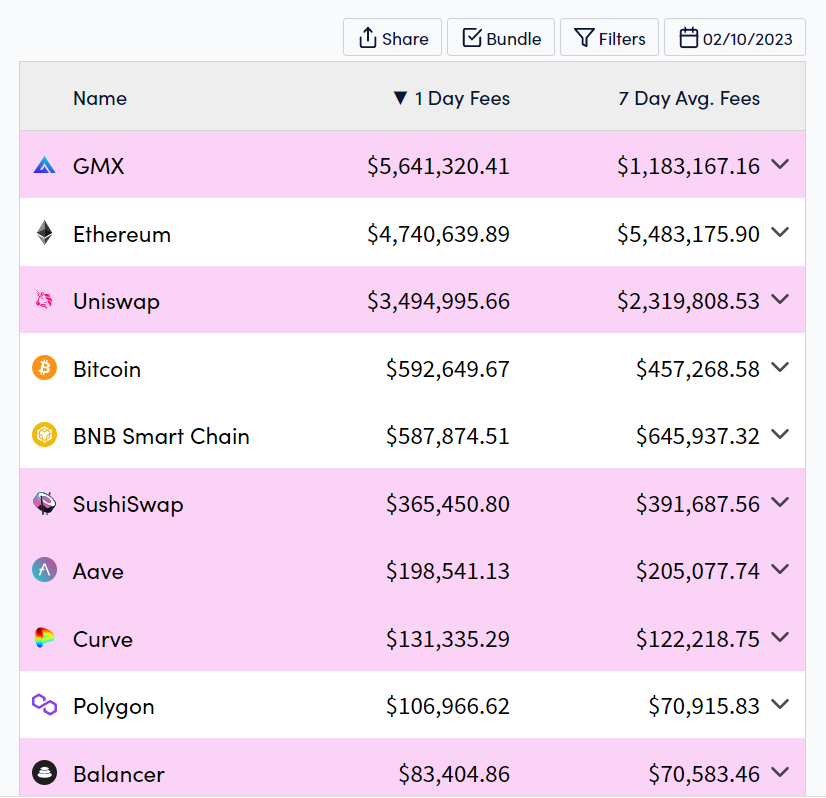

Derivatives exchange DEX GMX grew to become the biggest income-making DeFi platform in the DeFi area above the weekend, surpassing Ethereum.

According to the statistics of CryptocurrenciesTransaction charges obtained by GMX above the weekend of above $five million additional to the complete $120 million in platform charges accumulated due to the fact September 2021, signaling rising basic power for the native token.

The charges are shared involving two task tokens, GMX and GLP. GMX is a utility and governance token that accrues thirty% of the charges created by the platform, whilst GLP is a liquidity supplier (LP) token that accrues the remaining 70%. DeFi merchandise like GMX are primarily based mostly on wise contracts to deliver customers with market-main monetary companies, this kind of as leveraged trading and lending.

On the GMX side, the task lets customers to trade numerous token futures and monetary derivatives on the DEX supplying with leverage up to 50x the authentic collateral.

It can be stated that due to the fact the dYdX fever in 2022 with $466 billion traded on the platform, GMX has emerged as a robust competitor to dYdX, assisting the derivatives section achieve a whole lot of traction in current occasions.

Notably, GMX functions this kind of as very low slippage, low-priced commissions, and safety towards undesired liquidations have also contributed to the recognition of DEXs. The task has locked up above $500 million in cryptocurrencies as of Feb. 13, with $455 million on Arbitrum and the rest on Avalanche. However, to know much more about the prospective of GMX, read through the particulars by means of the post under:

– See much more: GMX Project Overview – Impressive and prospective decentralized perpetual exchange task

In basic, this kind of a sudden boost in transaction charges on GMX is partly due to a variety of prominent figures in the crypto Twitter local community this kind of as Mechanism Capital founder Andrew Kang closing lengthy positions of his hundreds of thousands of bucks in Bitcoin and Ethereum on GMX.

Recent exercise on @GMX_IO , like Andrew Kang’s lengthy positions in ETH and BTC, closed at a new all-time large for GMX on our charge panel. In the previous 24 hrs, GMX hit $five,641,320 in consumer charges, which is much more than double its prior all-time large pic.twitter.com/HqW3ZMdSsL

— DefiLlama.com (@DefiLlama) February 11, 2023

However, gaining the believe in of other crypto “sharks” by utilizing the similar substantial positions has partially demonstrated the utility that GMX gives customers. On the other hand, this kind of a large push charge on the platform is also the information that exhibits that the current investor game in the derivatives industry has started off to heat up much more than all through the late 2022 economic downturn.

It’s not just person traders who are passionate about derivatives, but the wave of institutions are also seeing a equivalent image. Recently, the President and CEO of the famed Chicago Mercantile Exchange (CME) uncovered that institutional demand for crypto futures merchandise is the moment yet again displaying indicators of robust development.

Synthetic currency68

Maybe you are interested: