The selling price of the AMM Curve Finance protocol CRV token surged on Feb. 14, hinting at the approaching stablecoin crvUSD.

On the morning of Feb. 14, the Curve Finance Twitter web page posted a proposal to update the protocol, which would assistance stablecoin pools with constructed-in selling price benchmark oracle, supporting interaction with other DeFi tasks.

Things would have been fine if Curve hadn’t “implied” that this update was essential for crvUSD to do the job instantly. Many traders see this as a indicator that the Curve stablecoin is in the last phases of improvement and is about to be launched.

It goes with out saying that this is essential for crvUSD to do the job autonomously https://t.co/GFA5aXAjv0

— Curve Finance (@CurveFinance) February 13, 2023

crvUSD is the title of the native stablecoin formulated by Curve, which has been disclosed by this AMM protocol due to the fact mid-2022 but the launch date is unknown. Even so, Curve has launched the total supply code and relevant technical paperwork of the stablecoin.

As a end result, crvUSD is a stablecoin that operates below the in excess of-collateralized stablecoin model, i.e. the collateral have to be higher than the pahst of the issued stablecoin. Users have to deposit crvUSD into the Curve protocol in purchase to problem crvUSD, very similar to MakerDAO’s common ETH-DAI model.

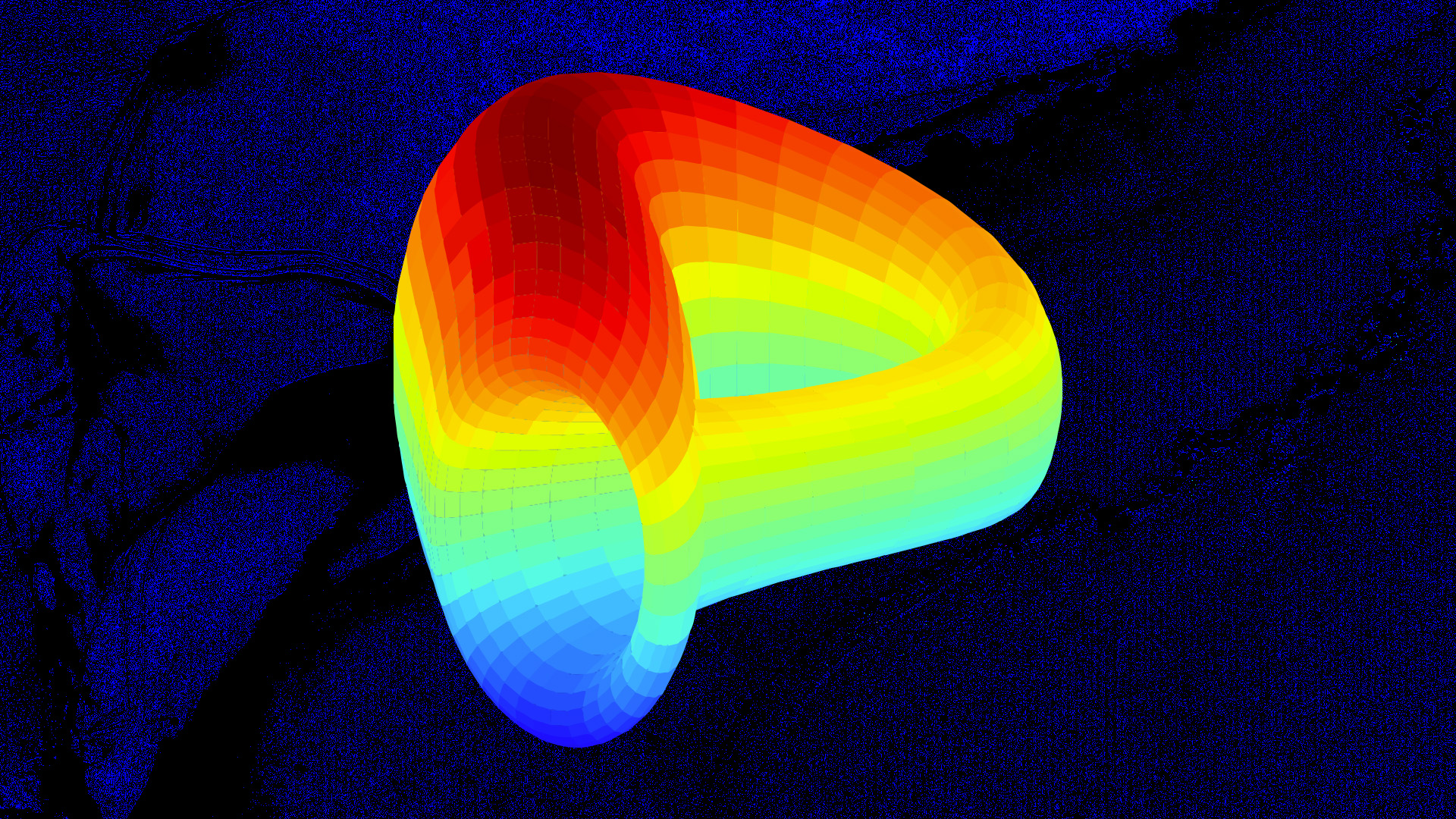

However, the variation of crvUSD from other stablecoin algorithmic options is the application of an anti-terrible credit score mechanism named LLAMMA.

CRV selling price is surging extra than twelve% thanks to the advantage of the over info, as very well as the reality that AMM has had a trading volume of $one billion in the final 24 hrs, as reported by Coinlive.

The cryptocurrency market place in standard is encountering a whole lot of turmoil in the stablecoin section as lately, the legal occasions surrounding Paxos and the stablecoin issued by this business, BUSD, created traders nervous and they switched to different options.

Furthermore, the continued downtrend in the market place has also induced lots of DeFi protocols to seem at stablecoins as new equipment to entice liquidity from end users, commonly the GHO stablecoin of the Aave decentralized lending protocol.

Synthetic currency68

Maybe you are interested: