dYdX, a significant derivatives exchange, had a fairly superior 2022. So what is the trigger?

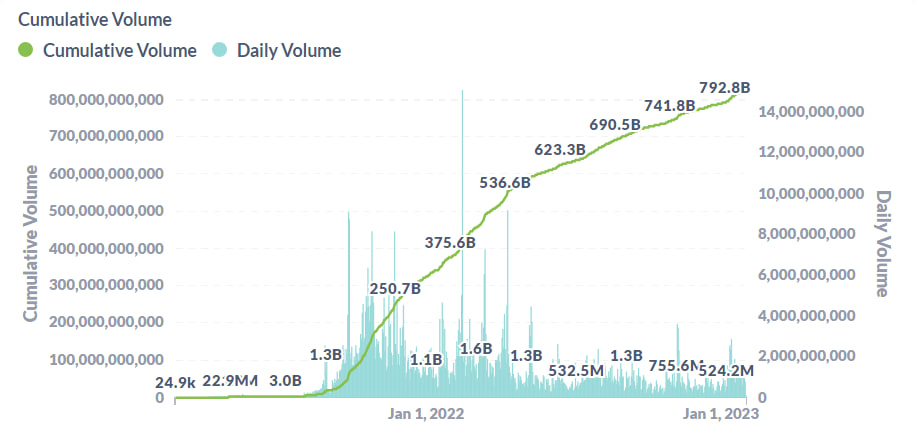

Quote annual report Announced by the dYdX Foundation on January 31, the platform garnered $466.three billion in cumulative trading volume and $137.eight million in charge cash flow in 2022. As a end result, the platform’s cumulative volume improved by 140%. in contrast to the similar time period final yr, or about 322 billion US Bucks.

dYdX Foundation is fired up to share the ecosystem’s inaugural yearly report 🔥

Despite difficult industry disorders in 2022, stakeholders in the dYdX ecosystem persevered and continued to create in the direction of the long term of finance, one particular block at a time 💪🏾https://t.co/NPKPOdEpeG pic.twitter.com/hwz8mgOQOW

— dYdX Foundation (@dydxfoundation) January 30, 2023

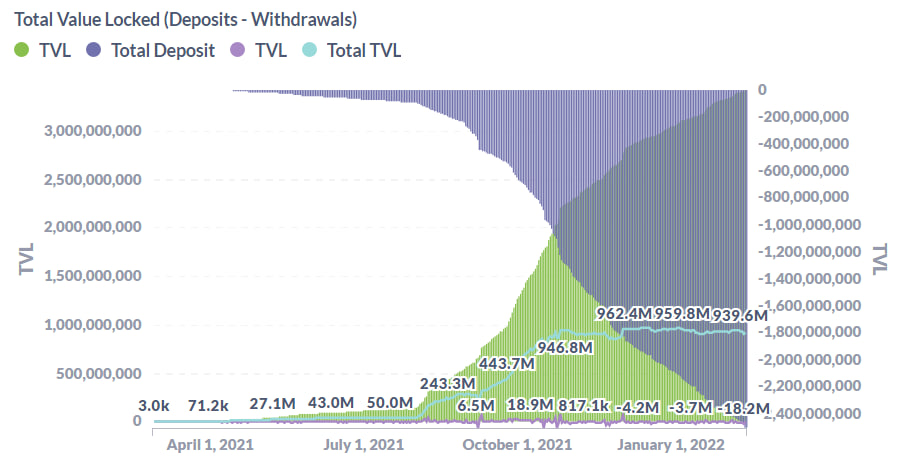

Even so, the complete quantity of locked assets (TVL) on the platform has decreased to about 400 million bucks immediately after peaking at one.one billion in October 2021. The over numbers reflect that dYdX customers carry on to remain and use the platform.

