The ETH/BTC ratio, which measures Ethereum’s price performance against Bitcoin, has hit its lowest level since March 2021. This development comes as BTC spikes to $98,000.

While the leading cryptocurrency has gained 7.45% in the past seven days, ETH remains firmly around its old price range, leaving investors concerned about the future of this altcoin.

Ethereum Continues to Lag Behind Bitcoin

In February, the ETH/BTC ratio climbed to a yearly high of 0.060. During that time, many predicted that Ethereum price would outperform Bitcoin and trigger an altcoin season. However, this did not happen, Bitcoin continued to set new highs.

In contrast, Ethereum has yet to retest its all-time high despite reaching $4,000 earlier in the year. This performance difference may be related to a number of factors. For example, both cryptocurrencies were approved for exchange-traded funds (ETFs) this year.

However, while Bitcoin receives billions of dollars in capital, ETH is unstable in attracting capital. As a result, institutional capital inflows pushed BTC towards $100,000, causing the ETH/BTC ratio to drop to $0.033 — a 42-month low.

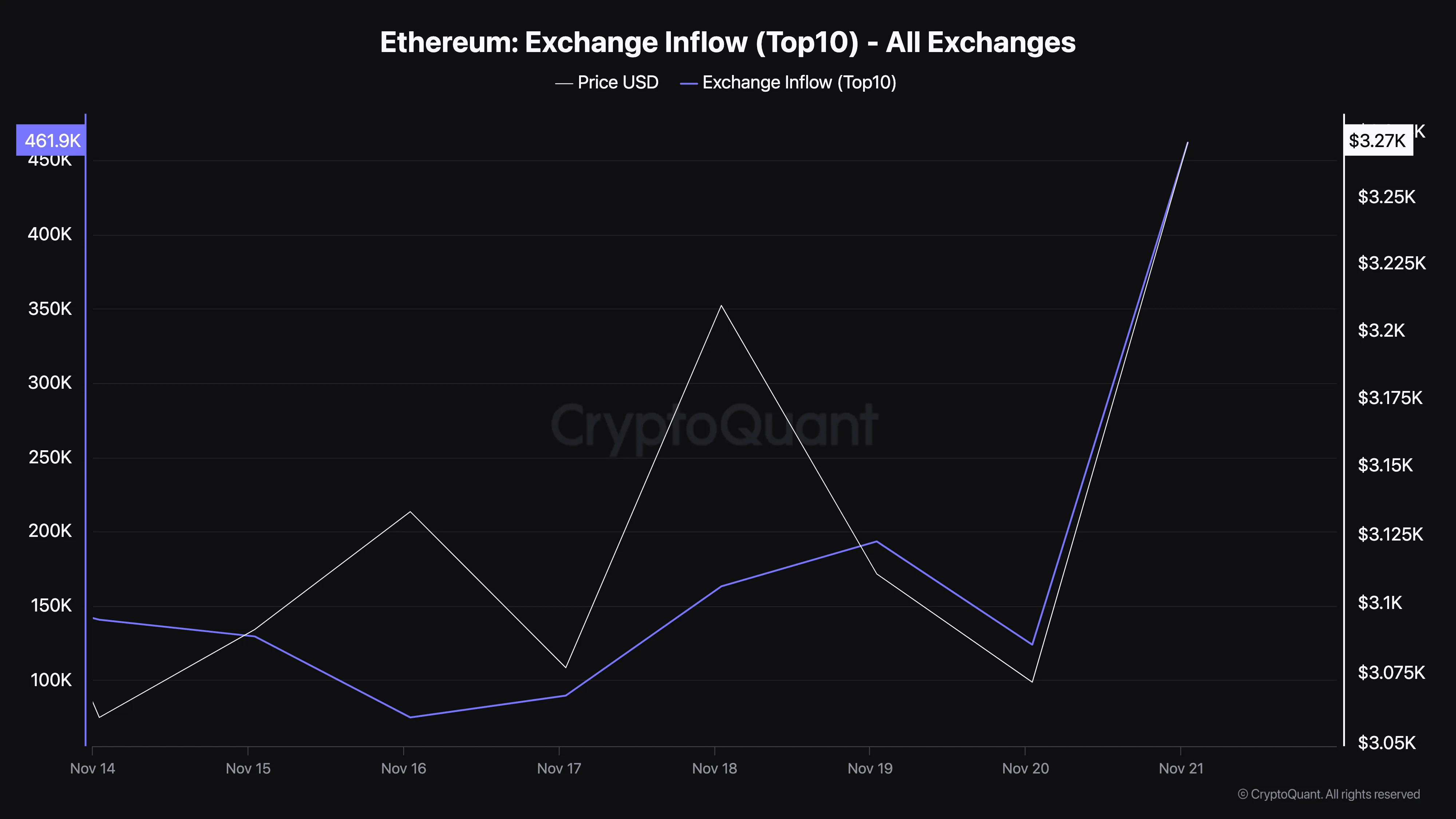

Further, the gap in Ethereum’s performance can largely be attributed to persistent selling pressure. For example, data from CryptoQuant shows inflows to top exchanges increased to 461,901 ETH, worth about $1.50 billion at the time of this writing.

This increase in exchange flows reflects large deposits from investors, indicating an increased desire to sell. Such moves typically increase the supply of ETH on exchanges, increasing the likelihood of a price drop.

Conversely, a low exchange inflow typically indicates investors are holding on to their assets, which is not the current situation for ETH.

ETH Price Forecast: Cryptocurrency May Adjust

At the time of writing, ETH trades at $3,317, higher than yesterday’s close. However, the altcoin is still below the Parabolic Stop And Reverse (SAR) indicator. Parabolic SAR creates a series of points that track price movements, located above price during downtrends and below price during uptrends.

A “reversal” in points — a move from one side to another — often signals a possible trend reversal. As shown below, the indicator sits above the price of ETH, suggesting that the cryptocurrency could reverse recent gains.

If this is the case and the ETH/BTC ratio falls, Ethereum price could drop to $3,083. However, if buying pressure increases, that may not happen. Instead, the value could surpass $3,500 and move towards $4,000.