The cryptocurrency market is set for a volatile week with many developments in the ecosystem on the cards. From the listing of the new Sonic Token on Binance to the major unlocking of the ONDO Token, the market could see volatility this week.

Forward-thinking investors may consider structuring their trading strategies around this week’s events.

List Sonic on Binance

In one post On December 24, Binance announced plans to delist all Fantom (FTM) trading pairs on January 13. The move is in line with Fantom’s rebranding and token migration initiative, paving the way for the listing of Sonic’s Token S.

FTM Tokens will be converted into Sonic Tokens at a 1:1 ratio, ensuring that users will receive the same number of S tokens as their FTM holdings. The initial circulating supply of S will be around 2.88 billion, with a total supply of 3.175 billion — in line with FTM’s index when Sonic chain launched.

Token FTM holders who do not choose to upgrade to Token S can continue to use FTM on the Opera network. However, participation in the above transactions, administration and other activities Sonic network will require Token S.

This rebranding prepares for the launch of the Sonic mainnet in February, which will introduce a number of new features such as a decentralized exchange (DEX) and native RPC, aimed at improving reliability and capabilities. network expansion.

Upgrade Aerodrome DEX

Version two (V2) of Slipstream, the exchange positioning Aerodrome as the leading Layer-2 DEX, is scheduled to launch this week. Aerodrome describes this upgrade as a combination of DeFi’s most efficient liquidity sources with fees that dynamically adjust based on market fluctuations. This innovation aims to provide an on-chain experience similar to an order book, while providing higher yields to users.

“Finally providing an on-chain orderbook-like experience that delivers maximum rewards to users,” Aerodrome explain.

Since adopting Slipstream in April, the protocol has performed strongly in most major metrics. These benefits come as Slipstream secures its position as a liquidity provider by allowing them to determine the scope of liquidity provision (centralized liquidity). Since Slipstream launched, Aerodrome has climbed from around 20% to 60% dominance over Uniswap on Base.

Slipstream V2 from Aerodrome delivers lower fees, faster transactions, improved liquidity and increased revenue. Dynamic fees and other new features come with this release, which can increase commission rewards by up to 40%.

The average APR (annual percentage rate) to date is 53.17%, so a 40% increase would go up to 74.44%. This development could affect Aerodrome’s liquidity and price.

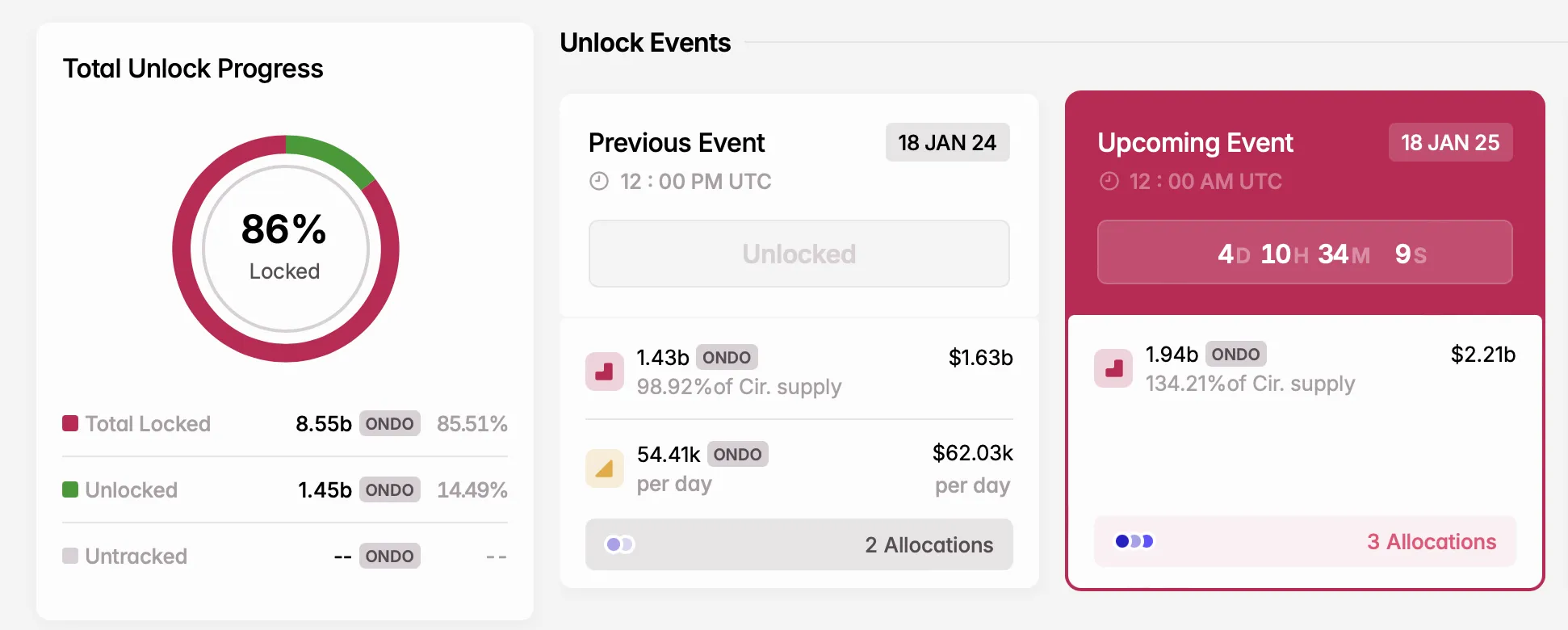

Unlock ONDO Tokens

The ONDO Token unlock on January 18 was one of this week’s top crypto events. As TinTucBitcoin reports, Ondo Finance will issue 1.94 billion ONDO Tokens, currently worth $2.15 billion. This unlock is equivalent to 134.21% of the current total supply. Tokens will be distributed to parties participating in private sales, ecosystem development, and protocol development.

A recent survey found that 90% of unlocks exert negative price pressure, with major events causing steeper drops. The report shows that investor unlocks show more controlled price behavior than team unlocks.

Regarding Tokens allocated for ecosystem development, these have a unique positive impact. They often lead to price increases (+1.18% on average) when they provide liquidity or stimulate ecosystem development. These tokens are often used to develop infrastructure, contributing to the long-term development of the ecosystem.

Launch of Token Solv Protocol

Another big crypto news this week was the launch of Solv Protocol’s SOLV Token on January 17. Solv Finance is a decentralized platform focused on liquidity and yield infrastructure for digital assets, along with with providing liquidity staking solutions for Bitcoin. The protocol has built a decentralized Bitcoin reserve that currently holds over 25,000 BTC.

The project recently raised $22 million in a funding round, valuing it at around $200 million. As Bitcoin DeFi products continue to see growth in total value locked (TVL) and adoption, Solv Protocol is emerging as a significant player in the space.

The SOLV token will be listed on Binance and Bitget exchanges, where it will trade with USDT, BNB, FDUSD and TRY on Binance. Additionally, the protocol has a public sale that includes a major sale on Binance, creating an opportunity for Binance Coin (BNB) holders to benefit.

“Bonus formula is based on locked BNB points + Web3 Quest Bonus (with Binance wallet),” Binance said.

Launch of Mode’s AI Station

Mode’s AI station is one of this week’s crypto highlights. This AI-powered chat co-pilot allows users to perform DeFi actions, potentially changing the way users interact with DeFi protocols.

James Ross, founder of Mode, said that AI’s biggest impact on DeFi will be in transforming the way users interact with protocols and networks.

Instead of navigating a complicated DeFi application interface, users can use Mode’s AI Stations and Agents to execute transactions and deploy contracts directly on-chain. This initiative aims to simplify and enhance the DeFi user experience.

Released Blast Mobile Platform

Blast is also in the spotlight this week with the anticipated release of its mobile platform. Along with that, this Layer-2 network is expected to announce a major upgrade in tokenomics. These developments aim to improve user experience and drive adoption, positioning BLAST as a token to watch closely.

“We’ve been working very deeply for months and we’re about to launch. We’re finalizing the final details on the Blast mobile platform, tokenomics updates, and other important announcements. Everything will be released next month,” Blast said in a December post.

In a follow-up post over the weekend, the L2 network called on all Blast Dapps to distribute Points and Gold to users before these changes occur.

“There will be no January Gold distribution. All users should ensure to log in to Blast’s website with their wallets,” Blast explain.

US CPI index

Rounding out this week’s list is the US CPI (Consumer Price Index) report, scheduled for release on Wednesday. This economic data is likely to influence Bitcoin by indicating a trend. Inflation and Federal Reserve policy. In addition to CPI, Trump’s upcoming inauguration also makes the market tense. This is the first pro-Bitcoin administration to take power in the Oval Office in the United States.

“The macro situation is guiding the discussion right now. Focus on tomorrow’s PPI and Thursday’s CPI. We’re a week away from the first pro-Bitcoin administration in the US…Yes, we could be down, but the reality is we’re not up right now. meaning Trump’s inauguration looks less like a news event,” said one user on X give comments.