dYdX Unlimited has launched new features designed to change the way decentralized trading works.

The Instant Market Listings feature allows users to create and trade markets instantly, eliminating the need for traditional approval processes.

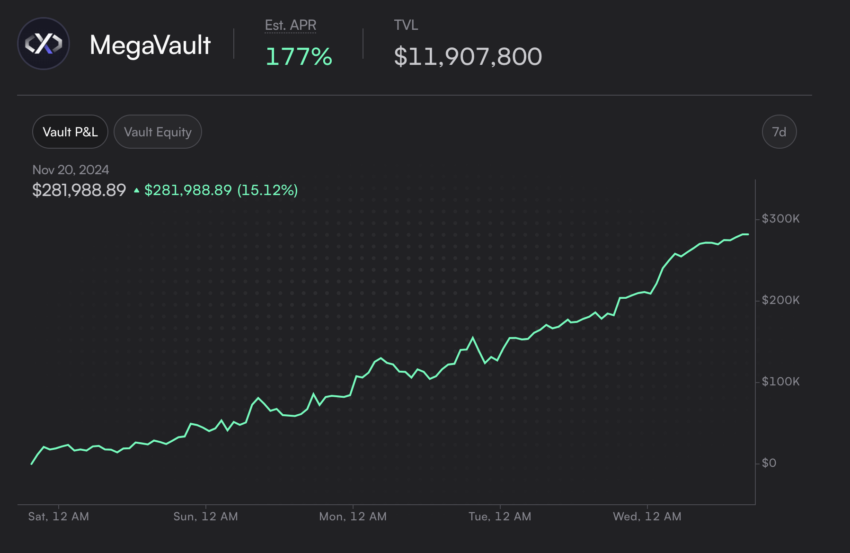

dYdX’s approach enables faster and more flexible access to liquidity for traders in the derivatives space. Platform also include MegaVault, automatically distributes liquidity in the market and allows users to earn passive income by depositing USDC. The tool supports sustainable liquidity for all markets while providing yield opportunities through automated market making strategies.

Instant, permissionless listings have created a new wave of trading opportunities in DeFi. Now, dYdX brings that to derivatives,” according to dYdX’s press release.

Additionally, dYdX Unlimited has updated its Trading Rewards program, allocating 1.5 million USD of DYDX Tokens monthly and providing the ability to earn Tokens with every trade. The new Affiliates program allows users to receive commissions in USDC for referring others, with higher rewards for larger affiliates.

These features aim to streamline the trading process, enhance liquidity, and provide additional profit opportunities, supporting the continued growth of DeFi platforms. Community reaction mostly positivewhich is reflected in MegaVault’s post-launch returns.

However, the sustainability of a high annual percentage return (APR) remains in question. In fact, in the early hours of the launch, the APR even exceeded 1,000%. As of the time of writing, the platform offers an estimated APR of 177%.

Liquidity Challenges in DeFi

Liquidity is a major challenge in DeFi (DeFi), especially for new or less popular markets. These markets often lack sufficient liquidity, leading to problems such as high slippage and reduced trader participation. The rise of multi-chain ecosystems has further fragmented liquidity, spreading users and capital across different blockchains, creating shortages.

DeFi platforms also rely heavily on liquidity providers, who can withdraw funds when conditions are unfavorable, destabilizing the market. Attracting liquidity often requires costly incentives that are not always sustainable, and non-traders often have few opportunities to contribute liquidity and earn passive income.

dYdX Unlimited solves these problems through its MegaVault feature, ensuring automatic liquidity allocation across markets, supporting sustainable liquidity for new projects, and providing users with a simple way to earn income by depositing capital. These solutions help stabilize markets, reduce liquidity fragmentation, and make participation more accessible to active traders and passive investors, strengthening the overall DeFi ecosystem .