According to transaction information, the demand for trading important stablecoins on Curve Finance has elevated appreciably in latest days as the section heats up once more due to the latest occasions with BUSD.

Daily volume 1B https://t.co/jqYMfKv6yB

— Curve Finance (@CurveFinance) February 13, 2023

On the morning of February 14, the top AMM platform on Ethereum, Curve Finance, uncovered that the project’s transaction volume reached $one billion in the previous 24 hrs.

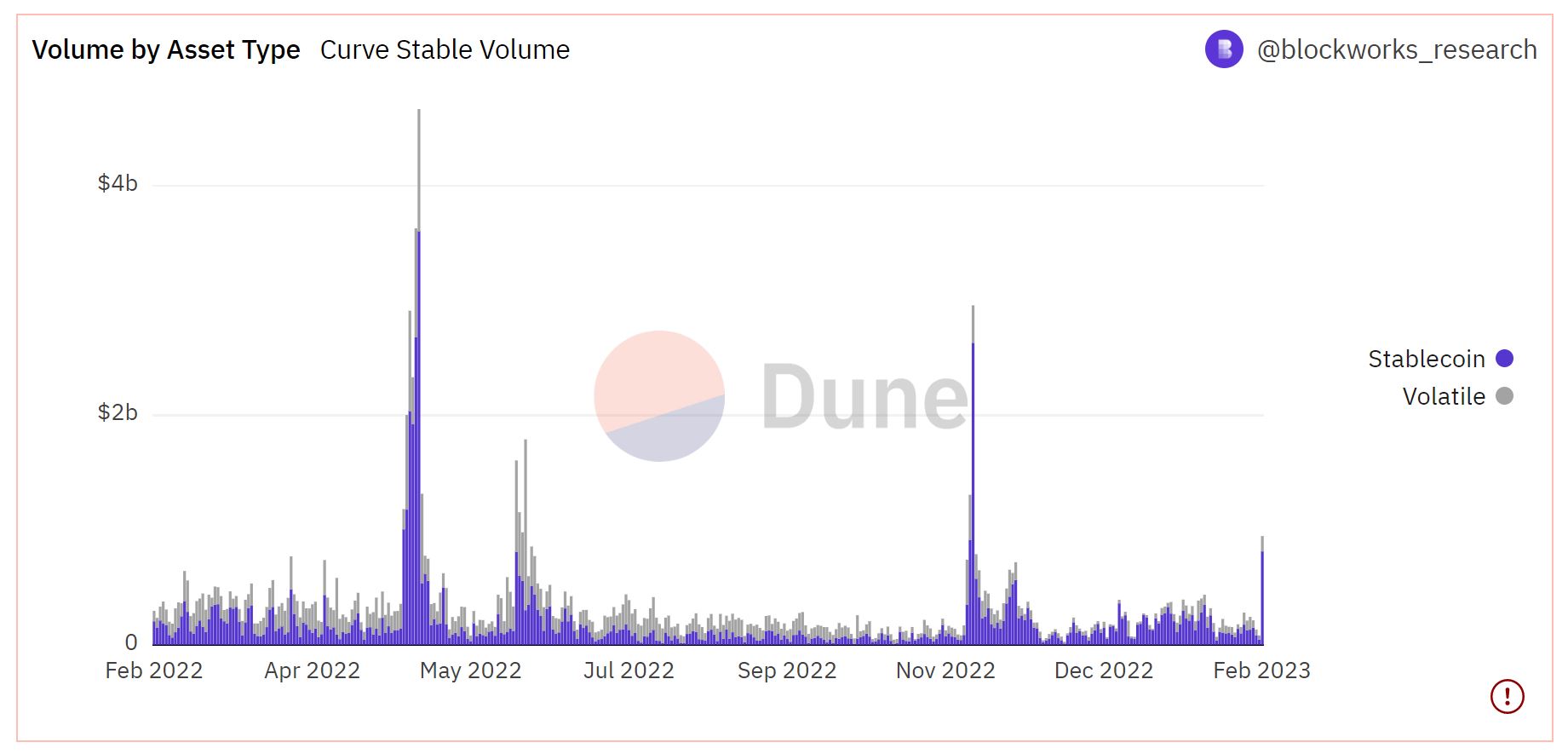

This is Curve Finance’s highest trading volume due to the fact Nov. ten, 2022, when the FTX crash peaked, with virtually $three billion in swap volume. Since then, trading volume on Curve has regularly remained beneath $400 million, averaging beneath $one hundred million in the to start with two weeks of February 2023.

The record for trading volume on Curve was nonetheless at $four.seven billion on May twelve, 2022, amid a promote-off wave as the “catastrophic” LUNA-UST led to panic in the market place at attain the zero price.

Fast forward to the current day, on Feb. 14, transactions involving stablecoin pools accounted for the bulk at $814 million, even though altcoin pools left $133 million in trading volume.

