DeFiance Capital, an investment fund that after “eliminated” its ties to Three Arrows Capital (3AC), is making a $ one hundred million fund to invest in “liquid tokens.”

According to quite a few sources acquainted with the matter, DeFiance Capital is in talks to generate a “cash fund” well worth $ one hundred million and has now reached half of its target.

DeFiance Capital has obtained pledges from a crypto fund and quite a few household offices. DeFiance’s new fundraising move comes soon after quite a few giants have stepped up investments in liquid tokens, the phrase applied to refer to tasks that problem tokens that have been listed or are waiting to go public. Earlier this yr, Sequoia Capital debuted Fund of 500 million bucks for very similar functions.

DeFiance Capital was founded in 2020 by Arthur Cheong, after “very close” to Three Arrows Capital, who invested in quite a few tasks in the presale round. But considering that 3AC it has fallen into a state of economic downturn to the level of obtaining to declare bankruptcy, DeFiance Capital “withdrew” and declared an independent operation. The peak is nevertheless there Rumors of DeFiance are suing 3AC.

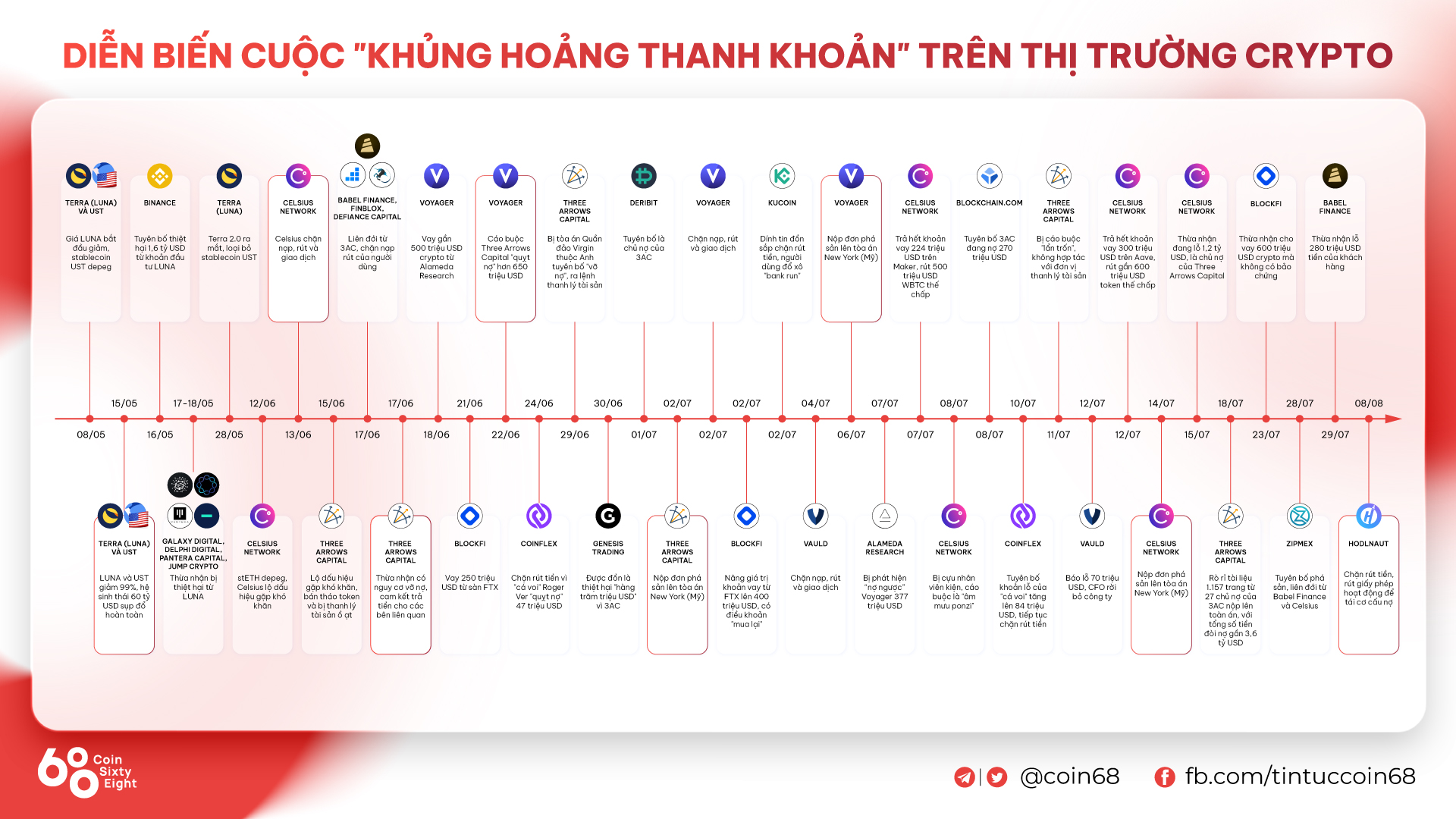

In late May and early June, 3AC was the scorching title in the cryptocurrency marketplace. Despite keeping its place as one particular of the greatest hedge money in the marketplace ever considering that The earth’s ecosystem has collapsedthe fund suffered a series of losses, as reported on a regular basis by Coinlive.

Synthetic currency 68

Maybe you are interested: