The price of Celestia (TIA) has plummeted, falling more than 15% in the past 24 hours and nearly 40% in the past 30 days. The current market capitalization is $2.2 billion, and this decline comes as technical indicators are signaling bearishness, including a new death cross, hinting at the possibility of further declines. .

Although TIA holds key support above the $4.54 level, the overall market sentiment remains negative. To recover, resistance at $5.50 needs to be overcome, but the current trend shows that sellers are in tight control.

The Downtrend Of TIA Is Strengthening

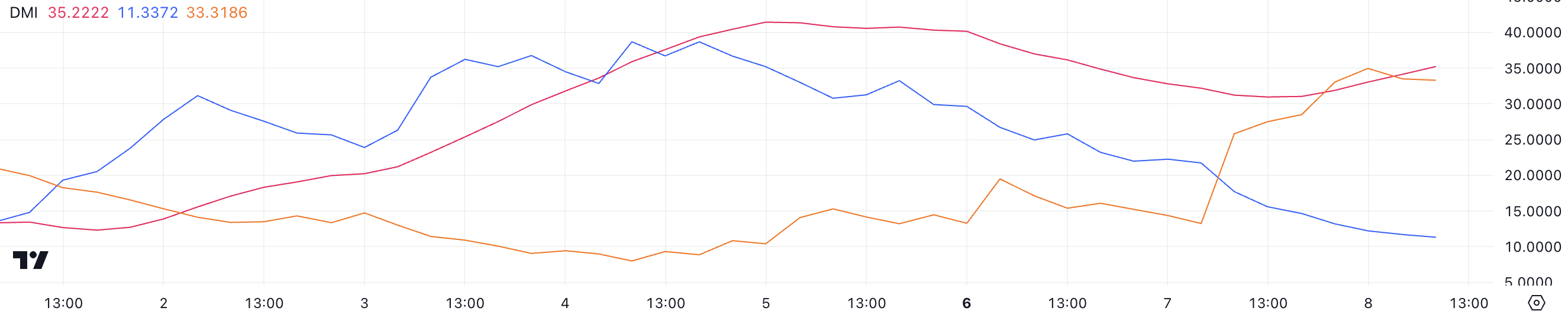

The Average Directional Index (ADX) for TIA is currently 35.2, up from 31.2 just in the past day, signaling a strengthening trend. ADX measures the strength of a trend, whether bullish or bearish, on a scale of 0 to 100, with values above 25 indicating a strong trend, and below 20 reflecting weak or no momentum.

The rising ADX confirms that TIA’s downtrend is intensifying, highlighting increased selling pressure in the market.

Directional indicators provide additional insight into trend dynamics. The +DI index, which represents buying pressure, fell sharply from 22.2 to 11.3, reflecting a significant weakening of bullish momentum. Meanwhile, the -DI index, which indicates selling pressure, rose from 14.3 to 33.3, signaling increasing bearish activity.

The combination of a decrease in +DI and an increase in -DI confirms that the sellers are firmly in control. This suggests that Celestia’s price may continue to come under downward pressure unless buying interest increases to counter the bearish momentum.

Ichimoku Cloud Shows Bearish Momentum for Celestia

The Ichimoku Cloud shows that TIA price has fallen deep below the cloud, indicating a strong downtrend. The red cloud (Senkou Span A and Senkou Span B) reflects overhead resistance, as the slope remains flat but remains above the price, suggesting no immediate reversal in sentiment.

The blue line (Tenkan-sen) and orange line (Kijun-sen) have diverged, with the green line below the orange line, confirming the bearish momentum.

Additionally, the green span (Chikou Span) is below the cloud and price, reinforcing the downtrend and the dominance of bearish sentiment in the current market situation. To show signs of recovery, TIA would need to move back inside the cloud, which doesn’t look promising based on current indicators.

TIA Price Prediction: Will It Test $4.10 Soon?

The recent death cross formation for Celestia has increased its bearish momentum, triggering further price declines. A death cross occurs when a short-term moving average crosses below a long-term moving average, signaling a possible transition into a more prolonged downtrend.

This technical development suggests that bearish sentiment is currently dominant, increasing bearish pressure on TIA’s price movement.

Despite the bearish setup, TIA price still holds important support at $4.54. If this support breaks, the price could continue to decline to $4.16, signaling a deeper correction.

Conversely, if TIA can recover and establish an uptrend, the price could head towards the nearest strong resistance level at 5.50 USD.