Changpeng Zhao (CZ) lately confirmed report that Paxos – a US-based mostly blockchain regulatory infrastructure platform – has been instructed to quit minting BUSD following advice from the New York Department of Financial Services (NYDFS).

“Paxos will continue to service the product and manage the acquisitions,” CZ explained, incorporating that “Paxos also assured us that the funds are #SAFU and guaranteed. They are fully secured by their bank reserves, with their reserves having been audited several times by different auditing firms. .”

“I have no information about it, other than public articles. The lawsuit is between the US SEC & Paxos,” CZ more.

However, CZ reiterated his lengthy-standing place that he does not feel that BUSD is topic to securities laws, due to a criterion acknowledged as the Howey Examination criteria. According to the U.S. Supreme Court, an item can be a safety if it meets the following 4 criteria:

- An investment of funds

- In a joint company

- With the expectation of revenue

- Derived from the efforts of other people

“If BUSD were to be considered a security, it would have a profound impact on how the crypto industry will develop (or not develop) in the jurisdictions where it is regulated as such,” CZ explained. “.

Responses arrived significantly less than 24 hrs following the authentic The Wall Street Journal report that the NYDFS instructed Paxos Rely on Co. — issuer of stablecoin Binance USD (BUSD) — ceases any additional BUSD generation.

“Binance will continue to support BUSD for the foreseeable future. We foresee users moving to other stablecoins over time. And we will adjust the product accordingly. e.g. avoid using BUSD as main trading pair etc.”

CZ added: “Due to regulatory uncertainty in certain markets, we will be looking at other projects in those jurisdictions to ensure our users are protected from any unnecessary harm”.

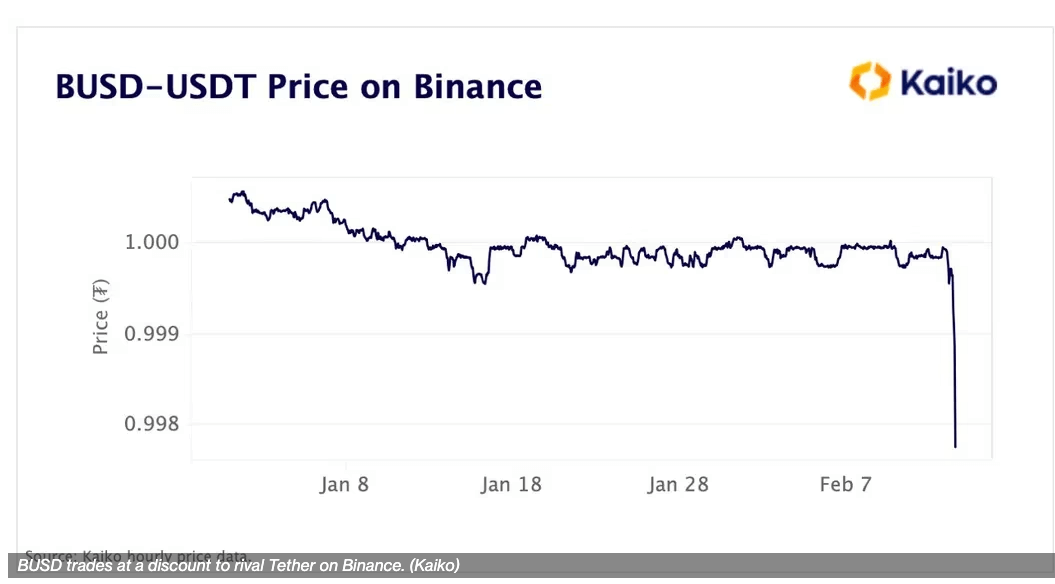

On February 13, BUSD slipped to .9950 against the 1:1 rate of the US dollar due to Paxos news.