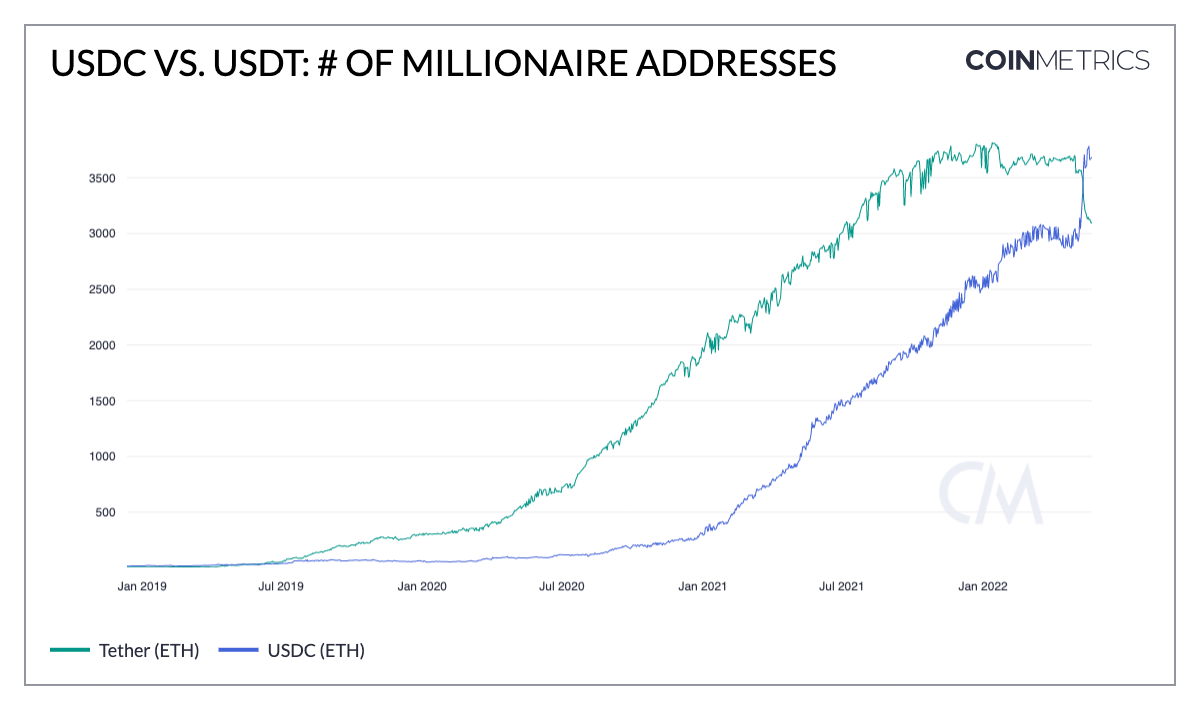

There has been a significant shift in crypto whale mindset about picking in between the two existing stablecoin industry leaders, Tether (USDT) and USD Coin (USDC), following the LUNA-UST occasion.

According to information from CoinMetrics, a properly-recognized blockchain analytics company, it exhibits that the variety of wallet addresses on Ethereum containing much more than $ one million USDC has exceeded the variety of wallets containing USDT, establishing strong proof confirming that USDC has grow to be the favored stablecoin on Ethereum, not USDT.

This occurred amidst the industry turmoil that was not nonetheless in excess of due to the LUNA-UST occasion, which dragged the worth of the two currencies shut to zero in just a couple of days, resulting in a fast reduction of USDT. Although the USDT price tag rapidly returned to USD one, the fluctuation of the industry-main stablecoin is triggering a whole lot of confusion for investor self-assurance.

CoinMetrics has looked at the over information considering the fact that May 9, when UST misplaced its 1st USD peg. The corporation recognized 147 Ethereum wallet addresses that greater their USDC stability by at least USD one million when lowering their USDT by the very same worth.

Among them, there are 23 organizations that have additional at least ten million USDC and liquidated ten million USDT. Many of these addresses are exchanges, custodianships, or DeFi protocols. Therefore, CoinMetrics analyst Kyle Waters pointed out that significant gamers are lowering the chance of their holdings by moving to USDC asset-backed reserves with total and transparent securitization. Circle, the corporation behind USDC.

Because it has lengthy been rumored that Tether, the corporation behind USDT, has quite a few vague indicators of help background, even although USDT nevertheless exists as a stablecoin with the key industry cap. It was only in the encounter of the LUNA-UST occasion, named by the neighborhood to “verify” due to the complete provide falling by $ seven billion in a week due to significant consumer withdrawals, that Tether launched a report which licensed the account. new asset, claiming to hold $ 82.four billion in reserves, claiming “excess power” in help of the USDT.

For a comprehensive overview of the escrow issuance of Tether (USDT), USD Coin (USDC) and other stablecoins, as properly as the standard developments surrounding the problems that have engulfed USDT in current occasions, go through the facts in the write-up by following :

– Detail: Investors pour into stablecoins: why USDT depreciates, USDC – BUSD “on the throne”?

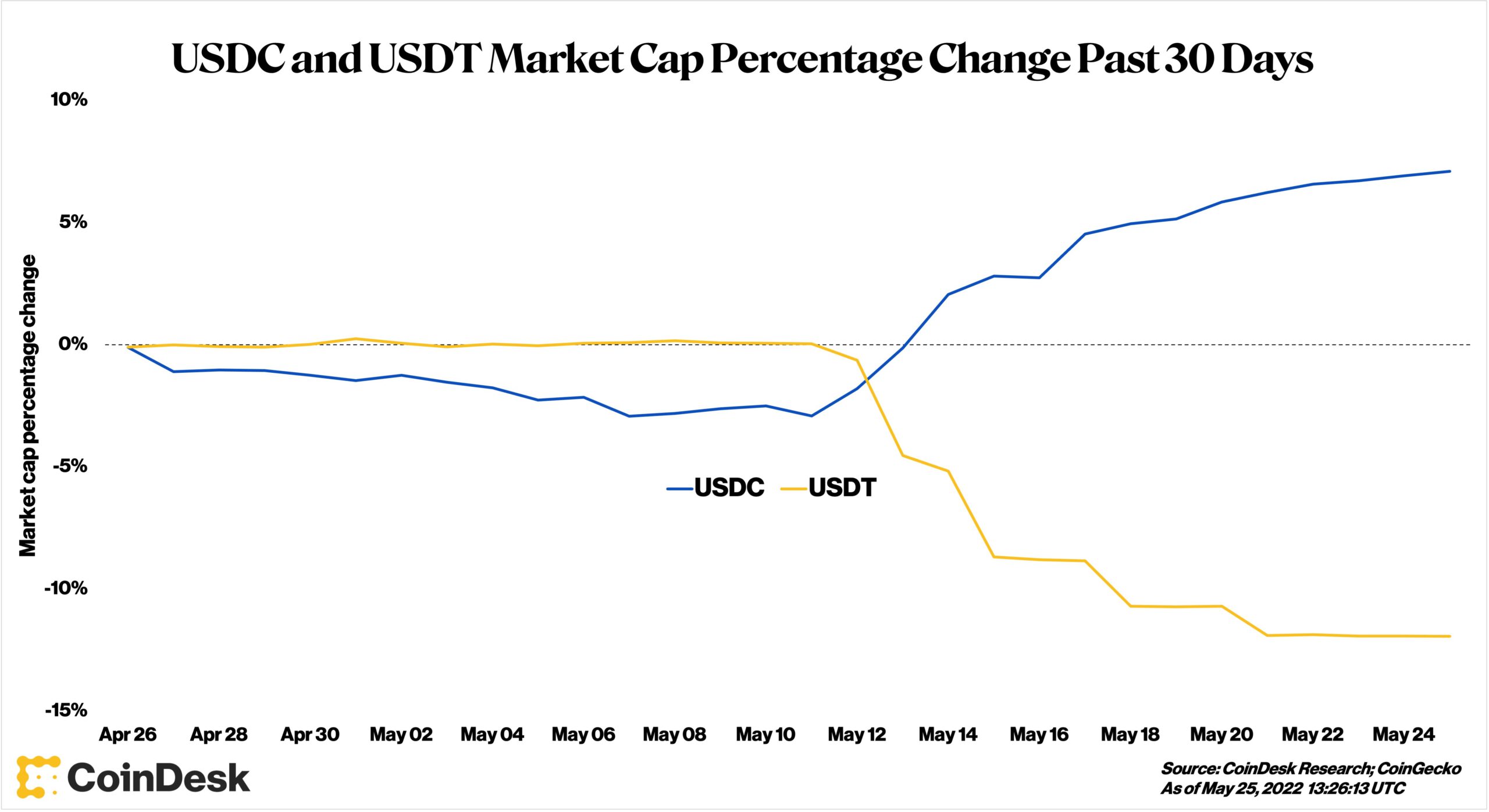

However, Tether’s most recent consolidation failed to end the $ seven billion reduction. So far this week, Tether continues to record an more $ three billion in supplies disappearing from the undertaking, pushing USDT’s all round circulating provide to $ 73 billion from $ 83 billion. This has shaken investor self-assurance in the stability of stablecoins in standard.

Over the very same time period, nevertheless, USDC’s provide greater to $ 53 billion from $ 48 billion.

Another testament to USDC’s existing power is that most DeFi economic transactions that get location on Ethereum are USDC decision oriented. For instance, DAI, the MakerDAO platform’s existing biggest decentralized stablecoin, holds USDC as an alternative of USDT in its reserve.

Synthetic currency 68

Maybe you are interested: