According to information shared by Arcane Analysis’s Vetle Lunde, Bitcoin (BTC) exchange-traded merchandise (ETPs) recorded six,031 BTC in the previous week.

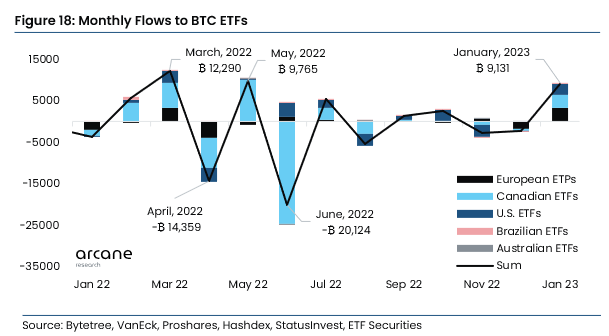

Lunde speak ETPs recorded a cumulative net inflow of 9,131 BTC in excess of the previous month — the highest regular monthly inflow due to the fact May 2022, when ETPs recorded 9,765 BTC inflows.

The twenty,124 BTC outflow follows the May 2022 outflow into June 2022, when the major digital asset dropped forty% to under $twenty,000. Since then, Bitcoin ETFs have gone with the movement, recording additional outflows than inflows as a result of January 2023.

Meanwhile, there is a notable variation in the geographic composition of ETFs seeing additional inflows this month than in May 2022, when Canadian ETFs like Bitcoin Intent dominated. deal with it.

However, latest inflows seem to be evenly split across Europe, US and Canada ETFs as of January 2023.

Valkyrie ETF to expand a hundred% in 2023

The Valkyrie Bitcoin Miners ETF “We’re Gonna Make It” (WGMI) has emerged as the very best-executing fund in 2023, up additional than a hundred% in the previous month, in accordance to Bloomberg’s data. The ETF, launched in February 2022, has misplaced additional than 80% of its worth by 2022.

ETF holding shares of miners like Hive Blockchain Technologies Ltd, Marathon Digital Holdings Inc., Bitfarms Ltd and so forth. All these miners have also observed the worth of their shares enhance considerably in 2023 following the previous yr has observed their worth plummet.

However, first optimistic returns are not ample to restore investor returns, as most ETFs are nevertheless trading under all-time highs. For context, WGMI is down 68.32% from the beginning price tag in February 2022.

Meanwhile, the optimistic effectiveness of these ETFs is primarily driven by the latest marketplace sentiment surrounding the crypto marketplace. The crypto marketplace is off to a brilliant begin to the new yr, with Bitcoin and Ethereum (ETH) up additional than thirty% in the previous month.