Yesterday, DeFi two. tasks abruptly grew to become the hub of the market place, with remarkable development numbers (the two in cost and TVL). However, the wind abruptly transformed course right now when this venture group took a sharp dip. So what took place? Let’s locate out in the post under!

The distinction of DeFi two. tasks

As outlined in the post “DeFi 2.0 – Future trend or simply the title“ unreal ”?”, The clear distinction in between the one. and two. group lies in the function of optimizing the movement of capital. DeFi one. have been the to start with tasks with congested liquidity pools and DeFi two. was born to optimize this backlog.

Furthermore, DeFi one. considers Yield (agricultural premiums) as its target of reference, although DeFi two. targets the sources of liquidity (Liquidity) in these pools.

The wind “suddenly” transformed course

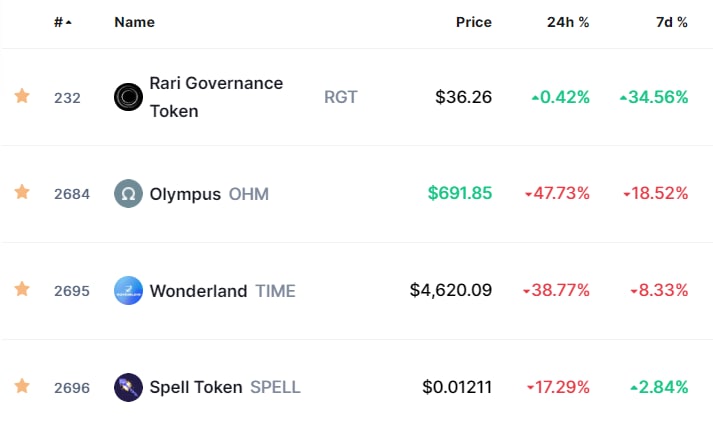

The twitter account of Adam Cochran (member of Cineamchain Ventures) launched an picture this morning, describing the whole efficiency of the latest DeFi market place:

– Adam Cochran (@adamscochran) October 15, 2021

The efficiency of the DeFi two. group was not really beneficial, when representative tasks this kind of as Olympus DAO, Spell, Rari, .. all had powerful downward momentum immediately after yesterday’s remarkable efficiency.

So what took place?

It is simple to see that two. tasks are largely dependent on the Olympus DAO flagship, when Time Wonderland is forking this venture to Avalanche and Rari has produced a help pool for the OHM token.

This morning, Olympus DAO announced edition V2, with alterations in terms of the governance mechanism.

We are really enthusiastic to share with you … Olympus V2https://t.co/IhmmhaVnYX

– OlympusDAO (@OlympusDAO) October 14, 2021

To realize these alterations, examine the Olympus operational description under !!

>> See a lot more: Olympus (OHM) – The DAO Trend Leader or the New “Pyramid Model”?

Of these alterations, the most notable are Series of bonds. As outlined in the former edition, but people who contribute LP and purchase Olympus Bond will appreciate some price reduction. This indicates that they will be purchase OHM under the market place cost at that time and this token will be Vesting (unlocked) slowly.

However, the new modification in V2 would like to “help” consumers not to have to do as well a lot of operations to conserve gasoline. Therefore, the sum of tokens bought by means of the Bond module will be staked and unlocked only for customers on the expiration date. The expiration intervals are picked by the purchaser, ranging from week to week.

This typically generates two pretty adverse side results Bond customers mixed the stakes.

On the side of the bond purchaser, they will be a lot more constrained in their liquidity, no longer actively offering OHM tokens to the market place as ahead of.

Compared to its peak on October 13, the worth of the Treasury, or collateral for OHM, has somewhat decreased. This is the short-term response of the Bonders immediately after the over announcement by Olympus. In distinct, secure mortgages like DAI or FRAX have been the greatest losers.

People burned at the stake, the lower in collateral in the Treasury tends to make OHM token holders in the pool truly feel insecure, which invisibly generates stress to withdraw the tokens from the pool and promote them. Also, in the close to potential, the APY will also slowly lower, lengthening the staker break-even time, creating the game a lot more complicated for this group.

Domino impact

As mentioned over, practically every single products depends on Olympus. Time is a fork edition, so the influence on the cost of this venture is a lot more in terms of novelty, fomo psychology of the participants.

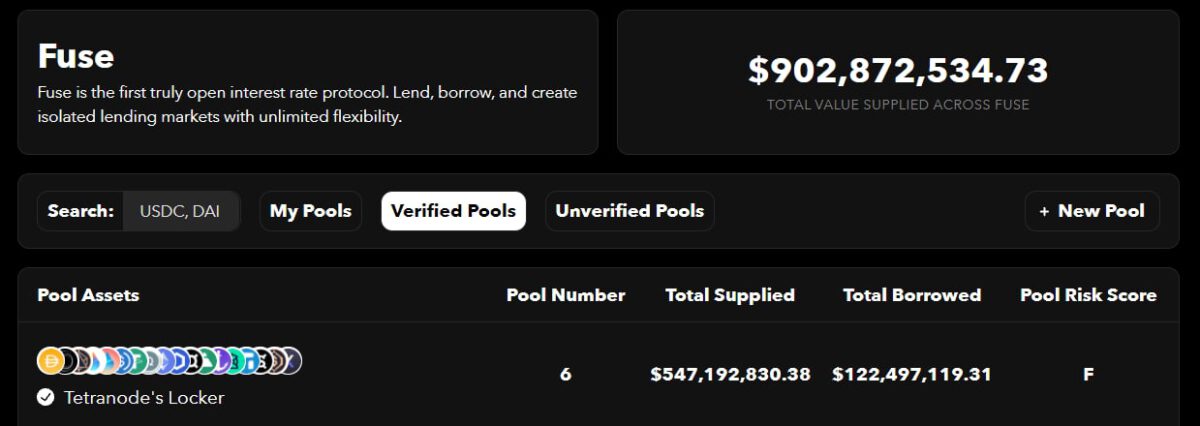

Meanwhile, sOHM is also an asset in a lot of collateral baskets for the Rari venture. Therefore, Olympus’ influence also produced this venture a bit volatile this morning.

finish

Undeniably, the difficulty that the DAO organizations in distinct and the two. venture crew in basic resolve is really exciting. However, if the management and coordination mechanism is not ideal, it can totally lead to a chain of “snowball” reactions and the collapse of the program.

The new developments of these new solutions will be constantly up to date by Coinlive.

Synthetic currency 68

Maybe you are interested: