Bitwise Asset Management has filed to establish a trust in Delaware for its Solana ETF (exchange-traded fund) proposal. The move signals a new effort to expand Cryptocurrency products amid growing interest in blockchain-based assets.

This filing represents the preliminary steps necessary to launch the financial instrument. The general expectation is that it could lead to a filing with the US Securities and Exchange Commission (SEC) for approval.

Bitwise Plans Strategic Expansion With Solana ETF

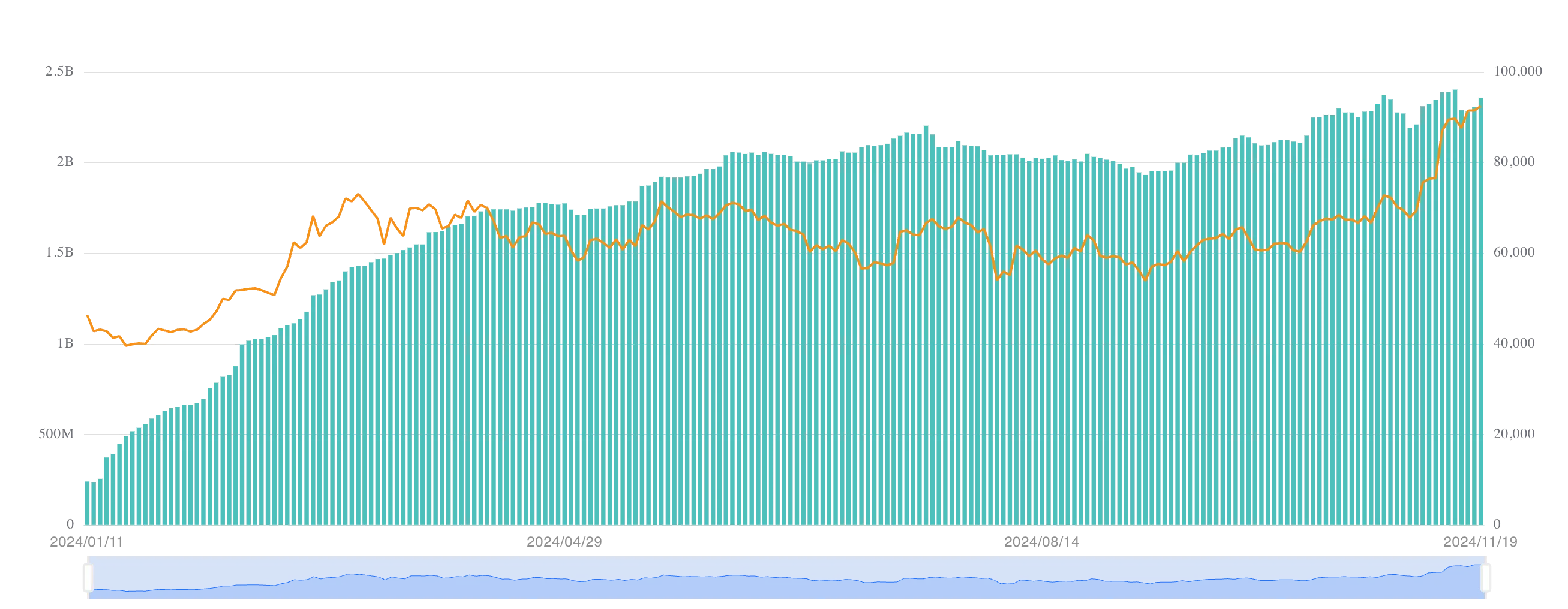

According to State department recordsBitwise’s proposed Solana ETF aims to track the price of Solana (SOL). The move is part of Bitwise’s broader expansion strategy and follows the 400% growth notable in the company’s assets under management (AUM) this year. Currently, Bitwise owns at least $5 billion in assets under management (AUM).

These recent acquisitionslike the Ethereum Attestant staking service, and the success of their Bitcoin spot ETF BITB demonstrates a strong growth trajectory. Notably Bitwise’s BITB has attract 2.3 billion USD inflows. Meanwhile, their Ethereum ETF (ETHW) is currently available noted $373 million positive cash flow.

Although it has not yet announced its proposed stock code or exchange list, Bitwise’s Solana ETF filing puts the company in competition with rivals such as VanEck, 21Shares and Canary Capital. These entities are also attempting to capitalize on Solana’s increasingly prominent position, with VanEck comparing Solana to commodities like Bitcoin and Ethereum in his filing.

“The language in Ethereum ETF 19b4s, describing ETH as a commodity also applies to Solana,” said Mathew Siegel, head of research at VanEck.

While it’s progress, the road to approval of a Solana ETF has been fraught with challenges. The SEC has historically clamped down on Crypto ETFs, citing concerns about market manipulation, custodial risks, and asset classifications like Solana. Industry experts have expressed doubts that the SEC will

allows a Solana ETF in the near future, as seen in previous filings where Solana’s status as a commodity has been questioned.

Furthermore, the templates for the Solana ETF were previously delisted from the CBOE (Chicago Options Exchange) due to unresolved regulatory concerns. This caused the probability of approval to drop to almost non-existent earlier this year, creating skepticism among market participants.

New Hope Under the Trump Administration

However, the situation appears to be changing following the re-election of Donald Trump, which many in the industry see as a potential boost for the Cryptocurrency sector. The Trump administration has signaled a pro-crypto stance, with experts suggesting that his policies could create a more favorable regulatory environment for ETFs like the one Bitwise has proposed. .

According to analysts, Trump’s commitment to promoting innovation and reducing bureaucratic hurdles could allow the SEC to approve more Crypto ETFs, including Solana-focused products.

“Solana’s biggest win from the new Trump presidency will be the ETF we’ve been waiting for in 2025 or 2026. No surprise, the incredible VanEck team will lead the way with support from 21Shares and Canary Capital,” said Dan Jablonski, head of development at news and research company Syndica.

If the Solana ETF is approved, it could mark a major change in the US regulatory environment. Up close, it would allow the country to keep pace with the likes of Brazil, which launched a Solana ETF earlier this year. Such developments could help the US consolidate its position as a leading country in the global Cryptocurrency market.

The expected approval of a Solana ETF under the Trump administration would have far-reaching implications for the US Cryptocurrency market. It could stimulate greater institutional adoption, spur innovation, and position the country as a leader in blockchain technology.

Furthermore, it would send a strong signal that the regulatory environment is gradually becoming more favorable to Cryptocurrencies, which could attract more investment, talent and a potential XRP ETF, which Bitwise and Canary Capital is already leading the way.

“In addition to the listing of the Cryptocurrency Index Fund from Grayscale & Bitwise, there are now spot ETF applications for SOL, XRP and HBAR. Expect at least one issuer to test an ADA or AVAX ETF,” Nate Geraci said on X (Twitter).

According to data from TinTucBitcoin, Solana Token price is increasing by 1.48% on this information. As of the time of writing, SOL is trading for 238.91 USD.