BitDAO (BIT), the undertaking that promotes itself as “the largest DAO fund in the world”, has finished the IDO occasion on SushiSwap’s MISO platform with a raised sum of in excess of $ 381 million.

BitDAO overview

On the internet site, BitDAO declares itself not a business, but a decentralized automated organization. BitDAO’s working principle is to request donations from large names, then use this cash to produce DAO’s operations and make improvements to the worth of the total ecosystem.

The principal routines of BitDAO contain:

– Project grants (similar as Gitcoin)

– Protocol growth (by cooperation agreements, building of new solutions)

– Investment in the type of a token exchange: BIT token holders will have the proper to vote to decide on which tasks BitDAO will invest in. BitDAO will then trade the ETH and USDC that the fund manages for the project’s tokens on DEX exchanges.

As of press time, BitDAO has acquired a $ 77.9 million donation from the Bybit exchange. The exchange is anticipated to maximize the sum of contributions in the close to potential.

Also, a further purpose a lot of people today are interested in BitDAO is the reality that a lot of large names have invested in it. In June, BitDAO announced it raised $ 230 million from large names like billionaire Peter Thiel and his Founders Fund, Pantera Capital and Dragonfly Capital, traders Alan Howard, Jump Capital and Spartan Group.

The undertaking claims that this sum will act as liquidity for the Token Swap operation. However, this $ 230 million sum has not however been recorded on the internet site or internet site BitDAO smart contract. This sensible contract has so far only transferred money to ByBit, but there have been no other transactions.

Collect “huge” capital on SushiSwap’s MISO launchpad

Hence, BitDAO mentioned it would be the final IDO undertaking on SushiSwap’s MISO platform. This Launchpad has been concerned in a whole lot of controversy in the previous this kind of as the time Yield Games Guild (YGG) IDO – opened the sale of tokens really worth $ twelve.six million for just 32 participants.

This opening sale of BitDAO (BIT) is also not immune from associated disputes. Similar to YGG, IDO BitDAO on MISO is nevertheless performed below the “Dutch Auction” auction mechanism. This can be understood as a type of a reverse auction. MISO will set the highest value the undertaking accepts, then customers will obtain steadily till no 1 buys any longer, then the value will be lowered to the minimal. Buyers on MISO will not be restricted to the variety of BITs they can order.

As a outcome, the IDO on MISO will be split into two pools, a pool of 180 million BIT tokens will be offered in ETH, and the remaining twenty million BIT pool will be offered in SUSHI. Both have a commencing value of two USD, the minimal value is one.two USD.

The BitDAO IDO occasion begun on the evening of August sixteen, 2021. Within hrs, the ETH pool was offered out to 9269 attendees, expanding the sum to 112,670 ETH, really worth roughly $ 360 million. Meanwhile, the SUSHI pool at the time of creating has only offered almost 43% to 1338 participants, with revenues of one,612,300 SUSHI (roughly $ 21.six million). This variety ought to maximize even further.

The BIT-SUSHI MISO auction is nevertheless lively with equally available airdrop bonuses.

Join with $ SUHI right here: https://t.co/LMPhFYEOiZ

– BitDAO (@BitDAO_Official) August 17, 2021

Doubts revolve all around

The sudden physical appearance as nicely as the “excessive” IDO worth of BitDAO created a lot of traders additional interested in this undertaking, so uncovering some unclear shortcomings on the undertaking side.

The to start with is get the job done $ 230 million in investment from substantial money has not however been registered in the Treasury of the undertaking, which presently only has almost $ 78 million really worth of ByBit exchange alone. This is explained since the investment was not disbursed by the large names, or will be allotted in accordance to the prolonged-phrase roadmap.

The 2nd is IDO with skyrocketing charges. The complete provide of BIT tokens, in accordance to the undertaking internet site, will be set at ten billion tokens. Combined with the IDO commencing value of two USD, it indicates the undertaking will have Diluted capitalization of up to USD twenty billion – place this token amongst the ten/eleven biggest cryptocurrencies in the globe. It can be mentioned that this is an unimaginable variety for a newly born undertaking that has not been place into operation. It also can make some people today feel of the Internet Computer (ICP) “catastrophe” which will go public at the finish of May with a valuation of almost € 58 billion, and then catastrophically lower its worth by additional than 90%.

Tuesday is “weird” IDO session on MISO. According to statistics, in the ETH pool, 180 million BIT tokens have been promptly depleted at an regular value of USD one.99, which indicates that traders are nevertheless assured that BitDAO will have a marketplace capitalization of up to 19.9 billion. USD. But the odd factor is that the SUSHI pool is not however half offered.

The query is why is this so? Combining inquiries one and three, does the figure of $ 230 million in institutional investment flip out to be for this IDO? If this assumption is appropriate, then this seems to be a trick to polish BitDAO’s effective title, assisting them the two have a effective IDO round with a big sum of capital and appeal to a substantial sum of FOMO for the ETH pool ( with the evidence that there have been additional than 9,200 participants, not just 32 people today like IDO YGG). But it also displays that most of the opening cash is for investment money that have previously committed to participating, not since of the higher degree of curiosity from the retail investing local community.

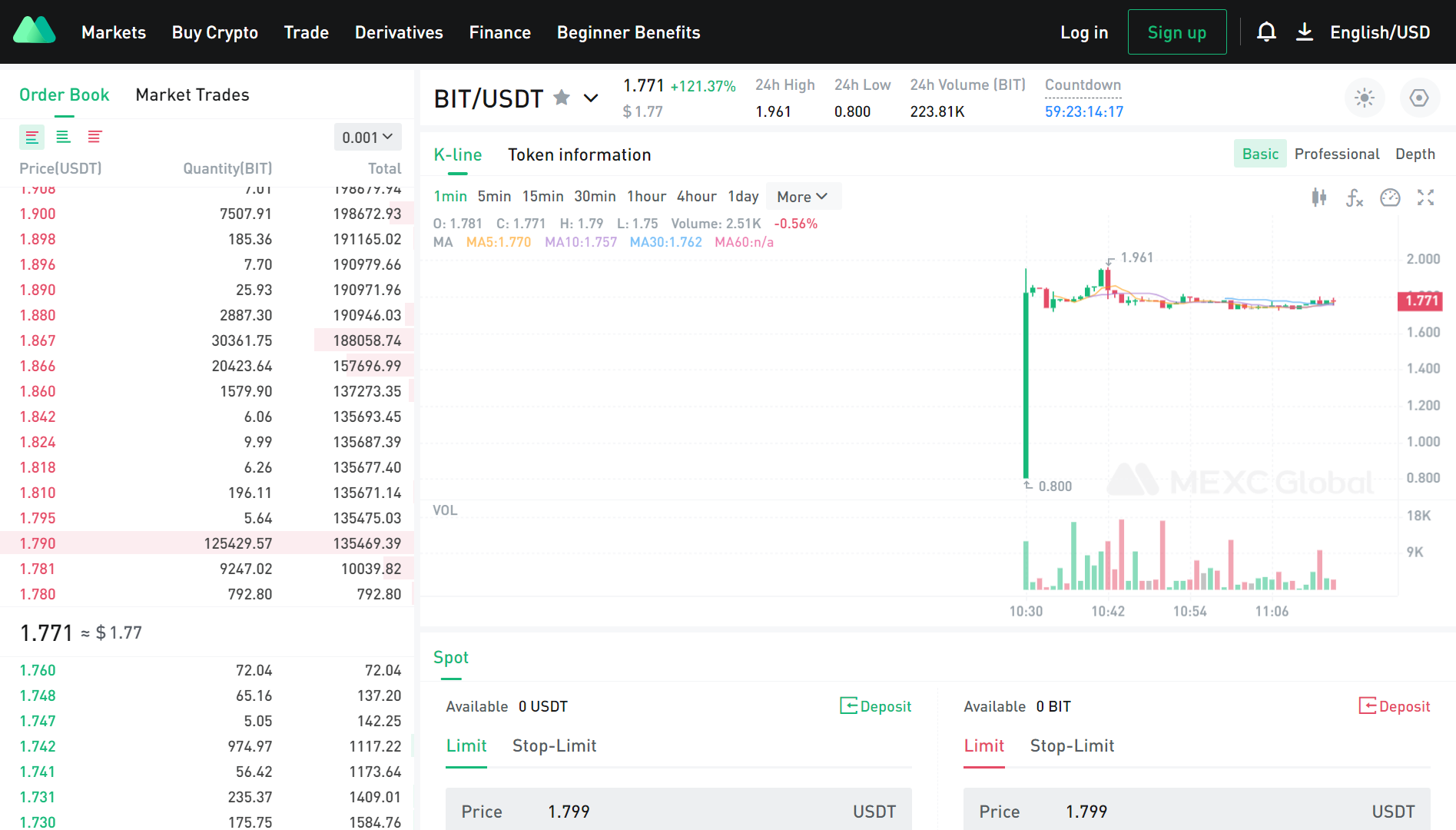

This morning, BitDAO’s BIT token went public on MEXC, with a peak value of just USD one.96, all around the regular IDO order value, when the existing trading value is just USD one.77. This could also be why the SUSHI pool on MISO “sold slowly” as traders flocked to exchanges to obtain tokens at a less costly value alternatively of obtaining right from the launchpad.

Synthetic currency 68

Maybe you are interested: