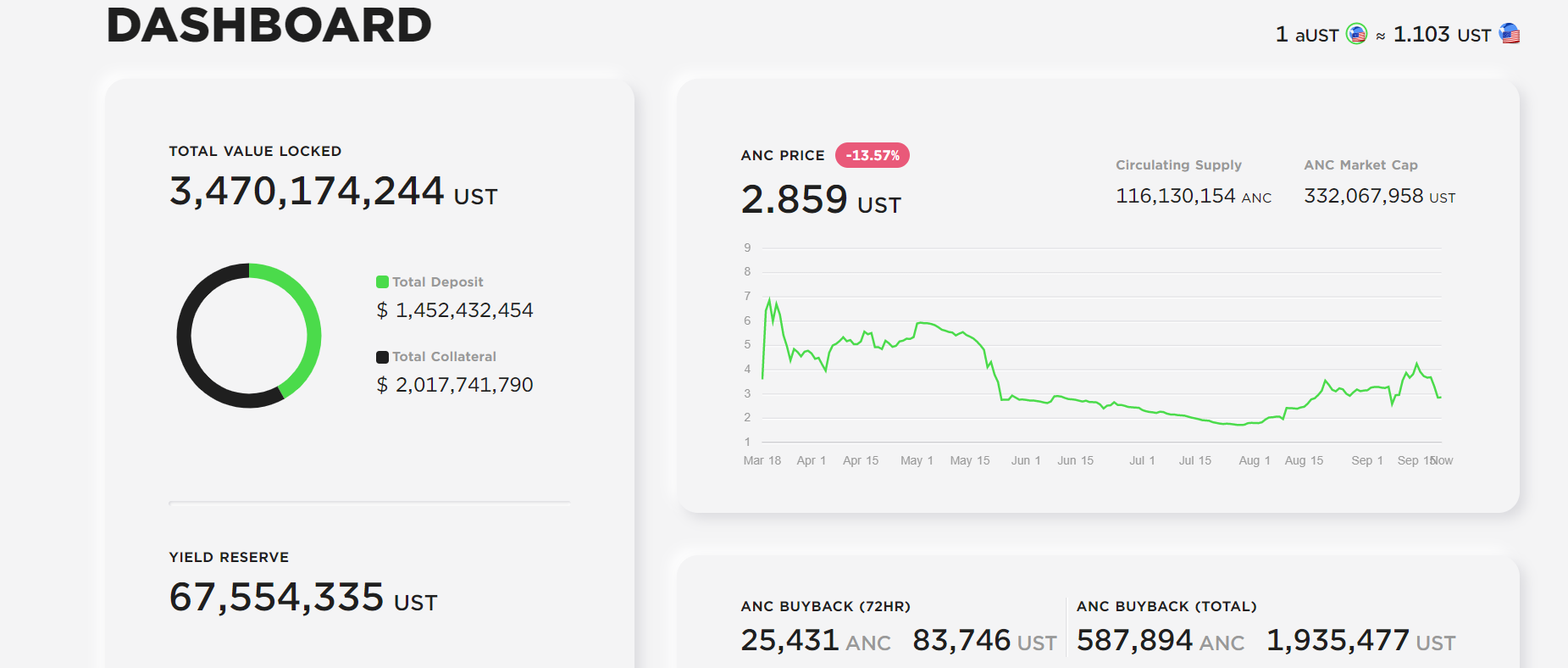

Just 6 months immediately after its launch, Terra’s Anchor protocol surpassed $ three billion in complete locked-in worth (TVL). The platform that supplies end users with an 18-twenty% return on the UST stablecoin is operating to place itself at the forefront of the DeFi marketplace.

Officially launched on March 18 on the ambitious Terra blockchain, Anchor Protocol has swiftly established itself as 1 of the major agricultural manufacturing protocols in the DeFi globe. Just 6 months immediately after release, the platform boasts almost $ three.five billion in complete locked-up worth (TVL), a “dreamy” figure that quite a few new tasks aspire to.

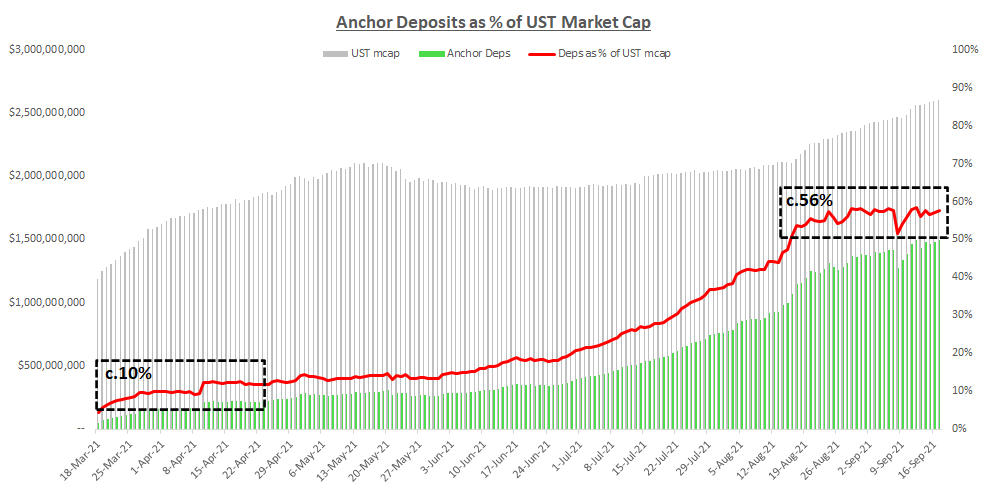

With that, Anchor’s deposits grew along with UST’s industry capitalization. Terra’s stablecoin has confirmed to be hugely common with Terra’s increasing consumer base, and quite a few participants deposit on Anchor as their 1st interaction with a new protocol in the ecosystem.

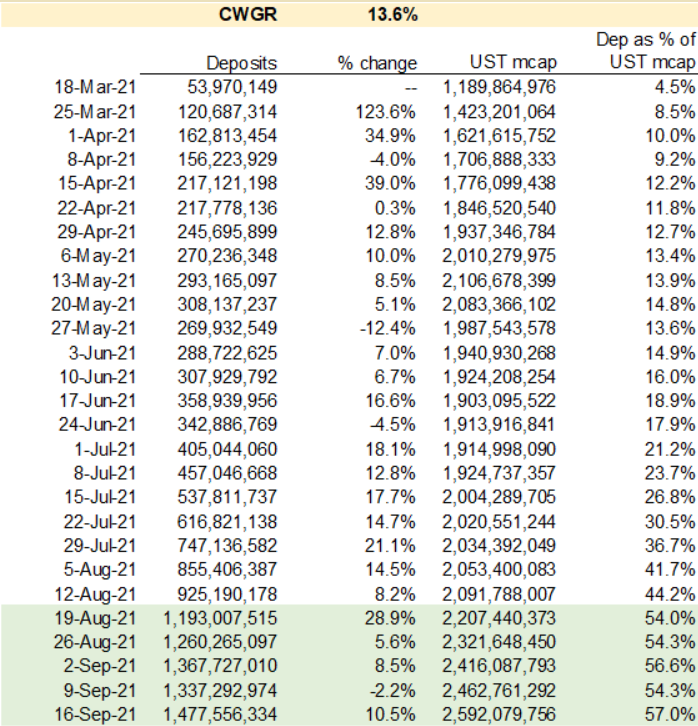

There is a close to fantastic correlation concerning the sum of UST obtained and the sum of UST deposited on Anchor. Anchor information demonstrates that Anchor’s deposits accounted for only ten% of UST’s industry capitalization in March. As the protocol gains much more momentum, the quantity has grown to signify 56% of UST’s industry capitalization.

At the similar time, the bond concerning UST deposits and loans in Anchor has also greater appreciably. Promote Anchor in 1 of the markets with the most essential UST use circumstances and the biggest UST ownership.

The over indicators have offered a significant improve to the Protocol’s Deposit Index which has grown at a compound weekly development charge (CWGR) of up to an astonishing 13.six%.

As Terra grows, end users will commence on the lookout for other methods to commit UST, LUNA and other tokens in the Earth “universe”. This does not imply that Anchor will eliminate worth for the Earth ecosystem.

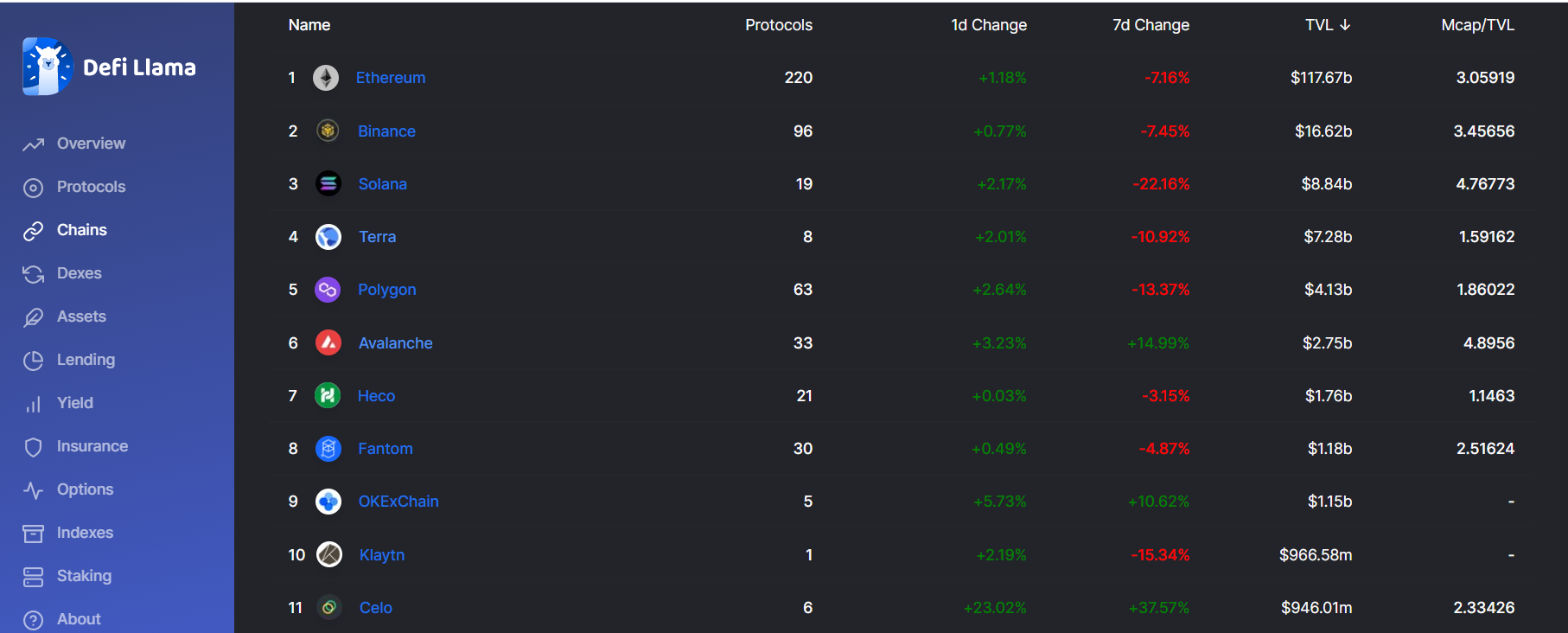

Also based mostly on the over information, Terra TVL’s leading protocol is also the platform’s “peak” in the race towards rivals like Solana (SOL), Binance Smart Chain (BSC) and Ethereum (ETH). ). At the time of creating, Terra is at present the fourth biggest platform in significant DeFi chains with a TVL of $ seven.28 billion.

The overriding intention that Anchor have to target on in the close to potential is to boost the UST provide index locked in the protocol, building the most of current strengths that will deliver good rewards to the platform. Anchor’s development prospective is nevertheless fairly big if it continues to increase at this charge as a result of the finish of the 12 months.

Synthetic currency 68

Maybe you are interested: