After the accident unpleasant collapse of USTSeveral DeFi platforms have launched their personal algorithmic stablecoins to maximize connectivity with consumers and entice new liquidity, but if an individual “bathes twice in the same river”, consumers are prepared to trade, risking taking twenty once again. % of APY?

Stablecoin tasks it looks to have been fairly miserable in the previous, when the reputation of algorithmic stablecoins and the “success” Terra left behind raised the crucial part of USD-pegged assets in the cryptocurrency industry.

In an hard work to undo the injury brought about by UST, lots of DeFi protocols have subsequently launched new stablecoin algorithmic patterns. In essence, the DeFi sector is total of consumer engagement tasks, and the latest stablecoin launches are just a tactic made use of to maximize TVL on the DeFi platform.

In this posting, we consider a seem at some of the newest stablecoins on the industry and the influence they could have on the DeFi sector as a entire.

USN

USDD

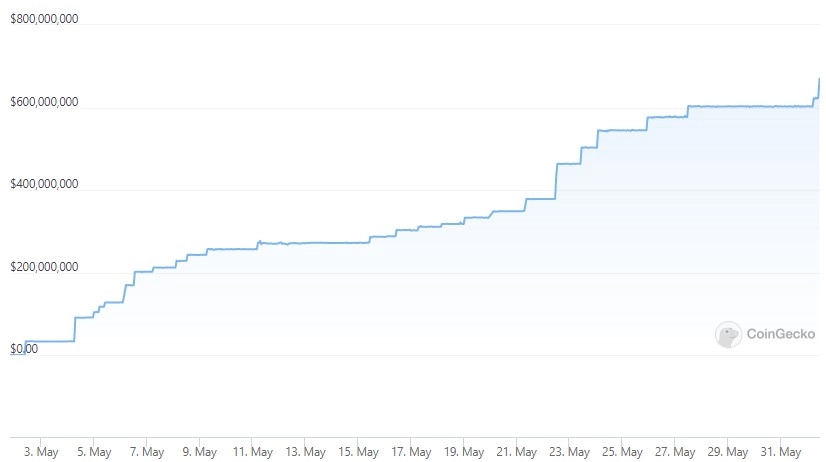

One of the greatest not too long ago launched stablecoin tasks is USDD on the Tron blockchain (TRX). USDD claims to usher in the era of “stablecoin 3.0”, competing right with UST and USN of Terra on Near in the stablecoin section supplying substantial curiosity costs. Since its launch on May 5th, USDD has seasoned fast development in circulating provide, at the moment at $ 602 million, and the presence of USDD in the Tron ecosystem is also fairly widespread to this day.

🚀With the launch of #USDD, #TRON the stablecoin is taking a much better form, forming a robust alliance of five #TRONstablecoins primarily based on: #USDT, #USDD, #USDJ, #TUSD & #USDC.

💪 In the long term, we will carry on to strengthen #TRONthe energy of stablecoin and provides much more ease to blockchain consumers. pic.twitter.com/qyBdponqhT– TRON DAO (@trondao) May 11, 2022

USDD is also implemented on Ethereum (ET) and BNB Chain (BSC), which aided maximize token distribution as effectively as supply further options for consumers.

Specifically, USDD will be pegged to the US dollar, with one USDD corresponding to one USD. For the foreseeable long term, the USDD worth will be supported by TRON’s TRX token. To get USDD, consumers will have to enter their TRX to obtain a corresponding quantity of USDD. In situation you want to get TRX back, you just have to do the opposite, which is to return USDD to the USDD contract and have the transaction send USDD back. This is precisely like the mint-burned model from UST and LUNA.

The element made use of by USDD to entice traders is the announcement that it will supply an APY curiosity fee of up to thirty%, increased than UST’s 18% and USN eleven% (base) on Near.

The selling price of TRX is up 17% from $ .07 to its recent selling price of $ .08 following hitting $ .092 on May 31.

fUSD

Fantom also issued fUSD, coined (created) by collateralising Fantom (FTM), Currency USD (USDC), Come on (HARD), SpiritSwap (SPIRIT) and Tether (fUSDT). Therefore, as opposed to algorithmic stablecoins that have not too long ago expanded, fUSD is an “over-collateralized stablecoin” backed by collateral with a fee of up to 500%.

The new @FantomFDNthe native stablecoins of $ fUSD…

Brings all the goodness of decentralization even though supplying stability:

✅Guided by the local community.

✅Total transparency.

✅ Excessively assured stability.Plus, you may be joyful to see new collateral assets!

– Stader.Fantom (@stader_ftm) May 25, 2022

The assure ratio figure of 500% usually means that to make one hundred fUSD, consumers will will need to home loan a complete of 500 USD of FTM. At the time of creating, the fUSD’s circulating supply is at 60,993,403 and is trading at $ .7112, which is substantially much less than the $ one peg that will have to be hit.

one particular USD

After starting to be the to start with undertaking to win a parachain on Polkadot, decentralized finance platform Acala launched aUSD as the to start with stablecoin for Polkadot tasks.

aUSD is also an “over-collateralized stablecoin”, coined by Polkadot (POINT), Polkadot (LDOT), Kusama (KSM), KSM (LKSM), Acala (ACA) or Karura (KAR). Pledging assets in LDOT and LKSM enables DOT and KSM holders to carry on earning staking rewards even though also borrowing collateral.

On March 23, Acala partnered with 9 other parachains on Polkadot and Kusama and an sector investment fund group to produce a USD Ecosystem Fund really worth up to $ 250 million. With this massive help, Acala incubates tasks that can adopt aUSD stablecoins, as effectively as advertise DeFi business enterprise on the Polkadot and Kusama ecosystems by aUSD.

Acala, 9 parachain teams and a venture fund group launched the $ 250 million “Ecosystem Fund aUSD” ️💸

The fund is hunting for early stage tasks from any @A pois or @KusamaNetwork robust chain guard $ one USD stablecoin use circumstanceshttps://t.co/OJ2V47ZUry pic.twitter.com/NDgLg2bG8N

– Acala (@AcalaNetwork) March 23, 2022

As of May 31, US $ six.31 million has been minted and TVL committed to Acala has reached US $ 91.53 million.

Synthetic currency 68

Maybe you are interested: