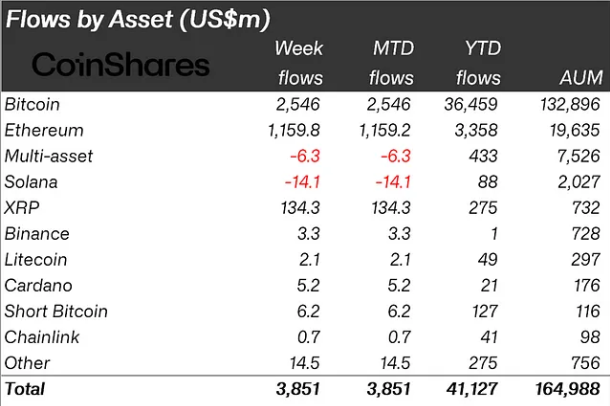

Last week, the flow of money into the cryptocurrency market experienced an unprecedented boom, reaching a staggering $3.85 billion. Positive inflows into digital asset investment products surpassed the previous record by just a few weeks.

This monumental activity brought total year-to-date (YTD) cash flows to $41 billion.

Bitcoin Takes the Lead as Cryptocurrency Flow Nears $4 Billion

Bitcoin (BTC) led the way, accounting for $2.5 billion in flows last week. This brings Bitcoin’s total YTD to a staggering $36.5 billion. The continued upward momentum has investors expecting even bigger gains, with some analysts targeting $100K this cycle.

Short Bitcoin products recorded inflows of $6.2 million, a trend often observed after strong price increases. According to the latest report from CoinShares reportthis shows the cautious psychology of investors, as many people are still hesitant to bet on Bitcoin’s current strength.

Meanwhile, Ethereum has exploded with its largest weekly inflow ever, totaling $1.2 billion. This has surpassed the excitement surrounding the launch of Ethereum ETFs (exchange-traded funds) in July. The significant inflows indicate growing confidence in Ethereum’s long-term potential, especially as This blockchain strengthens its role in DeFi (DeFi) and NFT (Non-fungible Token) ecosystems.

However, Ethereum’s success appears to be a loss for competitors like Solana (SOL), which saw a $14 million outflow last week. This is the second consecutive week that Solana has experienced a decline, signaling a shift in investor sentiment away from altcoins.

Institutional investors such as BlackRock, which recently delayed plans for altcoin ETFs, instead favoring products focused on Bitcoin and Ethereum, have further reinforced the market’s preference for these coins. this money. The record-breaking inflow reflects a broader trend of institutional interest in digital assets.

Companies like MicroStrategy and BlackRock are leading this movement. For BlackRock, its Bitcoin ETF spot product remains a major driver of market optimism.

With Bitcoin and Ethereum accounting for the largest share of inflows, questions remain about the future of altcoins in an increasingly competitive market. The outflow from Solana could signal broader challenges for smaller blockchain ecosystems, especially as institutional money gravitates toward mature markets.

Investor Psychology: Profits and Strategy

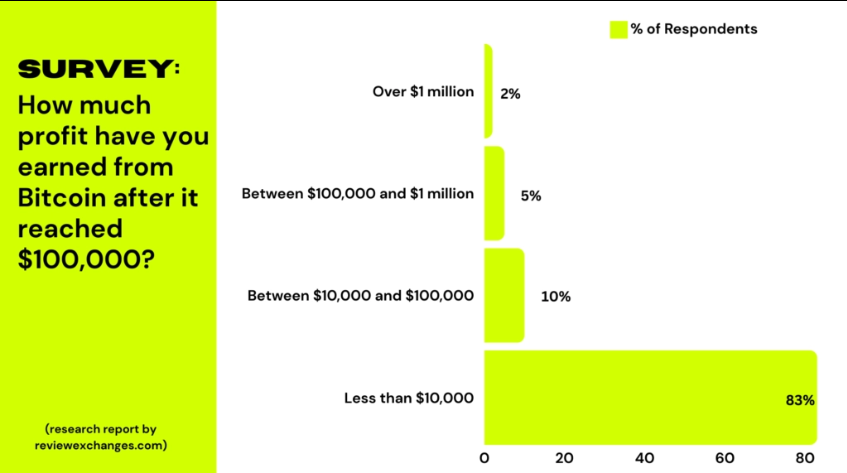

A recent study by ReviewExchanges revealed how Bitcoin’s rise to $100K affected American crypto investors. A survey of 719 investors revealed varying emotions, strategies and expectations following that milestone.

A significant 48% of respondents admitted they missed out on major gains during Bitcoin’s bull run and regretted not taking action sooner. Meanwhile, 31% still believe that it is not too late to invest. However, only 15% reported being successful in timing their investments to achieve their financial goals, while 6% revealed they were not interested in Bitcoin during the boom.

The survey also showed that 83% of investors earned less than 10 thousand USD from the price increase, with only 2% achieving over 1 million USD. This reflects the rarity of significant profits and emphasizes the importance of timing and strategy.

The survey also found that 72% of participants consider cryptocurrency to be a major investment in the future. Meanwhile, 43% expressed increased confidence in this market, 29% remained cautiously optimistic due to inherent risks. At the same time, 7% reported low confidence, reflecting concerns about volatility.

On top of that, 67% of respondents said they are holding assets for long-term gains, while 18% are diversifying their portfolios. Only 10% chose to withdraw completely, and 5% reinvested profits into altcoins, reflecting growing interest in blockchain innovation beyond Bitcoin.