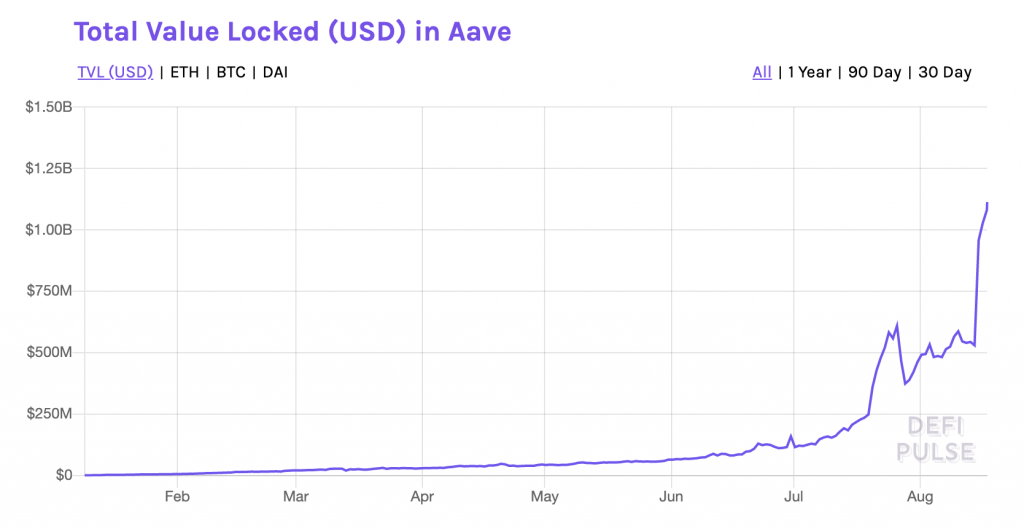

Aave, the non-custodial lending and lending protocol, has develop into the 2nd DeFi to surpass the $one billion mark. This variety implies that consumers have loaded the Aave protocol with $one billion well worth of assets to execute lending and borrowing functions.

Recently, Aave also announced model two of the protocol, getting ready a set of new options for consumers, which include native non-decentralized loans/credit score authorizations, enhanced borrowing prices, and transactions. debt translation.

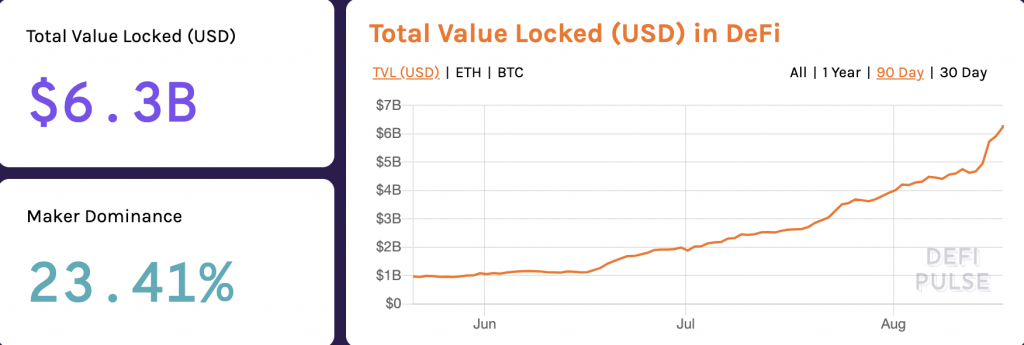

Aave hit $one billion in locked assets just 3 weeks following MakerDAO grew to become the to start with DeFi protocol to set the record. Currently, the complete assets locked in DeFi protocols have grown to $six billion.