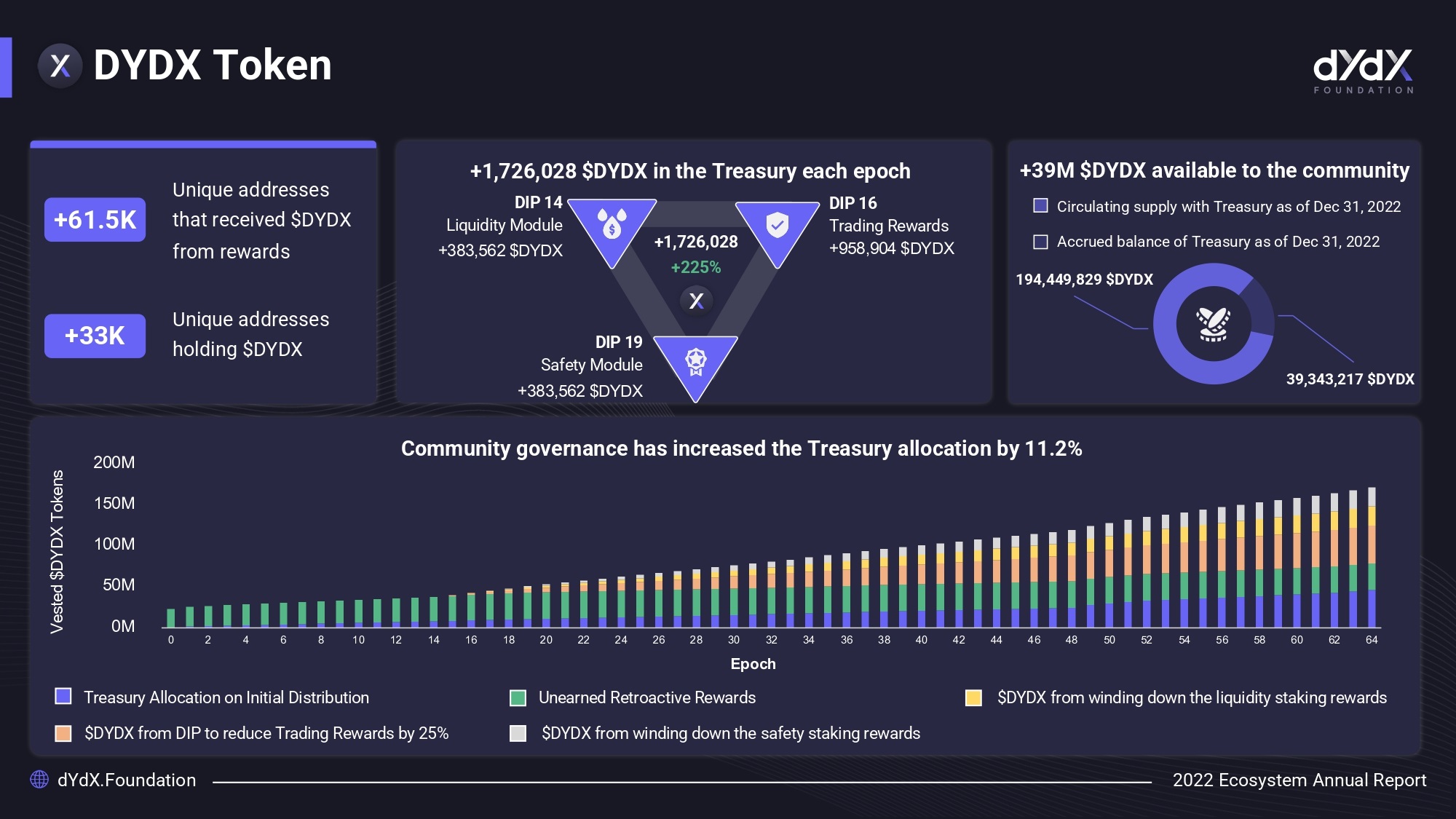

As of the finish of 2022, there are more than 33,000 exceptional addresses holding DYDX, and the task has distributed tokens to more than 61,500 wallets in the type of retroactive rewards, trading, staking, and liquidity mining.

Overall, 2022 is a productive yr not only for the mother or father organization but also for stakeholders this kind of as DAO members, industry makers, infrastructure, protection and audit support companies, exploration and analytics teams and teams.

The dYdX ecosystem is wealthy in:

🔴 DAO contributors and delegates accredited,

🔴market makers,

🔴 infrastructure, protection and audit companies,

researchers, e

🔴 Tool builders and DAO analytics.Congratulations to all stakeholders of the dYdX ecosystem for a productive 2022 pic.twitter.com/S0bJkMsyR1

— dYdX Foundation (@dydxfoundation) January 30, 2023

However, the reality that the DYDX token has develop into inflationary has speculators anxious. This stems from a program to “release” 150 million tokens, well worth more than $280 million, to early traders, staff members and task advisors on February three, 2023.

If it gets to be a actuality, the circulating provide of DYDX will be doubled from the present 156 million and the starting of 2023 will be an incredibly “sensitive” time for this token. Still, the task will carry on to unlock much more tokens in the following months.

As Coinlive when commenteda primary platform in this derivatives section might announce much more crucial details to “support” the price tag of DYDX.

Until final week, the dYdX staff manufactured up their minds Token unlock system delayed until finally December 2023. At that stage, the quantity of tokens to be unlocked will be up to 400 million DYDX, the task Confirm.

The price tag of the token has been flying “just sucking” more than the previous couple of days. DYDX has had “fast” development, temporarily peaking at $three.fifty five, the price tag variety by way of May 2022. DYDX is up virtually 35% on the preceding day and 104% on the weekly frame.

dYdX is at present launching on Layer two StarkEx, but will quickly migrate to its personal blockchain on the Cosmos process.

Synthetic currency68

Maybe you are interested: