Hedera (HBAR) price hit multiple highs in December but is now down more than 4% in the past 24 hours.

Although many indicators suggest the correction may end soon, a death cross is threatening to deepen the decline.

HBAR Still in Downtrend

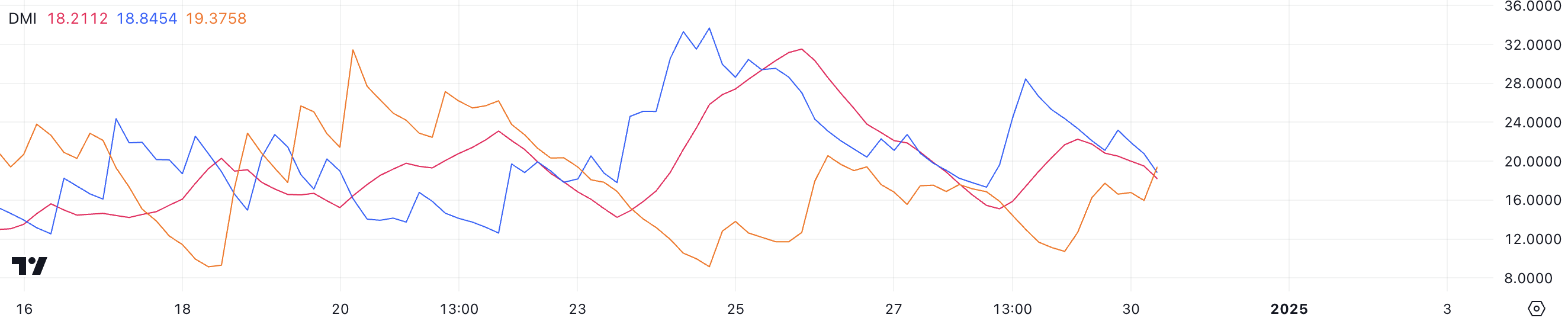

Hedera’s DMI chart shows its ADX is at 18.2, indicating weak trend strength. +DI (Directional Index) stands at 18.8, while -DI is slightly higher at 19.3, suggesting that bearish momentum remains somewhat dominant.

This configuration shows that HBAR is still in a downtrend, but the lack of strong ADX suggests that the trend is not firmly established, creating the possibility of movement in the market.

The Average Directional Index (ADX) measures the strength of a trend on a scale of 0 to 100, regardless of direction. Values above 25 indicate a strong trend, while values below 20, like the current HBAR of 18.2, indicate weak or no trend strength. The closeness of +DI and -DI indicates that neither side, long or short, is in significant control.

In the short term, HBAR price is likely to remain in a tight range or only move limitedly unless one side gains a clear advantage, with a rise in ADX to confirm stronger trend momentum.

Ichimoku Cloud Suggests Further Decline in Prices

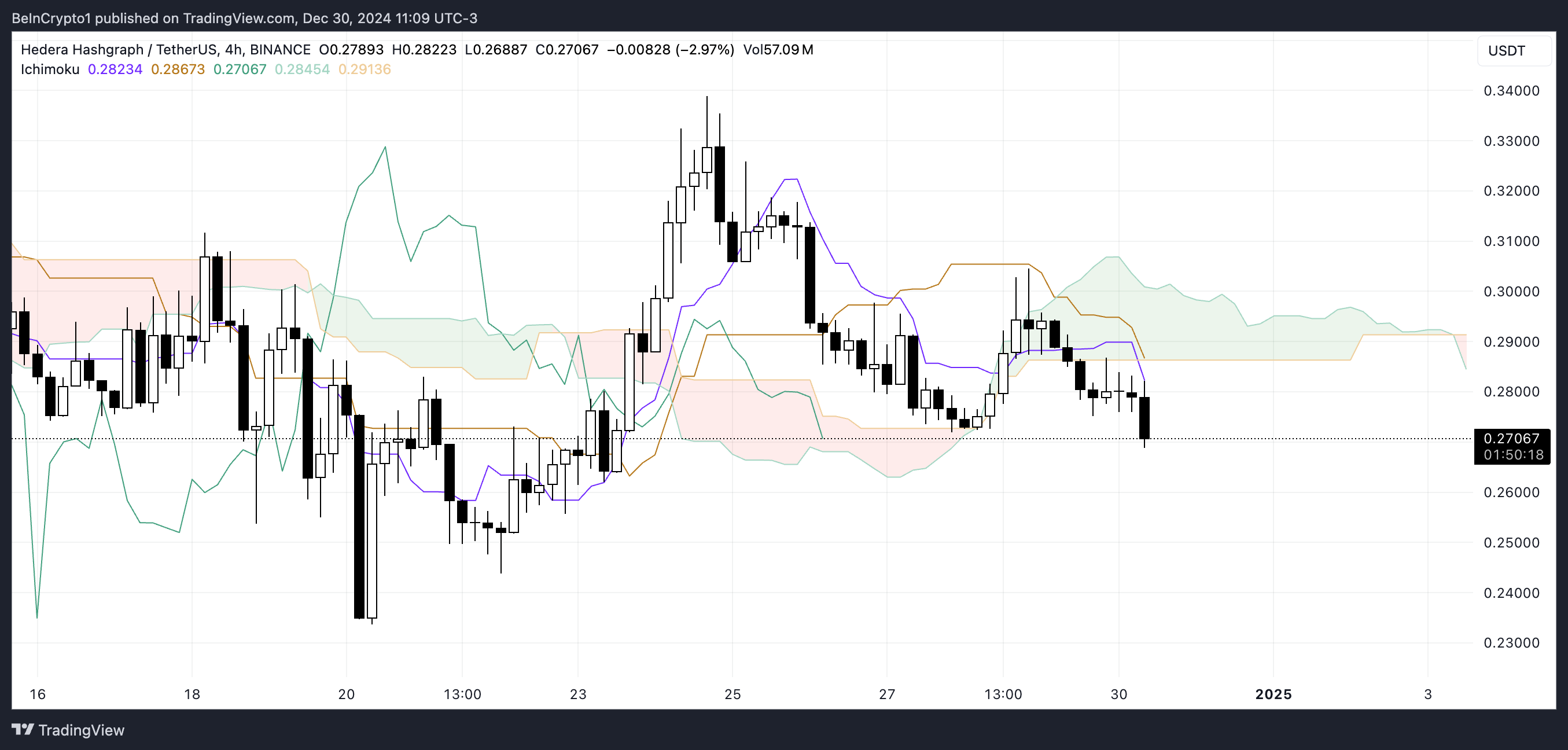

Hedera’s Ichimoku Cloud chart points to a bearish configuration, with price below the red cloud. The red color of the cloud, created by Senkou Span A and Senkou Span B, reflects the bearish price momentum as Senkou Span A remains below Senkou Span B. This configuration shows that bearish pressure is still present in the market, keep HBAR under bearish influence.

At the same time, the purple Tenkan-sen line (conversion line) is below the orange Kijun-sen line (baseline), reinforcing bearish sentiment as short-term momentum lags the long-term trend.

The green backstretch (Chikou Span) is also below the price action and cloud, further confirming the dominance of bearish conditions. Overall, the Ichimoku configuration indicates that HBAR is likely to continue its downtrend unless price rises above the cloud, signaling a possible reversal.

HBAR Price Prediction: Will Hedera Fall 13.7% Next?

If HBAR’s current bearish trend continues and strengthens, the price could fall further to test the support at $0.233. That could happen if the short-term line (red line) crosses below the long-term line (light blue line), forming a death cross. Failure to hold this support could signal increased bearish momentum, pushing prices lower.

On the other hand, if the trend reverses and the short-term line crosses above the long-term lines, HBAR price may attempt to recover.

In that case, the price could test the resistance at $0.31, and a successful breakout through this level could pave the way for a move towards $0.33. Such a bullish reversal would signal buying interest and potential momentum for continued upside.