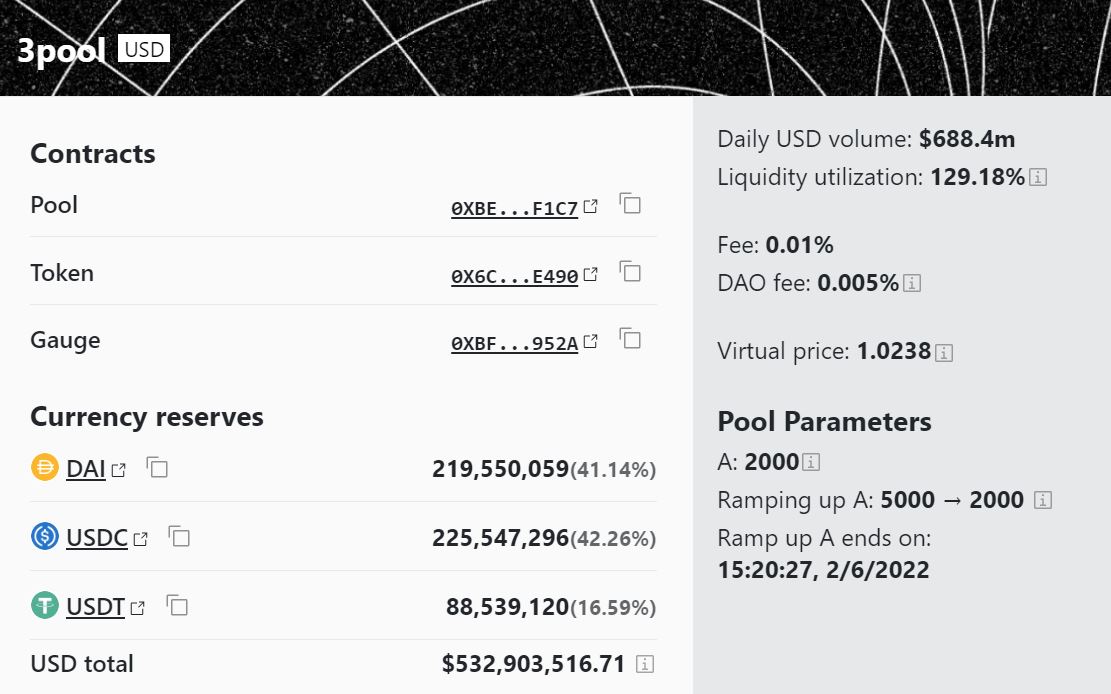

The pool contributing as normal with the greatest volume is 3pools together with USDT, USDC and DAI at USD 688 million. In distinct, the USDT percentage right here is at a minimal degree when it is only sixteen.seven%, displaying that traders have a tendency to “flee” in the direction of stableocina issued by Tether.

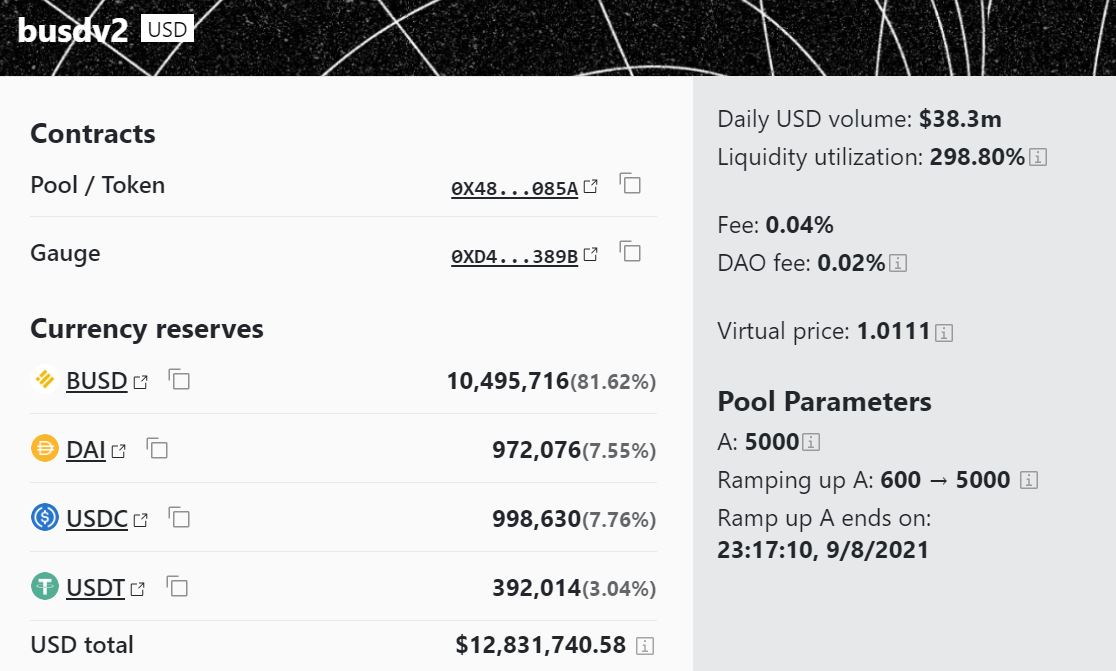

Meanwhile, the busdv2 pool is totally diverted to BUSD as traders actively trade the Binance stablecoin for other choices accessible in the pool together with DAI, USDC, and USDT. BUSD represents 81.62% of provide in this pool.

The explanation for the surge in trading volume on Curve, as very well as the wave of shifts to USDT, stems from the latest elevated regulatory strain from the US government on Paxos, the business that difficulties the BUSD stablecoin for Binance.

With the explanation why Paxos violated the regulation on issuing BUSD, the New York Department of Financial Services (NYDFS) asked them to end issuing new BUSD. The business complied with this necessity, but insists it nonetheless delivers total safety for BUSD and consumers can convert the stablecoin to USD every time they want involving now and February 2024.

At the identical time, BUSD was also accused of becoming a “security” by the US Securities and Exchange Commission (SEC), which Paxos also objected to and mentioned it was prepared to get legal action with the SEC if needed.

Due to the wave of adverse lousy information about stablecoin BUSD, consumer withdrawals from Binance have proven indicators of escalating above the previous 24 hrs.

Synthetic currency68

Maybe you are interested: