Nothing illuminates the relevance of vitality like a quick approaching winter. As temperatures drop, vitality scarcity gets to be obvious and international efforts to conserve it commence.

This 12 months, the battle for vitality is fiercer than ever.

Fiscal and financial policies set in the course of the COVID-19 pandemic have brought about harmful inflation in most nations close to the planet. Quantitative easing to restrict the consequences of the pandemic has led to an unprecedented boost in the M2 dollars provide. This choice minimizes buying energy and prospects to an boost in vitality charges, triggering a crisis that will peak this winter.

CryptoSlate The evaluation exhibits that the EU will most possible be the get together hardest hit by the vitality crisis.

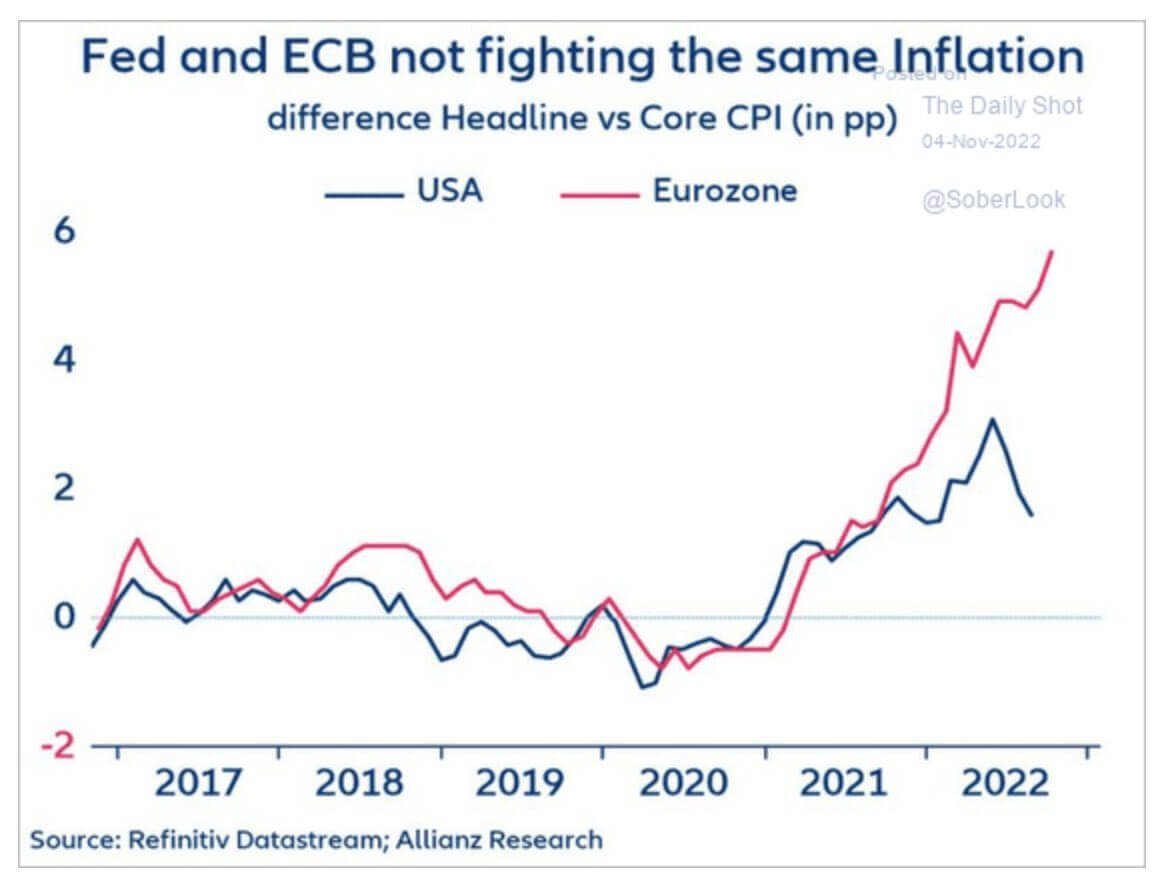

The European Central Bank (ECB) has struggled to lessen core inflation this 12 months. Core Consumer Price Index (CPI) begins to boost appreciably in 2021 due to pandemic in the two US and EU

The US has observed core CPI plummet considering that its peak in February and posted greater-than-anticipated outcomes final month. However, Core CPI in the Eurozone has continued to boost during the 12 months and exhibits no indicators of stopping.

Similar increases in Core CPI can also be observed in Japan and the United kingdom. One of the variables that can contribute to their currency instability is the lack of investment and assistance for commodities like oil and gasoline. Widespread efforts to switch to renewable vitality sources have resulted in a decline in oil and gasoline purchases in the EU and United kingdom.

In contrast, the US and Russia have invested heavily in oil and gasoline and fostered innovation in this region.

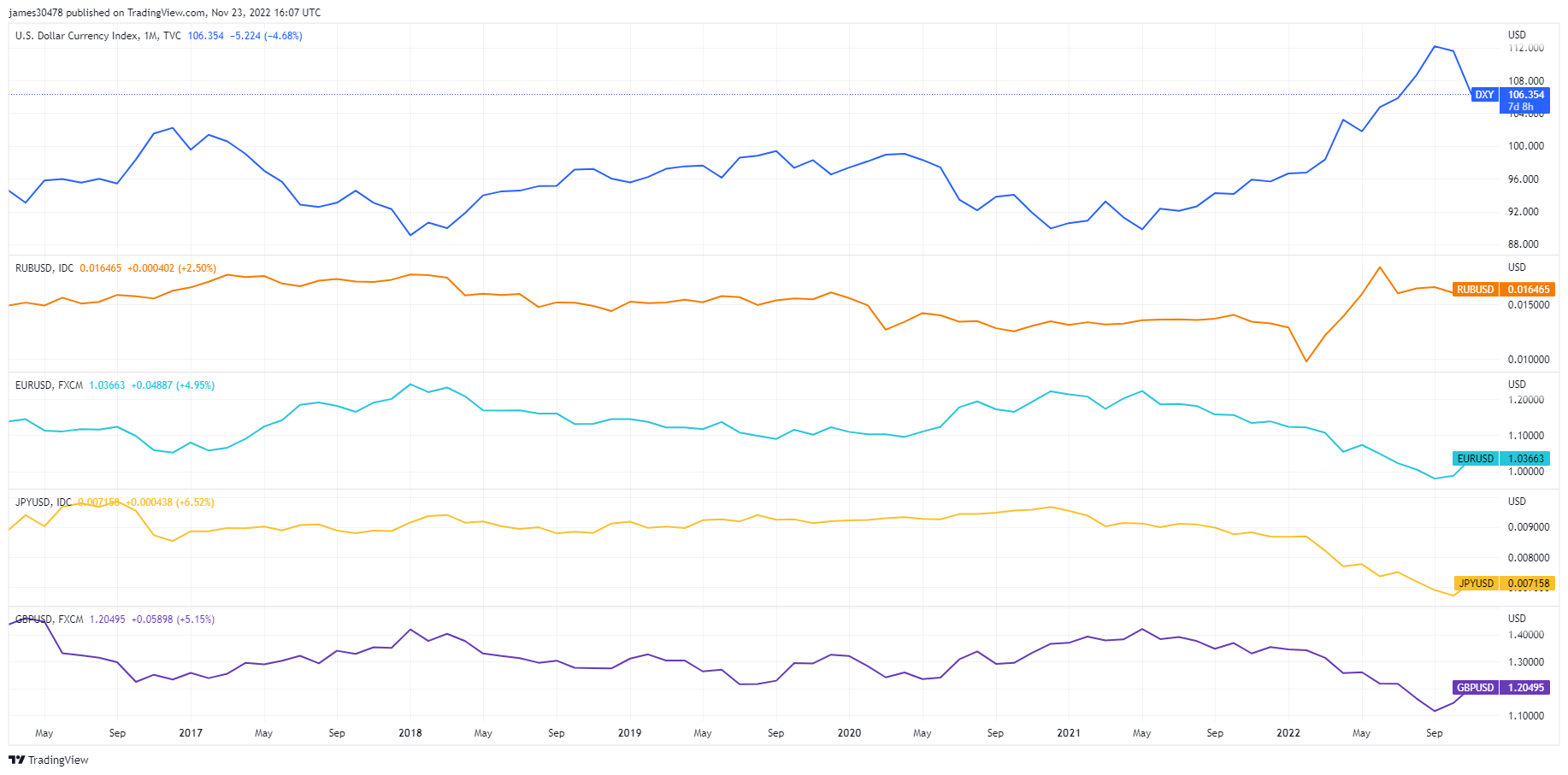

Looking at the worth of fiat currencies towards the US dollar additional confirms this affect.

The Russian Ruble and DXY have the two enhanced in worth above the previous two many years, although the euro, British Pound and Japanese Yen have all fallen in worth towards the Dollar.

With inflation growing and a currency severely weakened, it will be challenging for the EU to compete for oil and gasoline in the international marketplace. Natural gasoline producer warning that virtually all the prolonged-phrase contracts for normal gasoline coming out of the US have been offered out until finally 2026. Until then, when a new wave of normal gasoline provide is anticipated to arrive, the EU will have to compete with Asia for restricted provide and swallow substantial gasoline charges.

All this uncertainty can have a beneficial impact on Bitcoin. While the broader crypto marketplace struggled to keep afloat following the crash of FTX, Bitcoin has positioned itself as a pillar of stability in a marketplace rife with undesirable guys. Depreciating fiat currencies can push retail traders away from harmless-haven assets like gold and commodities in the direction of an asset like Bitcoin.