[ad_1]

CRV, the local Cryptocurrency of decentralized lending and borrowing protocol Curve Finance, has become the top performing Altcoin among the top 100 coins. Over the past 24 hours, the price of CRV has increased by about 10%.

This development comes as many cryptocurrencies have struggled to show strong performance since the beginning of the week. Here’s an analysis of how this Altcoin tops the rankings.

Curve Whales, Investors Hold the Ground

Yesterday, Curve’s price stood at around $0.98. However, it has since skyrocketed to $1.17, outperforming other Altcoins on the market. Notably, CRV also surpassed other tokens with DeFi (DeFi) platforms such as Aave (AAVE) and Ethena (ENA).

According to TinTucBitcoin analysis, CRV’s strong performance is mainly driven by sentiment among short-term holders. Data from IntoTheBlock shows that the number of short-term CRV holders has increased significantly over the past seven days.

To clarify, these addresses represent unique wallets that have purchased this Altcoin within the last 30 days. An increase in these addresses indicates a positive outlook for short-term price action, while a decrease would suggest the opposite. Therefore, the increase in these short-term holders indicates that the value of CRV may continue to escalate.

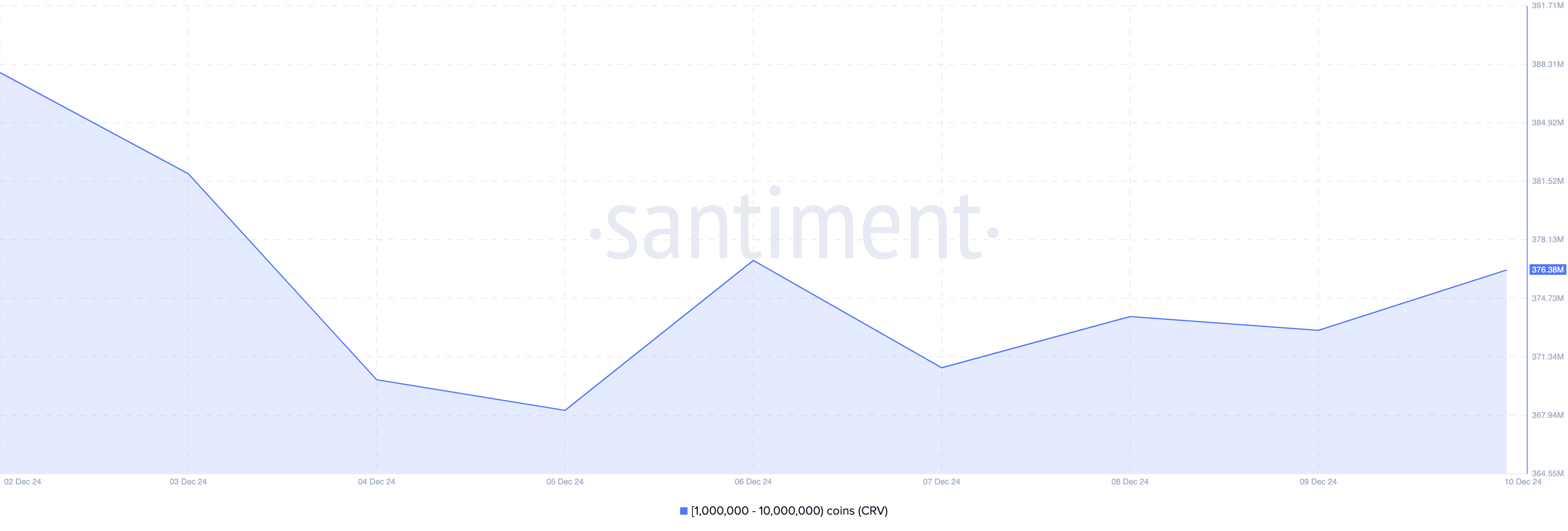

Furthermore, on-chain data from Santiment also shows that Crypto whales are also contributing to this. Normally, as whales accumulate more Tokens, the price tends to increase. On the contrary, when sold, it causes the price of Cryptocurrency to decrease.

As seen in the image below, CRV addresses holding between 1 million and 10 million tokens have increased in balance.

On December 5, the balance of these addresses was 368.24 million. Today, that number has increased to 376.38 million. If this trend continues, CRV prices could continue to rise.

CRV Price Prediction: Remains Positive

On the CRV/USD 3-day chart, Bull Bear Power (BBP) remains in the positive zone. BBP compares the strength of buyers (bulls) with sellers (bears). When this index has a positive value with green histogram bars, buyers are taking the initiative.

On the contrary, red bars with negative values favor sellers. So, in the case of CRV, it implies that the value of the Altcoin may continue to increase in the coming days.

If this trend holds, CRV could continue to stabilize its position as a top-performing Altcoin, with possible targets above $1.35 and even up to $1.70. However, if sellers take over, the DeFi protocol coin could slide to $0.62.

General Bitcoin News

[ad_2]