[ad_1]

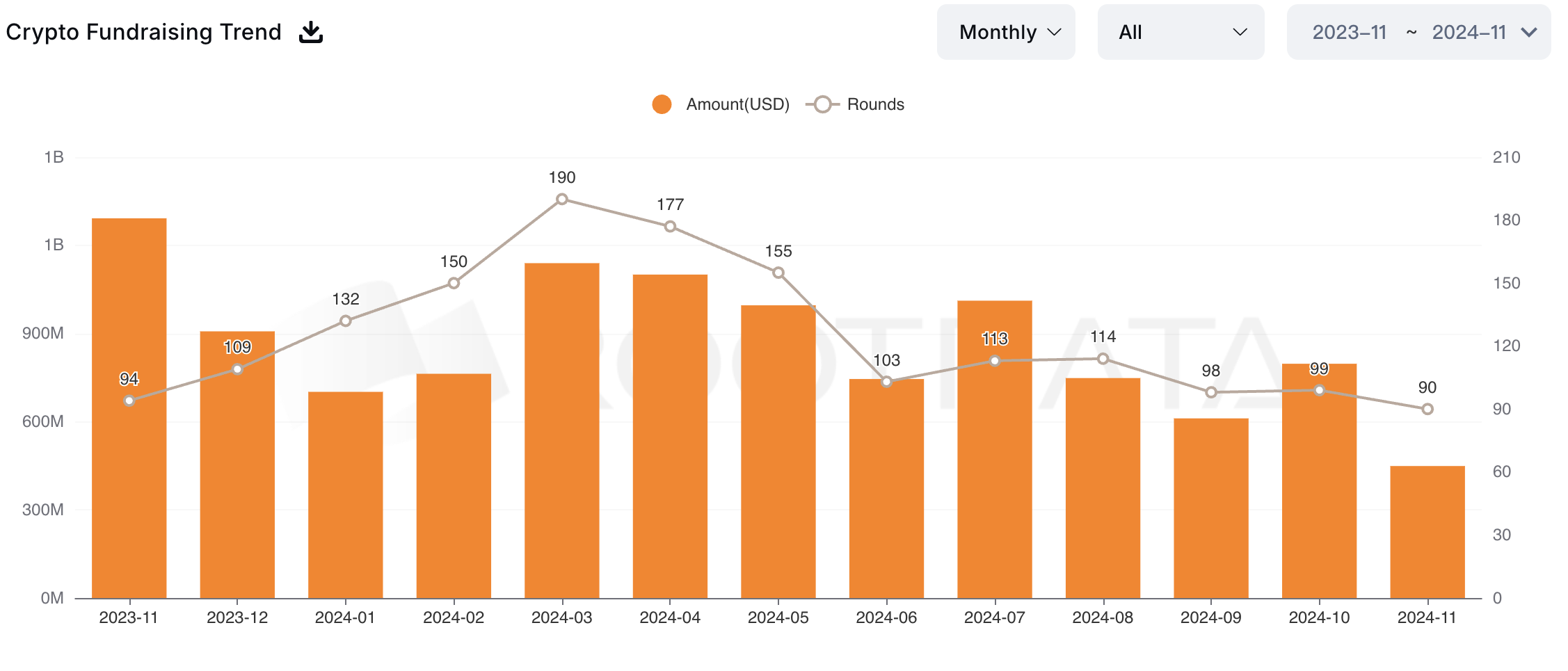

According to statistics from RootData, there were 90 venture capital (VC) investments related to Cryptocurrency made public in November, down 9% compared to 99 investment rounds in October.

The total amount raised in November reached 449 million USD, a sharp decrease of 43.66% compared to 797 million USD collected in October.

Significant Decline in Cryptocurrency Venture Investing

Venture capital activities are an important measure of the level of interest and trust of large investors in the Cryptocurrency market. Although November saw an intense rally in crypto assets, these gains did not translate into heightened VC activity. The number of sales and total donations dropped sharply this month.

In fact, November marked the lowest number of deals and capital raised in 2024. Additionally, the largest deals were also much smaller than in previous months: September was down 12% compared to August, however, there was a deal that raised $100 million. Meanwhile, November’s outstanding deals were all under $50 million.

The distribution of capital across sectors had some similarities to October: once again, infrastructure, DeFi and gaming saw the highest returns. However, levels have dropped significantly, and investment in CeFi appears to have declined.

usdx.money Leading a Hurt Market

On November 29, stablecoin issuer usdx.money announced a successful capital raising round of about 45 million USD. The company claims that this investment brings its total valuation to $275 million.

Their largest investors include NGC, BAI Capital, and Generative Ventures. usdx.money will use these capital sources to accelerate ecosystem development.

A close candidate is Zero Gravity Labs (0G Labs), a series of AI modules announced a 40 million USD seed round on November 13. Furthermore, the company received a commitment to invest 250 million USD for future token purchases and launched a successful node sale on the same day.

“We are excited to announce that the 0G AI Alignment Node Sale has reached 10 million USD in support! This is a huge step forward for decentralized AI as a public asset, where transparency, safety, and community come first. Thank you to our incredible community for believing in a trustless future for AI,” the company expressed in a November 13 social media post.

Additionally, two other Cryptocurrency companies share the 3rd position with an investment of 30 million USD. Monkey Tilt, an online gambling platform, successfully raised Series A funding on November 19. Canaan, a Chinese mining equipment manufacturer, raised a similar amount the day before, despite suffering from downward trends in the previous year.

These four companies are the only Cryptocurrency companies to earn more than $25 million in venture capital this November. Compared to previous months, this is a very significant decline.

Even so, the Cryptocurrency market is still very optimistic, which may explain this big change. Ultimately, many companies are investing directly in large BTC purchases, rather than in crypto companies.

General Bitcoin News

[ad_2]