from its peak of $108,000. Similarly, the broader cryptocurrency market, including major coins such as Ethereum (ETH), also suffered significant losses.

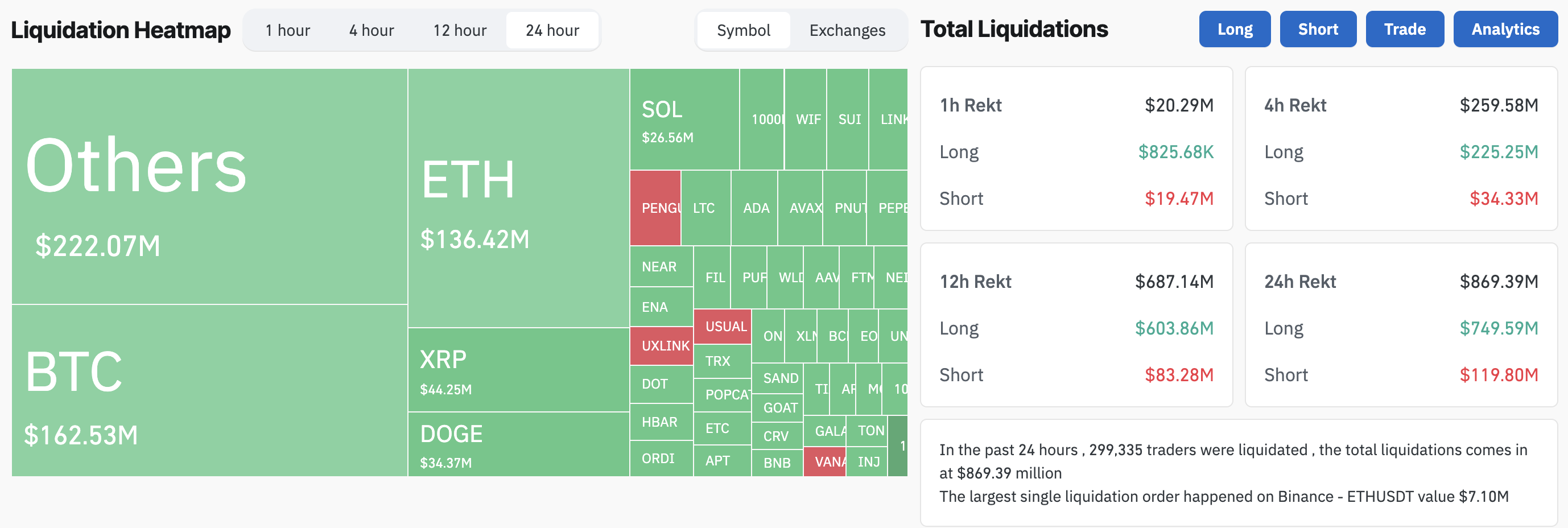

According to Coinglass, the past 24 hours saw a staggering $869.39 million in liquidations, with $749.59 million from long positions and $119.80 million from short positions. Notably, altcoins bore the brunt of the impact, accounting for over $222 million in liquidated assets.

Amidst these market fluctuations, a total of 299,335 traders were caught unprepared. The largest liquidation order occurred on Binance, involving a $7 million Ethereum transaction.

Despite these setbacks, the emotions of crypto traders are surprisingly resilient. The Crypto Fear and Greed Index is now at 75, reflect a strong bullish outlook amid market volatility. This sentiment underscores the continued appeal of cryptocurrency as an investment, even in volatile times.

Reinforcing this optimism, Bitcoin-related investment products saw notable inflows. For example, BlackRock’s iShares Bitcoin Trust noted $359.6 million in new investments on Wednesday alone. Meanwhile, total inflows for all spot Bitcoin ETFs reached $275.3 million.

These developments—reflecting Fed caution and crypto market optimism—reveal a complex interaction between macro policies and crypto markets. Investors appear to be hedging economic risks by increasing their holdings in digital assets, which, despite their potential for volatility, are still seen as a viable strategy for diversification. catalogue.

Recent market activity highlights the influence of US monetary policy on the cryptocurrency sector. As the Federal Reserve continues to navigate inflation-related challenges, the cryptocurrency market response remains swift and pronounced.