Source code and white paper on stablecoin crvUSD from the decentralized exchange Curve Finance It was launched.

Curve Finance decentralized exchange advancement crew launched source code and the official documentation for the approaching stablecoin identified as crvUSD.

However, Curve has not announced any official details so far. The library repository on the project’s GitHub account demonstrates Curve is full and prepared to launch the a lot-loved stablecoin.

To comply with White paper Written by Curve Finance founder Michael Egorov, crvUSD is functionally very similar to MakerDAO’s DAI, which is also an more than-collateralized stablecoin (more than-collateralized), i.e. the sum of the collateral is increased than the issued worth. To mint stablecoins, consumers want cryptographic collateral.

crvUSD is based mostly on the new Lending-Liquidating AMM (LLAMMA) algorithm, which constantly liquidates and sells deposited collateral to handle likely dangers.

Curve Finance each and every anticipated the launch of the stablecoin in Julywith objective assistance for CRV, the primary token of the exchange.

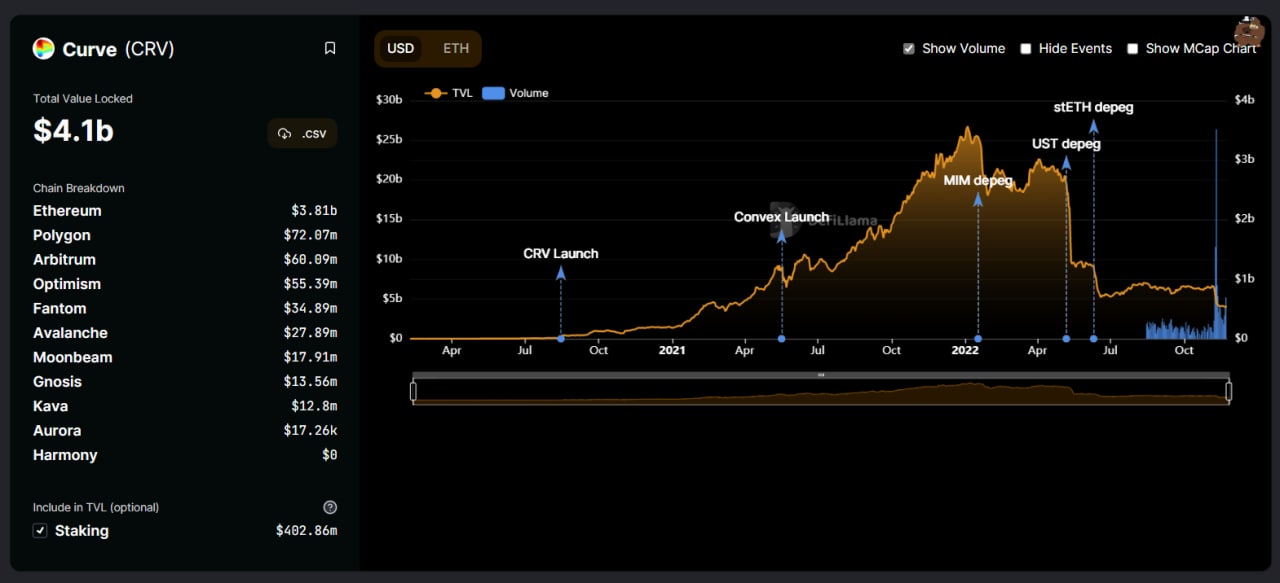

Curve, which is a stablecoin-centered exchange, is at present the anchor of additional than USD four.one billion TVL, a far cry from the USD 24.three billion peak in January 2022 right after a series of current occasions. .

Synthetic currency68

Maybe you are interested: