Soon, El Salvador will see the first regulated tokenized offering of US Treasuries, providing previously excluded individuals and institutions with access to this investment tool.

NexBridge Digital Financial Solutions, a licensed digital asset issuer in the country, has partnered with Bitfinex Securities to introduce this new product.

Bitfinex Securities Expects to Raise $30 Million for Cryptocurrency

Stage of calling for capital offering period starting Tuesday and lasting until November 29. Investors can use Tether’s stablecoin (USDT) to purchase the token, with plans to accept bitcoin (BTC) in the future.

After the funding period ends, the tokens will be traded on Bitfinex Securities’ secondary market. These codes will be traded under the ticker USTBL. Their value will be tied to BlackRock’s short-term Treasury bond ETF. Bitfinex Securities hopes to raise at least $30 million through this initiative.

“By leveraging Bitcoin’s technology and infrastructure, we are laying the foundation for a globally accessible financial ecosystem, bringing digital US Treasuries to investors around the world, ” Michele Crivelli, founder of NexBridge, shares in announcement.

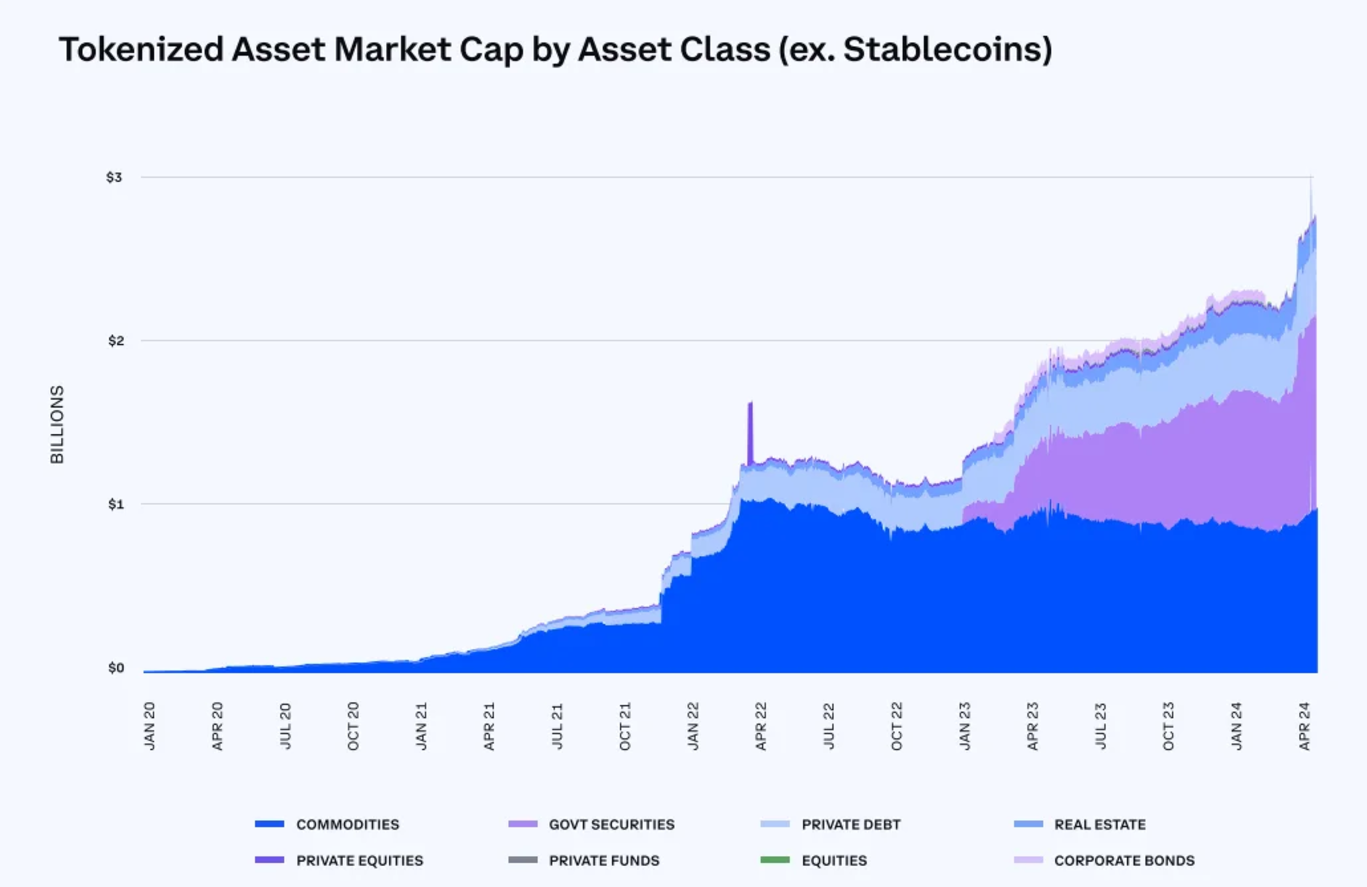

Overall, the tokenization of real assets (RWAs) is expanding rapidly. Earlier this month, BNB Chain launched a tokenized portal for RWAs and private companies to simplify onboarding for new Web3 users.

Similarly, MANTRA launched its mainnet, allowing on-chain integration of RWAs. This boosted the utility of their OM Token, which increased over 200% in November, reaching a new record high.

El Salvador Continues To Benefit From The Amount Of Bitcoin It Owns

El Salvador continues to move forward with significant financial progress. The government recently launched its third round of USD bond buybacks. The effort targets more than $2.5 billion in bonds, subject to securing new financing. This decision comes after BTC hit a record high after the election.

In addition, former US President Donald Trump’s second term could benefit the administration of President Nayib Bukele. It will likely improve El Salvador’s chances of receiving financial assistance from the International Monetary Fund (IMF).

Back in 2021, El Salvador received global recognition when it became the first country to accept Bitcoin as legal tender. Currently, the amount of Bitcoin the country owns is valued at up to 515 million USD.