Deribit, the greatest Bitcoin choices exchange by industry share, raised capital with a valuation of $ 400 million, four sources acquainted with the matter stated..

Two of the 4 anonymous sources stated the Panama-primarily based exchange raised about $ forty million in a deal with shareholders QCP Capital, Akuna Capital, and 10T Holdings.

The fundraising took location 3 months later on Deribed confirmed as a creditor of Three Arrows Capital (3AC) just after the hedge fund went bankrupt. Deribit raised new capital to carry its place back to pre-3AC.

3AC collapsed in June just after struggling hefty losses due to the collapse of the Earth ecosystem and the cryptocurrency industry chaos at the time. The fund’s $ 200 million investment in LUNA appeared to have wholly vanished when the algorithmic stablecoin TerraUSD (UST) was launched in mid-May.Deribit was 1 of the creditors who filed for a judicial liquidation of 3AC’s assets in the British Virgin Islands. .

This led to a new $ a hundred million fundraiser, raising the valuation to $ two.one billion in an August 2021 funding deal.

Luuk Strijers, Commercial Director of Deribit stated:

“Today’s valuation of $ 400 million is basically irrelevant as the fundraising comes from current traders. This can be any worth. It is the withdrawal of dividends from current shareholders. We had paid large dividends previously and made the decision to be much more cautious in consolidating our stability sheets and holding assets rather than distributing them to shareholders. “

Strijers adds that a company’s real valuation is unknown until finally it conducts a public funding application. Deribit stored his rating reduced in this inner round “to avoid word of mouth”.

Founded in 2016, Deribit is largely aimed at institutional traders. OperaDeribit’s reduced valuation exhibits the stress the cryptocurrency industry is exerting on the recent valuation of a personal firm.

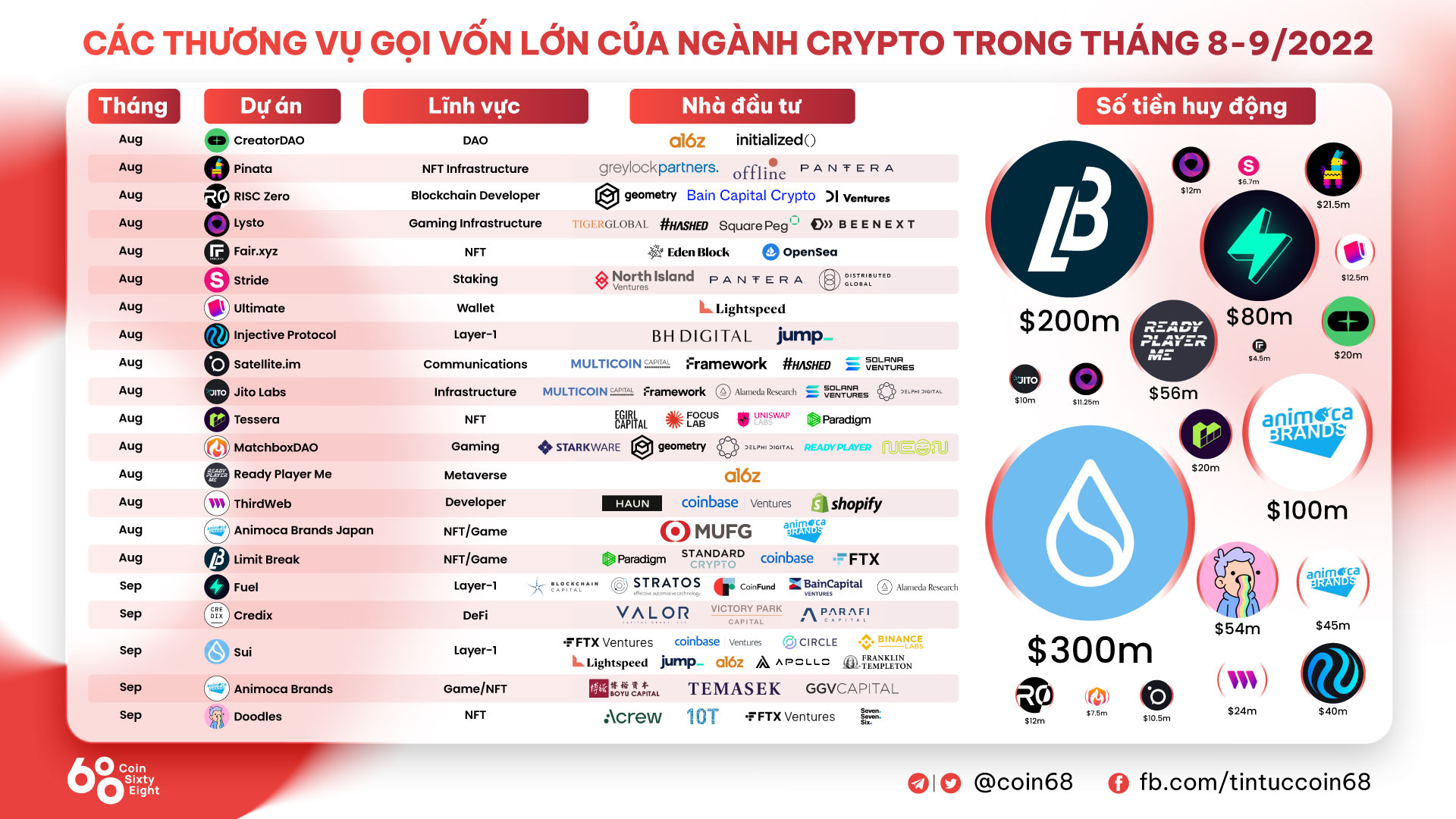

In contrast to the fascinating fundraising / funding ambiance of the prior quarter. There had been only a handful of funding rounds in September, but the worth raised was not as terrific as Azuki ($ thirty million), Messari ($ 35 million), Sardine ($ 51.five million), Doodles (USD 54 million) ). USD), Sender ($ four.five million), Mysten Labs ($ 300 million).

Synthetic currency 68

Maybe you are interested: