[ad_1]

Bitcoin (BTC) worth shocked traders when it dropped under $29,000. This is the bottom degree up to now 6 months. In addition, the info reveals that derivatives have little to do with Bitcoin’s latest important drop.

Bitcoin traders assume the bear market is formally over after the rally to round $41,000 on June 14. However, a big 30% drop in Bitcoin passed off the next week, beginning on June 21.

This causes BTC to hit its lowest worth for the primary time since January 22, 2021. The sell-off was largely decided by the truth that BTC miners in China have been pressured to shut their operations. Not solely that, on June 21, the People’s Bank of China (PBoC) acknowledged that every one banks and cellular fee purposes “must not provide the service of opening or registering an account for commercial activities”. associated to cryptocurrencies.”

In addition to information from China, many individuals additionally questioned whether or not derivatives performed an vital function within the latest occasion.

As Coinlive defined within the article Is This the Reason for Yesterday’s Bitcoin Crash?, the derivatives market has exacerbated the swings. dump of BTC lately.

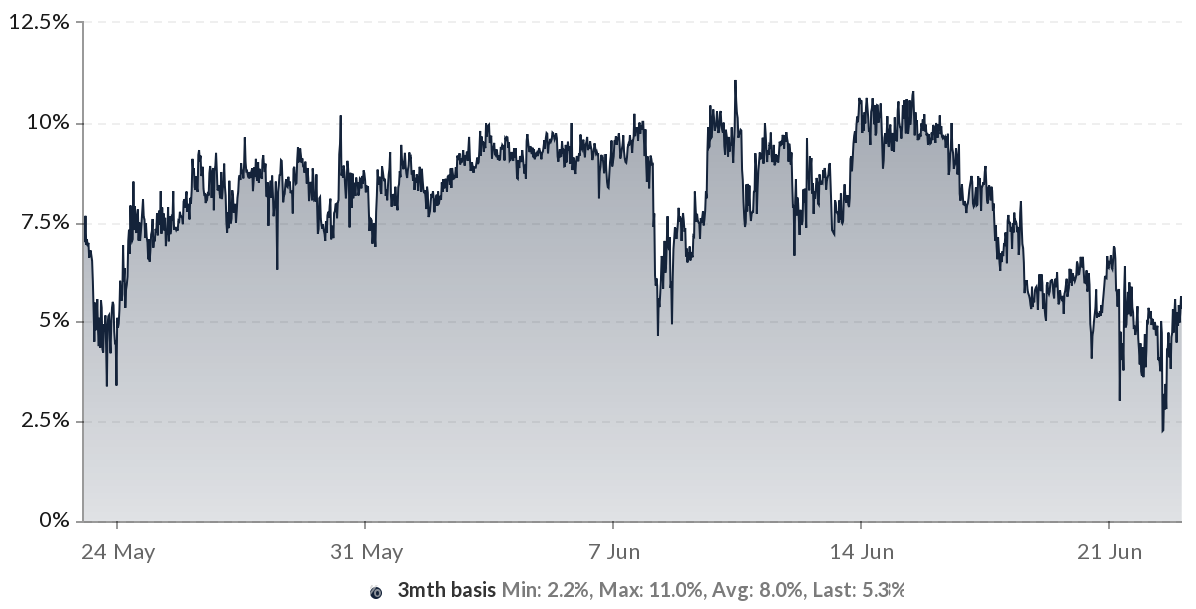

Futures contract premiums present no indicators of reducing

Futures contract premium (futures premium) is a device to measure the hole within the worth of a futures contract (future) in comparison with the spot worth (spot). Whenever this indicator fades or turns unfavorable, that is an alarm situation. This scenario is often known as a “preemptive sale”. (backwarding) in addition to forecasting a bearish sentiment (bearish sentiment).

Futures contracts ought to trade at a premium within the vary of 5-15%/12 months on wholesome markets, often known as “bump-back”. (contango). At the worst time of the previous June 22, this premium has bottomed out at 2.5% and is seen as bearish sentiment. However, that is nonetheless not sufficient to set off any warning situation!

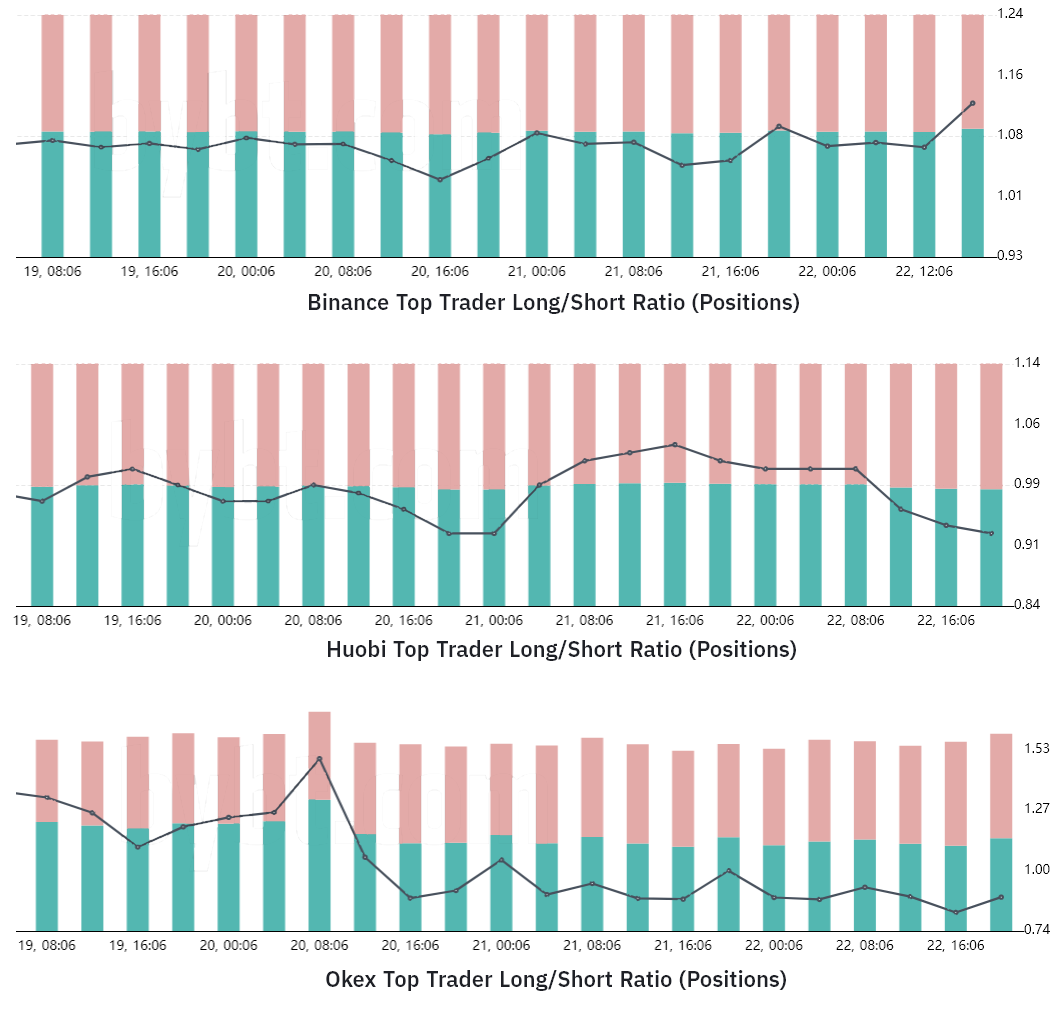

Top merchants do not panic

Indicators lengthy/quick of high merchants is calculated utilizing the consumer’s consolidated positions. This consists of spot orders, margin orders, and perpetual contracts (perpetual) and futures contract (futures). This metric collects a broader view of the skilled dealer’s place.

As could be seen within the picture above, high merchants at Binance have elevated their positions lengthy in comparison with place quick on June 22.

On Huobi change, the order charge is the other quick elevated, however this isn’t uncommon as this indicator has reached the identical degree two days earlier than (ie 20/06). Finally, additionally on June 20, main merchants on OKEx flooring decreased their orders lengthy.

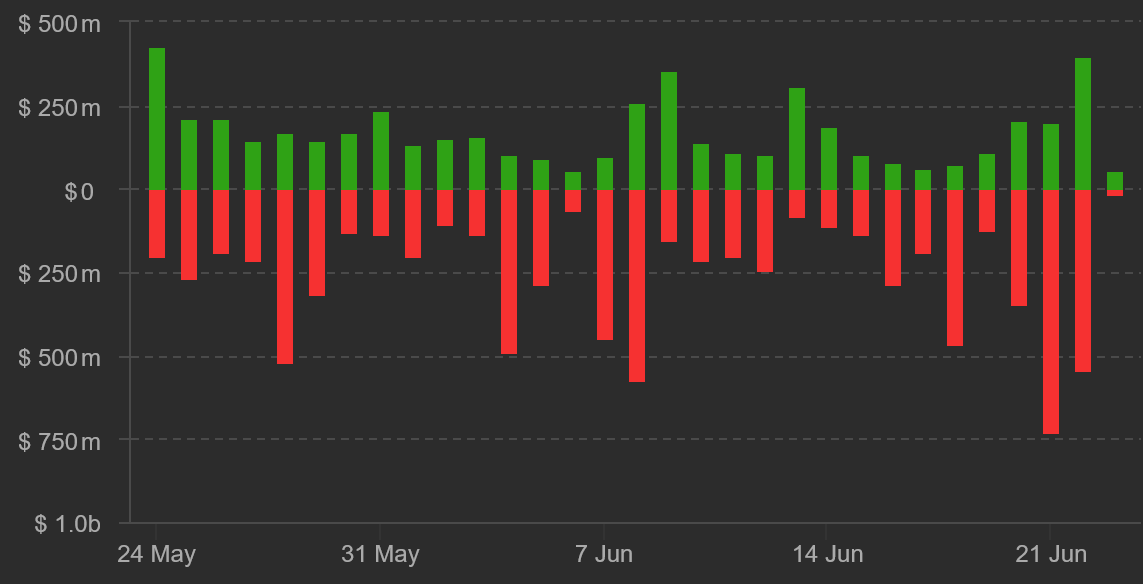

Long orders for futures contracts liquidated $600 million triệu

Based on futures liquidation knowledge on June 22, practically 600 million USD orders lengthy liquidated, this determine is decrease than $ 750 million on June 21.

Commands lengthy This used extreme leverage (overleverage) and a 20% drop from Bitcoin triggered cease orders (cease order) of orders with too giant leverage.

Finally, the info reveals no signal of stress from the command lengthy or potential unfavorable volatility brought on by the derivatives market.

Synthetic

Maybe you have an interest:

.

[ad_2]