- Trump calls for open Chinese markets during trade talks.

- Potential tariff changes could impact financial markets.

- Cryptocurrency markets may respond to trade policy shifts.

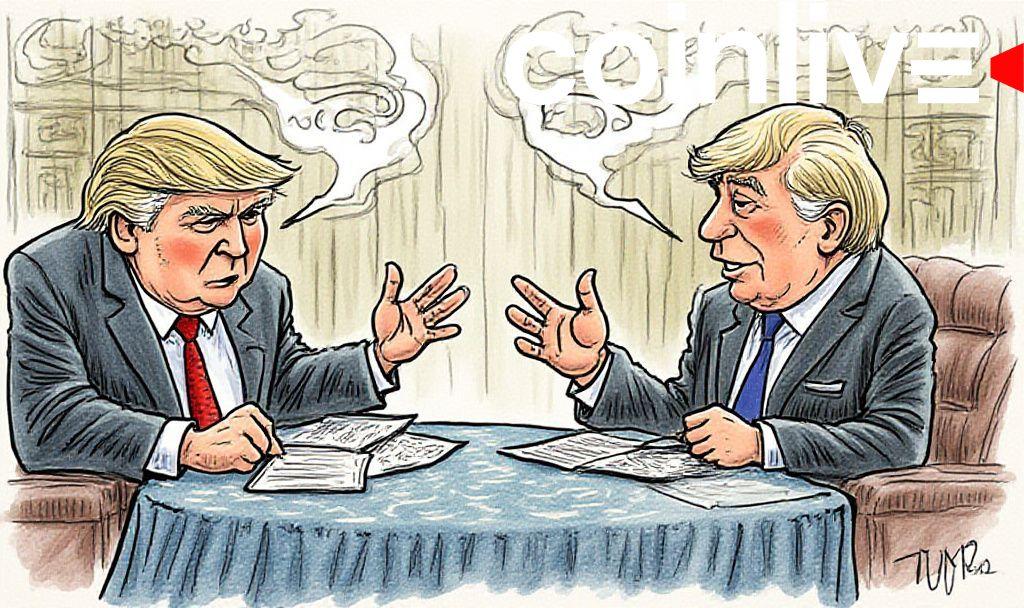

President Trump emphasized the need for China to open its markets to U.S. goods during ongoing trade discussions involving key figures in both countries this weekend.

Amid trade negotiations, Trump’s call for China to open its markets has significant implications for global trade dynamics and market reactions.

President Trump has made a public appeal, stating that “CHINA SHOULD OPEN UP ITS MARKET TO USA — WOULD BE SO GOOD FOR THEM!!! CLOSED MARKETS DON’T WORK ANYMORE!!!”, highlighting the ongoing trade discussions. Leading these negotiations are Scott Bessent, newly appointed U.S. Treasury Secretary, and Jamieson Greer, the U.S. Trade Representative.

These talks come as the U.S. imposes 145% tariffs on Chinese imports while China maintains 125% tariffs on U.S. goods. Trump’s suggestion of an 80% tariff marks a potential shift in the U.S. stance on trade.

Financial markets are poised to react to any movement from these discussions, especially if tariffs are adjusted. Such adjustments could signal a de-escalation, affecting both traditional markets and cryptocurrencies.

Historically, U.S.-China trade news has led to volatility in the crypto markets, with Bitcoin and Ethereum often experiencing significant movements. These negotiations are closely watched by investors and market analysts alike.

The resolution of this trade conflict could lead to economic shifts, impacting global markets and potentially spurring growth in investment and trading activities. Investors are advised to monitor these developments closely.