The Curve token (CRV), following the market’s downtrend, fell to the cost at which founder Michael Egorov opened an OTC sale in an try to sustain his debt place final August.

Curve (CRV) fell to the OTC cost of $.four

Curve (CRV) fell to the OTC cost of $.four

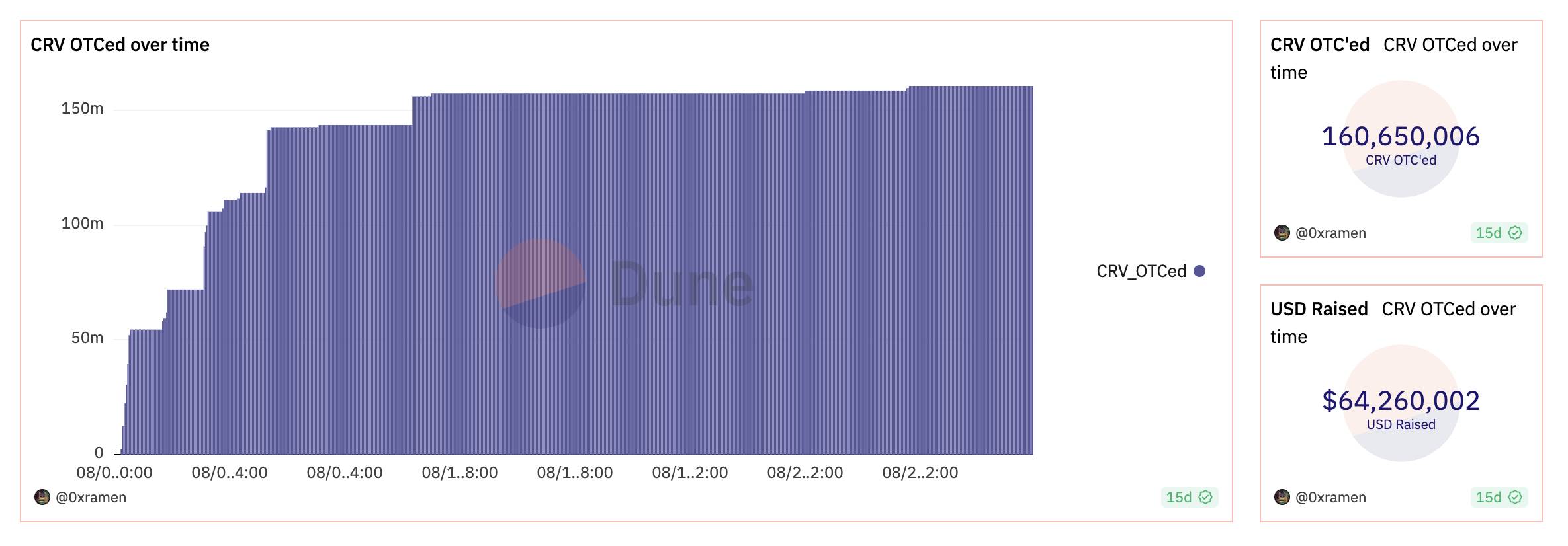

As Coinlive reported, in early August, Curve founder Michael Egorov started marketing CRV through OTC increase capital to sustain your lending place on DeFi protocols.

At the time of creating, the founder has offered much more total 160 million CRV to different traders, at the presumed OTC charges $.four/CRVhe collected Mr. Egorov for himself $64 million stablecoin.

Curve Founder CRV OTC Sales Transaction Statistics. Source: @0xramen on Dune Analytics

Curve Founder CRV OTC Sales Transaction Statistics. Source: @0xramen on Dune Analytics

While the market place cost at that time was about .five – .seven USD. Therefore, following much more than one month, the cost of CRV on the market place progressively decreased to the OTC cost at USD .four, following the common downward trend.

1D chart of CRV/USDT pair on Binance as of ten:25 am on September 13, 2023

1D chart of CRV/USDT pair on Binance as of ten:25 am on September 13, 2023

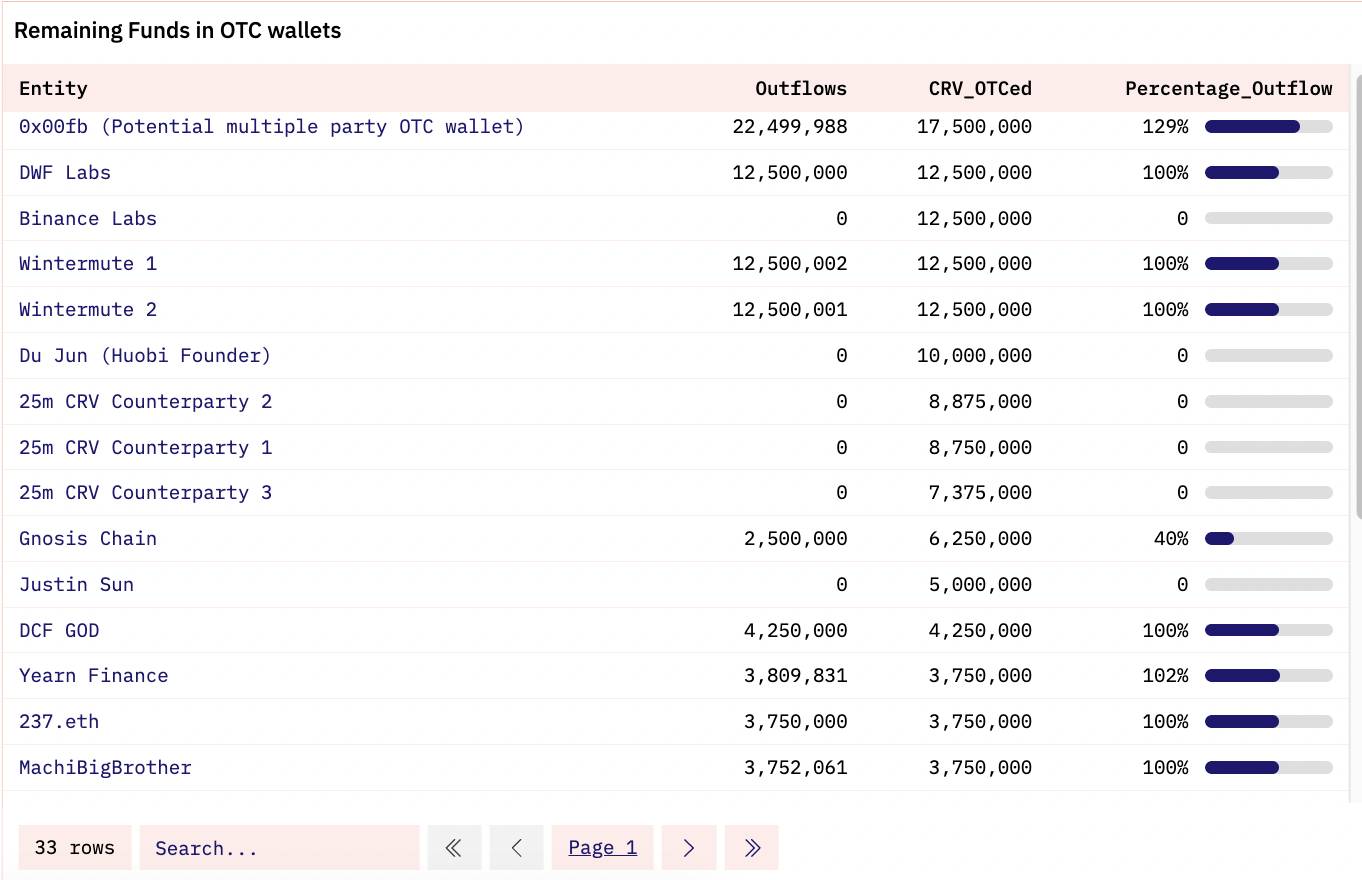

The record of traders who have participated in the “CRV rescue” to date contains the Wintermute money, DWF Labs, Binance Labs DeFi tasks contain Gnosis, Yearn Finance, Cream Finance, Reserve Protocol, Stake DAO person traders this kind of as Justin Sun, founder of Huobi Du Jun, DCF GOD, and so forth

List of traders participating in the obtain of CRV OTC. Source: @0xramen on Dune Analytics

List of traders participating in the obtain of CRV OTC. Source: @0xramen on Dune Analytics

The explanation why the Curve founder had to promote CRVs so massively came naturally Attack on Curve Finance on July 31st due to a vulnerability in pools utilizing the Vyper programming language. The consequences are coming $52 million was stolen by hackers.

The DeFi protocol at the time appeared to have entered a crisis as traders withdrew their cash one particular by one particular to avert widespread vulnerabilities, leading to the cost of CRV to plummet by practically twenty%. This equates to the worth of Mr. Egorov’s collateral in the kind of CRV also reducing in correlation, primary to loan liquidation possibility on other DeFi protocols this kind of as Aave, Acadabrada, Fraxlend.

To avert the contagion result from spreading to the whole DeFi ecosystem, Egorov had to promote CRVs cheaply by way of OTC transactions, not only to have cash to repay the debt and prevent loan liquidation, but also to prevent leading to CRV went right to the market place to make The crisis has turn out to be much more severe.

Coinlive compiled

Join the discussion on the hottest difficulties in the DeFi market place in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!!