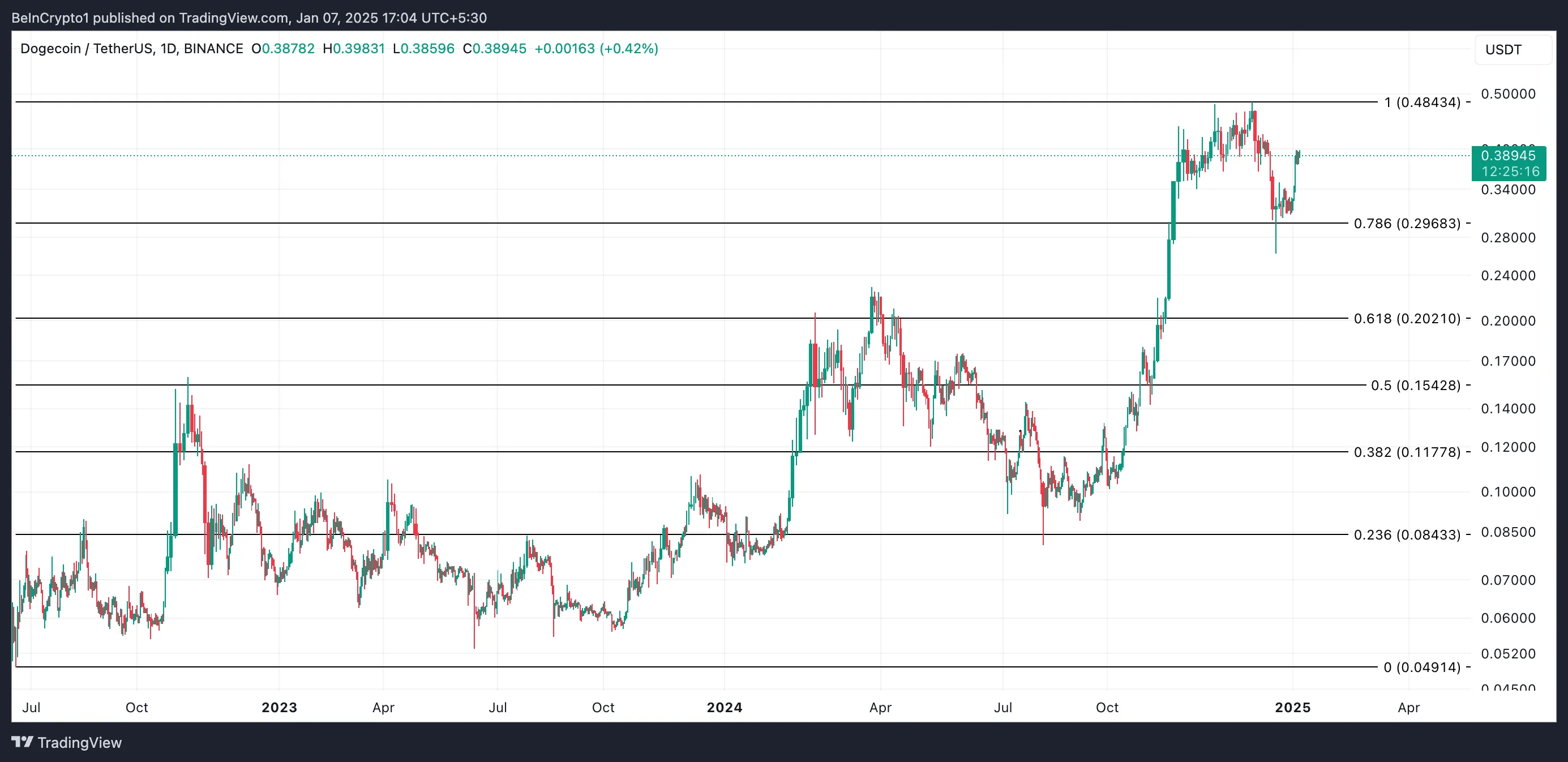

Dogecoin (DOGE), the leading meme cryptocurrency, has seen a notable price increase over the past week, outperforming rivals such as Shiba Inu (SHIB) and Pepe (PEPE). During this period, DOGE increased by 23%, surpassing SHIB which increased by 14% and PEPE which increased by only 4%.

With DOGE Short-Term Holders (STHs) extending their holding periods, the price of this meme cryptocurrency could continue its short-term uptrend.

Short-Term Holders Drive Dogecoin’s Gains

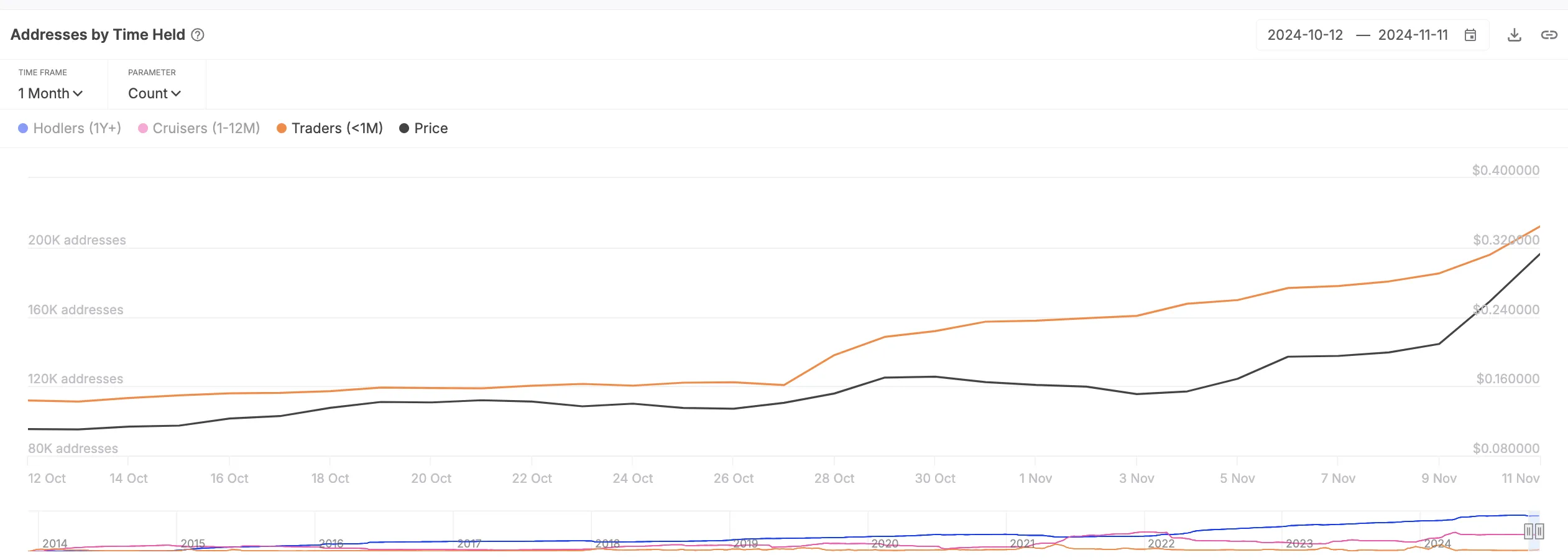

According to IntoTheBlock, DOGE STHs (those who hold assets for less than a month) increased their holding period by 110% in the past month.

When an asset’s STHs increase in holding period, this indicates a shift in investor sentiment from short-term speculation towards long-term investing. This reduces selling pressure in the cryptocurrency market, helping to stabilize prices and prevent sharp declines.

STHs play an important role in price dynamics, as they react quickly to market movements and create instant fluctuations through their trading activities. When STHs extend their holding periods, they reduce selling pressure, helping to stabilize asset prices and facilitate growth.

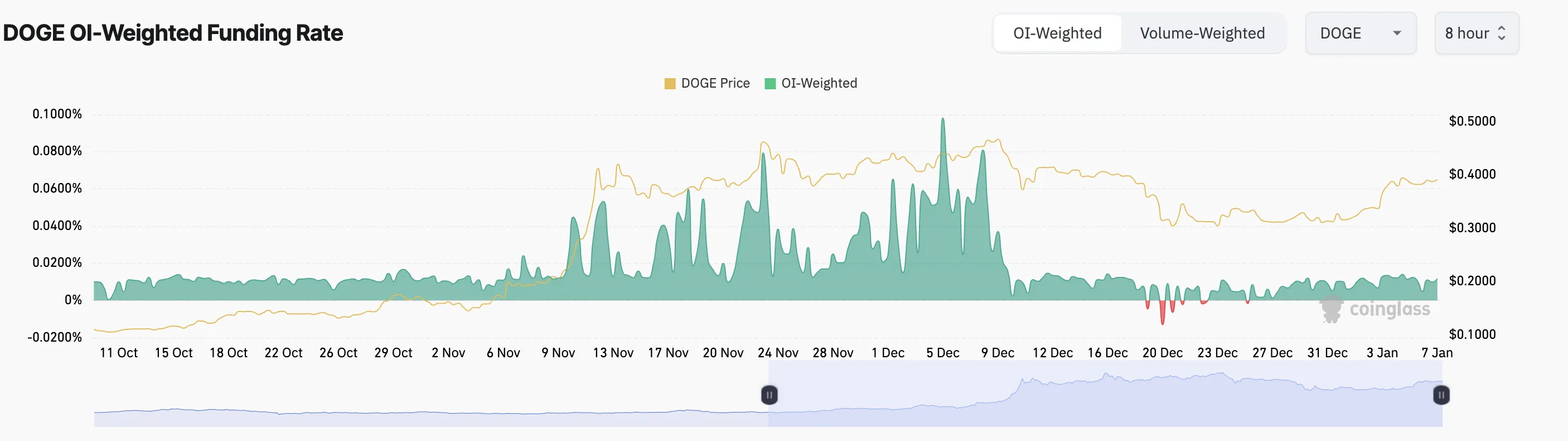

Furthermore, DOGE’s positive funding ratio, which stands at 0.0011% at press time, supports this bullish outlook. This is a periodic fee between traders in perpetual futures contracts to keep the contract price in line with the spot price of the underlying asset.

A positive funding ratio means long positions (buyers) are paying short positions (sellers), indicating bullish sentiment and high demand for leveraged long positions.

DOGE Price Prediction: Short-Term Holders Must HODL

If DOGE’s STHs continue their hodling strategy, the price could extend the uptrend and touch a four-year high of $0.48.

However, a negative strategic shift would invalidate this optimistic forecast. If DOGE’s STHs group starts selling for profit, the price of this meme cryptocurrency could drop to $0.299.