dYdX Chain will distribute all network costs to transaction validators and stakers.

dYdX Chain expenses transaction costs in USDC, split amongst validators and stakers. Photo: Pintu

dYdX Chain expenses transaction costs in USDC, split amongst validators and stakers. Photo: Pintu

dYdX Chain, a blockchain primarily based on the Cosmos SDK of the DEX of the exact same identify, will use all accumulated costs to pay out validators and stakers on the network, whilst strengthening the worth of the DYDX token on the v4 update.

⏰ Staking – It has the dual goal of guarding the chain and as a reward mechanism for respecting the guidelines of the protocol

All costs (USDC-denominated trading costs and gasoline costs for DYDX or USDC-denominated transactions) collected by the protocol are distributed to validators and stakers

— dYdX Foundation 🦔 (@dydxfoundation) October 27, 2023

In the early morning of October 27, the dYdX Chain alpha mainnet officially went reside with the 1st Genesis blocks, as reported by Coinlive. This is a important milestone, marking a new chapter for the greatest decentralized derivatives exchange in the cryptocurrency sector.

In the newest update, the dYdX Foundation announced the extension of the DYDX token to v4, highlighting its position in bettering network protection and governance. As a end result, DYDX can be utilised for staking functions. This implies that the token holder can develop into a transaction validator for the network by staking the token itself.

In individual, the derivatives platform will do this now charge transaction costs in USDC. To stay clear of token inflation and as an more reward, the dYdX Foundation will award all these network costs to validators and stakers. The distribution mechanism is managed via the Cosmos x/distribution module, to be certain honest distribution amongst validators and stakers.

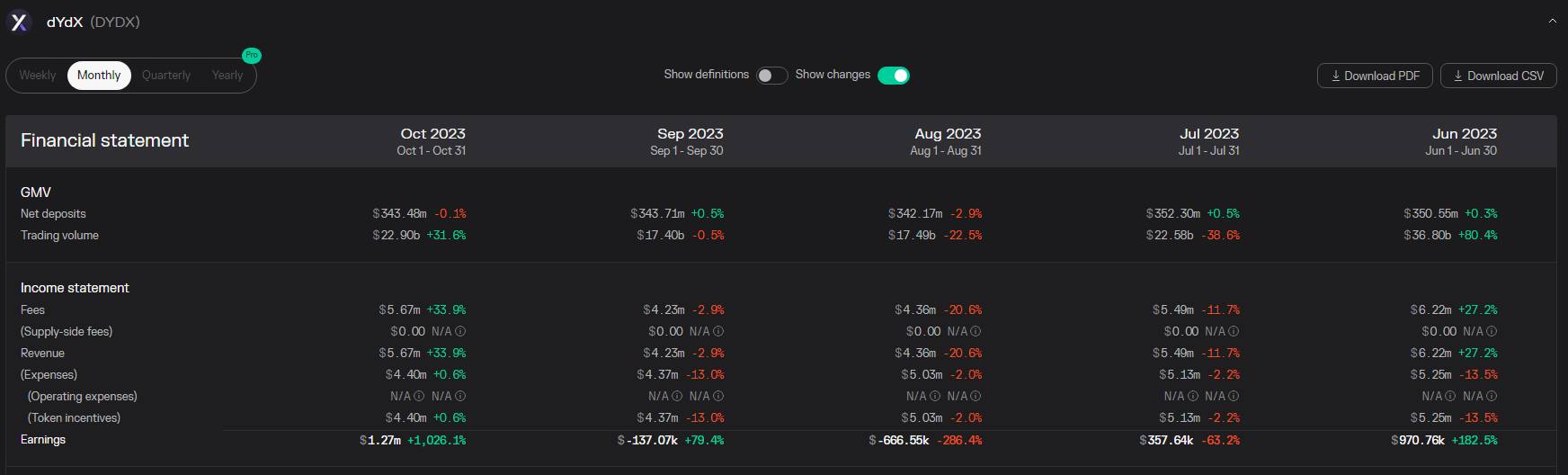

According to information from Token Terminal, dYdX has collected additional than $five.67 million in costs this October. Last year’s figure was $137 million, building it an beautiful piece of the pie for validators and ecosystem stakeholders.

Statistics on transaction costs earned by dYdX above the final five months. Source: Token Terminal

Statistics on transaction costs earned by dYdX above the final five months. Source: Token Terminal

Above are the 1st making blocks on which dYdX lays the basis for transitioning to the v4 improve and welcoming the wholly new, local community-driven, layer one blockchain.

The existing alpha phase of the mainnet is largely aimed at anxiety testing the network and making a validation crew. The beta release date will be voted on by the local community.

Coinlive compiled

Join the discussion on the hottest problems in the DeFi marketplace in the chat group Coinlive Chats Let’s join the administrators of Coinlive!!