This week, many big stories and important developments took place in the cryptocurrency sector, including rumors of a presidential pardon for FTX’s Sam Bankman-Fried, EU exchanges delisting Tether’s USDT and Ripple donate $5 million to Trump’s inauguration.

Centralized exchange Crypto.com has also expanded its operations in the United States, as Singapore and Hong Kong become major hubs for the industry in the region.

Amnesty Rumors for FTX’s Sam Bankman-Fried

Rumors are circulating that Sam Bankman-Fried (SBF), the infamous founder of FTX who caused one of the industry’s biggest financial collapses, could receive a Presidential pardon . CEO of Tesla, Elon Musk, said he would be “very shocked” if the SBF did not receive an amnesty.

These rumors are based on the fact that SBF was the 2nd largest individual donor to the Democratic Party in 2020 before being arrested.

Sam Bankman-Fried used more than $100 million in stolen client funds to donate to political campaigns. Watch him get pardoned. 100% Biden,” Jason Williams writes.

Not everyone agrees with this analysis. For example, the US government has signaled more friendliness towards cryptocurrencies, and the new SDNY Solicitor General said his office will ease up on cryptocurrency prosecutions. However, this only happened after he completed the dismissal of SBF’s appeal. In other words, there is a strong incentive to keep him in prison.

However, this motivation may not yield much. Joe Biden is now at the end of his term; His party lost the election, but he remained in power.

Last week, Biden extended it pardon to the infamous “kids for cash” judge who took bribes to detain hundreds of children. In other words, the President is willing to sign extremely unpopular pardons.

EU Exchange Removes Listing of Tether’s USDT

Due to upcoming Markets in Crypto Assets (MiCA) regulation in the EU, European exchanges have begun delisting Tether’s stablecoin USDT.

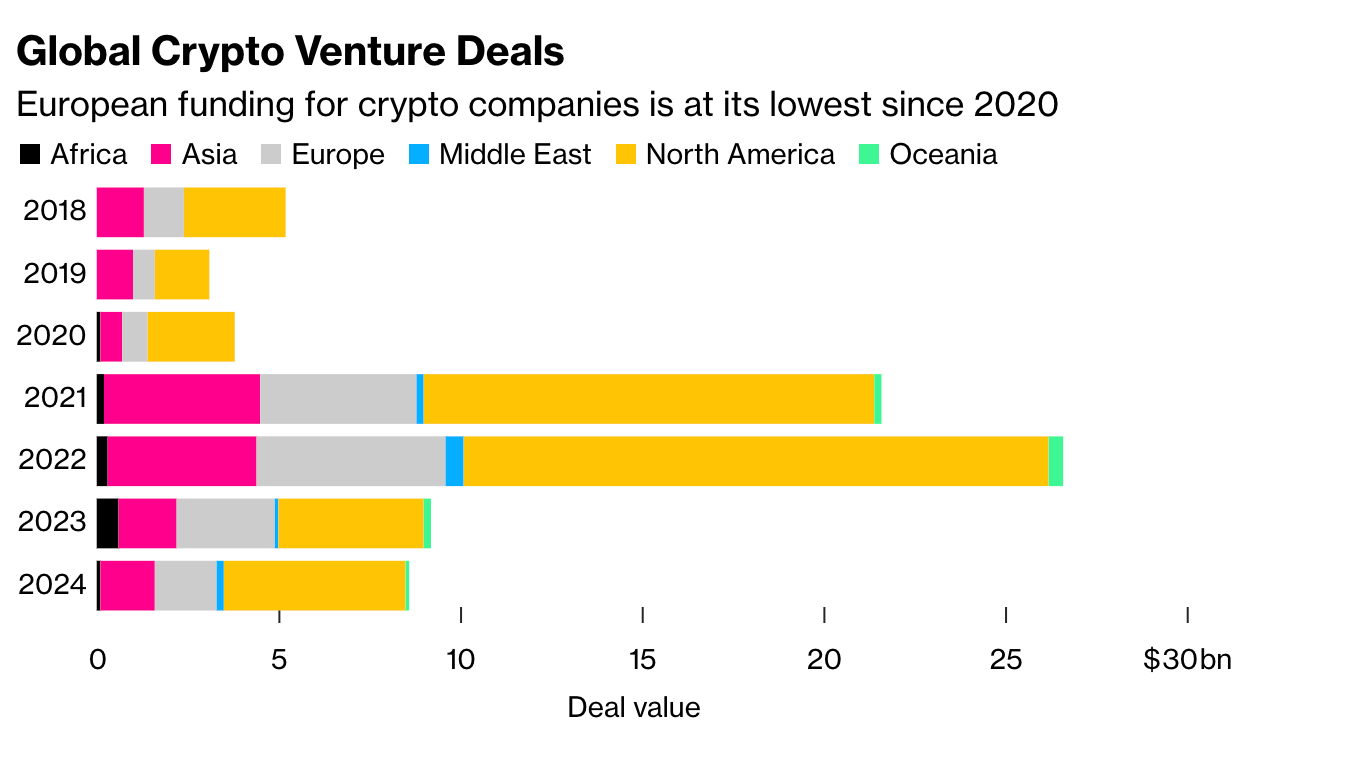

However, industry observers fear the move will significantly hinder cryptocurrency development in Europe, especially as the US market is booming. Recently, the EU region is lagging behind in cryptocurrency adoption compared to previous years.

The company has prepared for this storm. Tether has scaled back its EU crypto operations while also investing in MiCA-compliant stablecoins.

Furthermore, the company has profited significantly from several investments and partnerships in the United States, and even gained some political benefits. In other words, MiCA could influence European cryptocurrencies more than Tether.

Ripple Donates $5 Million To Trump’s Inauguration

Ripple pledged to donate 5 million USD worth of XRP Tokens to President-elect Donald Trump’s inauguration day. It is the largest donor, but other crypto companies such as Kraken and Binance have also donated, totaling about $8 million.

These donations come with many special benefits, such as attending private dinners with Trump and members of his cabinet.

“Ripple Makes Record Large Donation to Trump. Ripple just donated $5 million in XRP to bolster Trump’s $200 million inauguration treasury. This is the largest cryptocurrency donation ever. Cryptocurrency is not just an alternative investment tool anymore, we are seeing it reshape the political world in real time,” Mario Nawfal write on X (formerly Twitter).

During the last election cycle, Ripple was a major donor to pro-crypto candidates of both parties. Notably, however, this behavior continued even after the elections were over.

Last month, the company donated $25 million to prepare for the midterm elections, which will take place in the next two years. Clearly, corporate political contributions show no signs of stopping.

Crypto.com, a cryptocurrency exchange headquartered in Singapore, has launched a Trusted Depository Company to provide new services in the United States. Some of these new services include exchanges, exchanges, NFT marketplaces, and crypto payments.

“Establishing a U.S.-based trust is the latest major step in our product roadmap to build business and presence in two of the most important and dynamic crypto markets world – United States and Canada. This move reflects our confidence in the North US market, and we look forward to continuing to enhance and innovate the market for our customers,” said Kris Marszalek, co-founder and CEO of Crypto.com.

The company has increased its presence in the United States recently, with Marszalek meeting Trump at Mar-a-Lago this month. After their closed-door meeting, Crypto.com withdrew its lawsuit against the SEC.

Representatives of the exchange claim the move signals a new willingness to cooperate with the incoming administration and develop new, friendlier policies.

Singapore Leads Asia in Electronic Money Licenses

Singapore also leads Southeast Asia as a cryptocurrency hub, issuing more licenses to crypto-related businesses than any other country in the region. This also includes Hong Kong, which has been trying to assert itself as a regional leader in recent months.

Additionally, Independent Reserve became the first Singapore exchange to list Ripple’s new stablecoin, RLUSD.

“Independent Reserve is proud to be the first regulated exchange in Singapore to provide secure and trusted access to RLUSD, upholding our mission of leveraging cryptocurrency and blockchain technology to transfer transforming financial services,” Lasanka Perera, CEO of Independent Reserve Singapore, said in a statement press release.

However, Singapore and Hong Kong have been significant pioneers in the cryptocurrency industry this year. Compared to the population, they significantly outperform many important metrics such as blockchain patents, industry employment, and active exchanges.