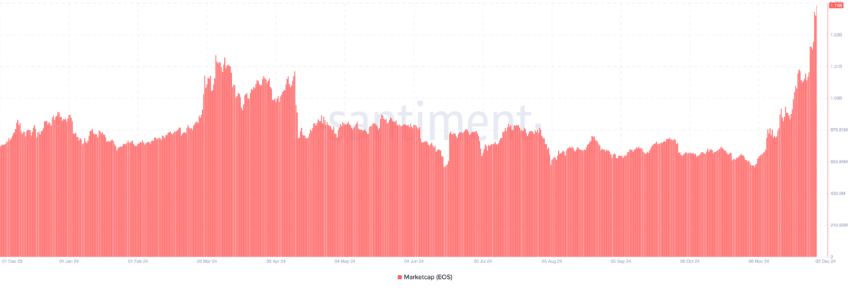

EOS, the native coin of the open-source blockchain EOS Network, has seen its market capitalization jump to $1.74 billion, marking its highest level since November 2022. The milestone comes after The price increased by a spectacular 165% in the past 30 days, surprising many market observers.

With EOS still 95% below its all-time high, investors are wondering if this bull run can last. This on-chain analysis uncovers the potential for further growth.

EOS Sees Growth in Key Areas

On November 4, the price of EOS was at 0.42 USD. However, as of the time of this writing, it has increased to $1.12, showing that this altcoin has experienced an increase in demand in recent weeks. While there have been no major developments driving this rally, it appears that increased interest in older coins has played a role in the push.

Following this development, EOS’s market capitalization skyrocketed to $1.74 billion. Market capitalization is the product of price and circulating supply. Therefore, an increase in this index involves a 165% increase in price, especially since the project has not unlocked any coins towards its 1.53 billion circulating supply.

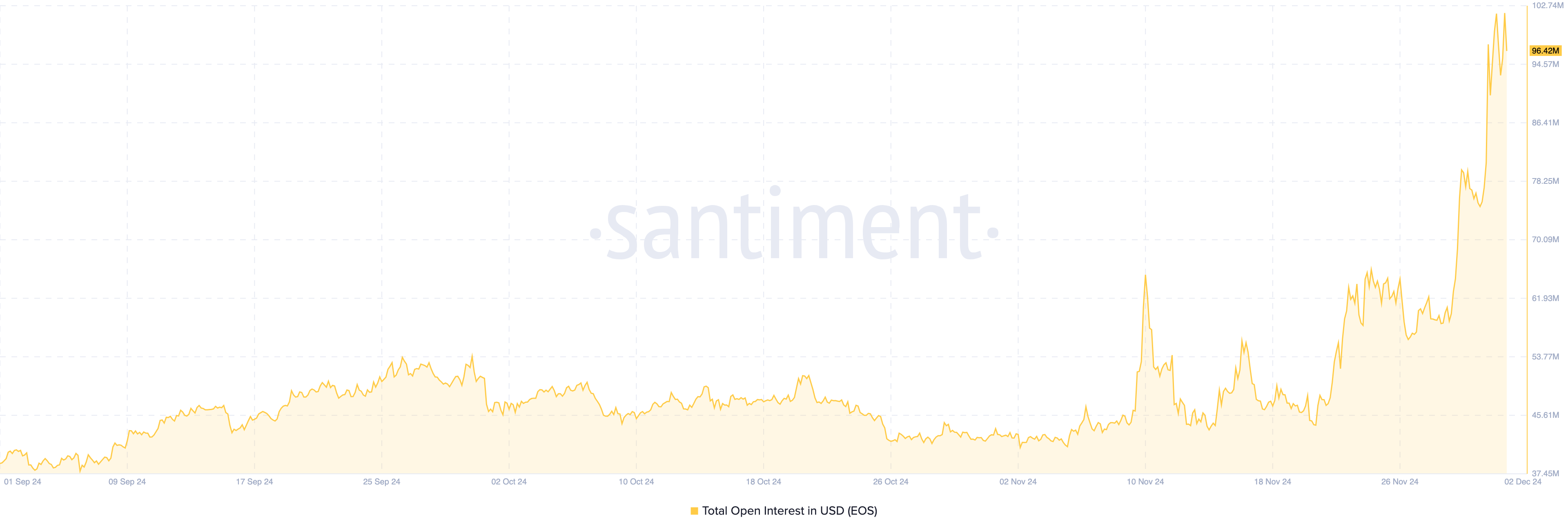

As Open Interest (OI) increases, it means more liquidity has poured into the derivatives market, hinting at increased buying pressure on the cryptocurrency. Conversely, if OI decreases, it means traders are increasingly closing their positions.

From a price perspective, the increase in OI coupled with the rising EOS price suggests that the market value may continue to increase.

EOS Price Forecast: Higher Highs on the Table

On the EOS/USD daily chart, the Awesome Oscillator (AO) index has increased. AO is a momentum indicator that measures the strength of recent market movements relative to historical trends, helping traders identify possible changes in market momentum.

When the index is positive, it means bullish momentum. Conversely, if the index is negative, the momentum decreases. In the case of EOS, the positive indicator as well as the green histogram bar shows bullish momentum.

If this continues, the price could rise to $1.21 and eventually $2 in the short term. Conversely, if selling pressure increases, this may not happen. Instead, the EOS market cap could decrease, and the price could go down to $0.93.