Terra (LUNA) provide has fallen to an all-time minimal, giving an critical driver of the token value regardless of issues about sustainability in the protocol’s working model.

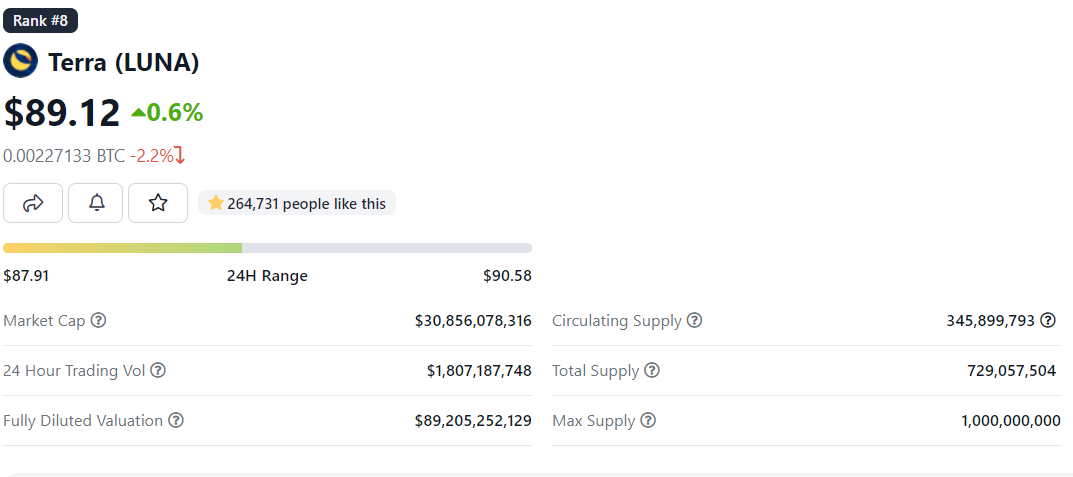

In unique, as of April 28, LUNA’s circulating provide fell to 346 million tokens, down from 355 million in the preceding month and to a optimum of 482 million final November. In addition, the complete assets out there in the industry that are not blocked for staking are lowered to 90 million for the 1st time.

$ LUNA for the 1st time ever, the provide of circulating liquids is much less than 90 million👀

Exciting occasions for anyone #MOON 🚀🌔 pic.twitter.com/brarV4WIcL

– Anonymous (@crypto_mystery) April 26, 2022

Additionally, the TerraUSD (UST) platform stablecoin has also turn out to be the third greatest stablecoin in the cryptocurrency industry due to LUNA’s fantastic capability in the previous.

Because the value of LUNA is closely tied to TerraUSD (UST), simply because LUNA is wanted to preserve the UST value fixed at one USD. The pricing mechanism is created utilizing an algorithm that incentivizes traders to enter a trade and return the value at a fixed fee, which completely cancels and generates a MOON to stability provide and demand for trading with UST.

When UST is in excess of one USD, LUNA is burned to UST. Likewise, if the demand for UST is minimal and the value falls under one USD, the FSO will be burned to generate LUNA. In buy to enhance the attractiveness of the platform, Terra also enables end users to deposit UST cost savings on its main lending protocol, Anchor Protocol (ANC) with an yearly curiosity fee of up to twenty%.

However, this does not make LUNA a deflationary asset. Presumably if the FSO’s enterprise weakens and traders depart the Earth ecosystem, the FSO will be burned to preserve the value fixed, therefore diluting LUNA’s provide, main to a drop in rates. On the other hand, solving lengthy-phrase monetary troubles with a twenty% curiosity in Anchor Protocol is also a challenging trouble for Earth. As a outcome, quite a few industry veterans extensively feel that Terra’s development may possibly be unsustainable.

In buy to remedy the over trouble, mostly aiming to strengthen investor self-confidence, Terraform Labs established the Luna Foundation Guard (LFG) organization to assistance the Earth ecosystem by means of the obtain of BTC as collateral for the UST currency. . Terra’s ambitious aim is to make the platform the greatest holder of Bitcoin in the planet, soon after Satoshi Nakamoto.

Additionally, in early April, Terraform Labs and Luna Foundation Guard purchased a complete of $ 200 million in AVAX to make this token the 2nd reserve currency for UST. Terraform Labs also just “donated” $ 880 million in tokens to the Luna Foundation Guard to bolster the organization’s assets to construct reserves.

So far, soon after paying billions of bucks in the previous two months, LFG’s UST escrow reserve holds additional than 42.five thousand BTC (equivalent to one.65 billion bucks), the rest is allotted to LUNA, USDC and USDT.

The @LFG_org now quit the $ US peg with $ two,235,147,731 USD.

Broken down:

BTC 42.53K (one.65B USD)

MOON one.76M ($ 155.72M USD)

USDC 398.66 million ($ 398.62 million)

USDT 26.28 million (USD 26.29 million)– Reserve_LFG (@Reserva_LFG) April 27, 2022

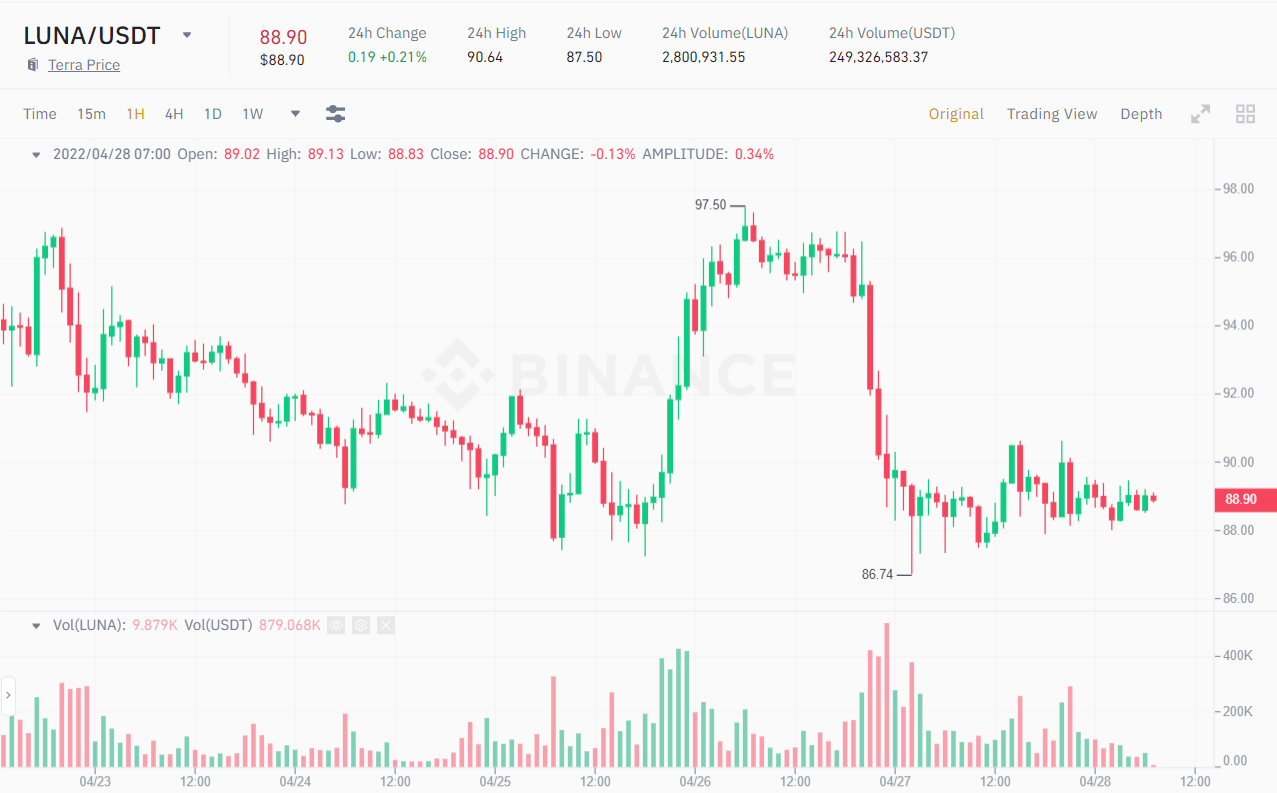

Overall, regardless of some inadequacies in the working model, the value of LUNA has risen pretty drastically amid most other preferred cryptocurrencies struggling with scorching inflation, increasing curiosity charges, and so forth. and geopolitical uncertainties brought about the industry crash. Since the starting of 2022, LUNA has been down by just two.eight%, even though Bitcoin is down by 18% and some important altcoins, this kind of as Solana (SOL) and Cardano (ADA), are dropping close to forty% of their worth. .

As of press time, LUNA is trading at close to $ 88.9, up .21% in excess of the previous 24 hrs.

Summary of Coinlive

Maybe you are interested: