The 2022 Global Cryptocurrency Adoption Index has launched its third report exhibiting in which the marketplace could head in 2023.

“The North American DeFi-based crypto market has been strong but volatile over the past year.”

-

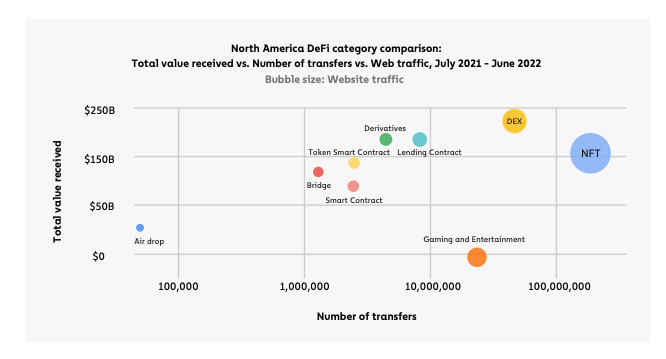

- Main findings: North America ranks 2nd in crypto exercise, obtaining $one.15 trillion well worth of crypto among July 2021 and June 2022, representing 19% of crypto exercise of the globe. DeFi has been a important contributor to North America’s crypto rise, accounting for 37% of the region’s crypto transactions, surpassing Western Europe’s 31% DeFi share. Other areas, this kind of as Sub-Saharan Africa, have considerably decrease DeFi exercise at 13%.

“Latin America’s main crypto-acceptance drivers: store of value, remittances and alpha search.”

-

- Main findings: Latin America ranked 7th in the crypto marketplace of the yr, with $562 billion in crypto acquired by residents among July 2021 and June 2022, marking a forty% boost from final yr.

- The aggregate inflation price of the prime 5 Latin American economies (Brazil, Chile, Colombia, Mexico, Peru) reached a 25-yr large of twelve.one% in August 2022, in accordance to the International Monetary Fund. financial. Bitcoin did not seem when inflation final reached this kind of large amounts, but stablecoins, built to be pegged to fiat currencies like the USD, are rising in reputation in the region’s most inflation-hit nations. . survey demonstrates that additional than a third of Latin American customers have made use of stablecoins for each day purchases.

“Central, Northern and Western Europe remains the largest crypto economy in the world thanks to DeFi, NFT and increasing regulatory clarity.”

-

- Main findings: CNWE is the biggest crypto-economic climate globally, with $one.three trillion well worth of cryptocurrency acquired by customers and institutions in the area among July 2021 and June 2022. Western Europe six out of forty prime crypto-accepting nations. DeFi is a important contributor, fueled by EU rules this kind of as cryptocurrency motion guidelines and the MiCA licensing regime. The United kingdom is the biggest DeFi hub in Europe, ranking 1st in CNWE and 6th globally, with $233 billion in crypto acquired among July 2021 and June 2022.

“Eastern Europe’s crypto markets are active, with a spike last year due to the Russo-Ukrainian War.”

-

- Main findings: Eastern Europe is the 5th biggest crypto marketplace, obtaining $630.90 billion in crypto among July 2021 and June 2022, representing ten% of international crypto exercise. In March 2022, all through the war, trading volume in Ukrainian hryvnia enhanced by 121% to USD 307 million and trading volume in Russian ruble enhanced 35% to USD 805 million. However, just after March, the trade volume of each nations dropped, fluctuating until finally August but hardly ever reaching a peak in March.

“Cryptocurrency adoption steady in South Asia, skyrocketing in Southeast Asia.”

-

- Main findings: CSAO is the third biggest crypto marketplace, with $932 billion well worth of cryptocurrency acquired by citizens of CSAO nations from July 2021 to June 2022. Games for Money and NFT are closely relevant. The vast majority of game blockchains these days have NFTs as in-game goods, which can be offered on several NFT marketplaces. For nations with large NFT marketplace internet site visitors, like Thailand, Vietnam, and the Philippines, a considerable portion of that site visitors could come from the blockchain that plays video games in video games like Axie Infinity. .

“Cryptocurrency market growth in East Asia stalled, China market fell but not out of the way of government ban.”

-

- Main findings: In East Asia, the fourth biggest crypto marketplace in our examination, with $777.five billion well worth of crypto transactions among July 2021 and June 2022, accounting for practically 13% of transactions. globally all through that time. The area has fallen from 3rd spot in the prior Crypto Geography Report, with trading volume expanding by only four% yr-on-yr, the lowest between the analyzed areas. Despite staying the biggest crypto marketplace in the area, China has witnessed crypto transactions drop 31% yr-on-yr, though Japan is up additional than one hundred%.

“Middle East and North Africa’s crypto market to grow more than any other region by 2022.”

-

- Main findings: The Middle East and North Africa (MENA) area may well have a smaller sized presence in the 2022 Global Crypto Acceptance Index, but it is the quickest rising crypto marketplace. From July 2021 to June 2022, MENA customers acquired $566 billion in crypto, up 48% yr-in excess of-yr. In Turkey and Egypt, the instability of fiat cash has created cryptocurrencies an interesting selection for preserving cost savings. The Turkish Lira has professional 80.five% inflation, though the Egyptian Pound has weakened by 13.five% final yr. In addition, the remittance marketplace in Egypt, which accounts for eight% of GDP, is significant. The country’s central financial institution has begun a task to make a crypto-based mostly remittance corridor among Egypt and the UAE, in which numerous Egyptians get the job done.

“Cryptocurrency meets the economic needs of residents in sub-Saharan Africa.”

-

- Main findings: Sub-Saharan Africa has the lowest crypto trading volume between the areas analyzed, with $one hundred.six billion in on-chain volume acquired among July 2021 and June 2022, representing two% operations globally and enhanced sixteen% yr-in excess of-yr.

- Small Retail Trades Drive Crypto in Sub-Saharan Africa The retail marketplace and the broad use of P2P platforms in sub-Saharan Africa set it apart from other areas. Retail transfers below $ten,000 accounted for six.four% of transaction volume, the highest of any area. The value of retail gets to be additional obvious when examining the variety of person transfers. Retail transfers make up 95% of all transfers, and 80% of them are retail transfers below $one,000, also the highest of any area.

The submit Chainalysis Dominant Emerging Markets Crypto Geography Report 2022 appeared to start with on CryptoSlate.

General Bitcoin News