Decentral Bank, the DAO founded to create stablecoins on the Near Protocol ecosystem, explained it has suspended the use of Close to for USN generation due to latest marketplace uncertainties.

The USN developers officially announced the v2. edition yesterday with the aim of making a certainly steady stablecoin capable to “survive” the winter of cryptocurrencies.

one / Announce $ USN v2.: Towards correct stability$ USN was created with a single query in thoughts: We know stablecoins can increase swiftly, but can we make them final? Our target is to develop a certainly steady stablecoin that can stand up to a bear and thrive in a bull. pic.twitter.com/q24teHjpOs

– Decentralized Bank (@DcntrlBank) June 30, 2022

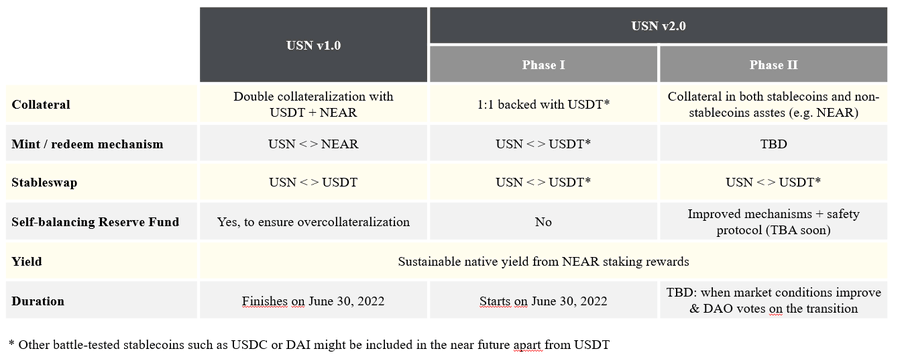

As a consequence, USN v2. will move to a far more versatile model and will be implemented in two phases. The transition will be established via the DAO grades.

three / TL DR

In phase I, $ USN will be one: one supported $ USDT: consumers can mint and redeem $ USN only with $ USDT. A native yield will be sustainably produced from $ CLOSE aim for rewards.

In phase II, $ USN it will also be backed by unstable assets, beginning with $ CLOSE. pic.twitter.com/Mu6ibDutyZ

– Decentralized Bank (@DcntrlBank) June 30, 2022

State one: USN will be supported one: one with USDT. That is, one blocked USDT will coin (develop) one USN and vice versa one USN can be converted to one USDT. Profit will be produced by Close to staking.

Phase two: USN will be assured with non-stablecoin assets, beginning with Close to.

As reported by Coinlive, USN is an algorithmic stablecoin with a one: one anchoring mechanism very similar to the UST coin of the Earth ecosystem, which signifies that to mint one USN, one USD of Close to is expected.

A representative of Decentral Financial institution DAO explained in a statement:

“Since it is impossible to predict how the market will move and if the selling pressure continues, there is a high probability that USN will not be sustainable as NEAR will also follow the general situation.”

The current marketplace downturn has proven that latest stablecoins are struggling to stand up to the pressures of latest crises, for instance:

- The death spiral is termed LUNA-UST, due to an “extravagant” escrow mechanism.

- A sizeable decline in the latest provide of collateralized declare-created (CDP) stablecoins this kind of as DAI or MIM. During a marketplace downturn, consumers are usually reluctant to lock collateral due to liquidation chance at any time.

- Newer remedies like FRAX are regarded also risky below latest ailments, in contrast to centralized possibilities like USDT or USDC.

- USDD in spite of getting a margin of far more than 200%, it is even now de-peg as normal.

Therefore, in addition to the newly up to date edition, Decentral Bank DAO also stated that it intends to include a “basket” of common stablecoins to be utilized as a base collateral for USN, such as USDT, USDC and DAI. This approach will make stablecoins far more possible to “bounce back” if the marketplace deteriorates once again.

Synthetic currency 68

Maybe you are interested: