Ethereum cost prediction is bearish as it trades under December’s downtrend line. ETH’s failure to reclaim the critical $four,000 degree is a hint that my largest altcoin sale by industry cap is nonetheless a risk.

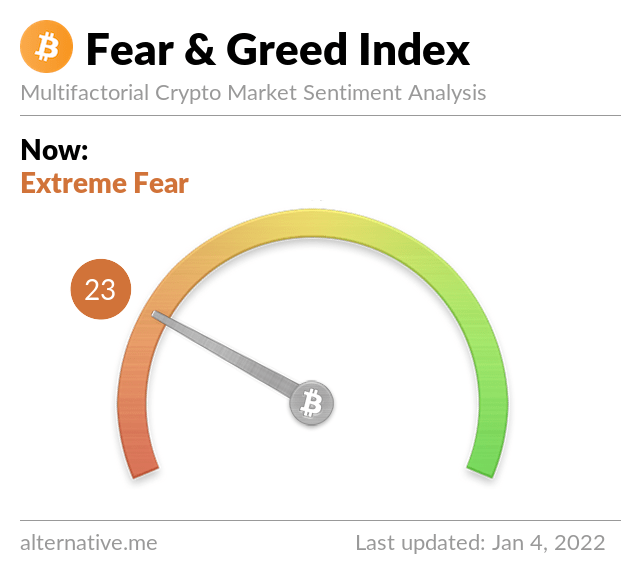

Ethereum (ETH) cost action has been volatile for the very first handful of days of 2022 and it continues to drop under the psychological $four,000 degree. The Crypto Fear and Greed Index found in the Extreme Fear Zone registers a worth of 23/one hundred on Tuesday.

However, in accordance to Ecoinmetrics, an on the internet resource analytics enterprise, episodes of intense concern seldom final prolonged, that means they will have a downside in about thirty days.

Ethereum continues to obtain assistance from numerous quarters. Convex Finance continues to enable customers to entry liquidity and earn charges from a secure coin exchange primarily based on Ethereum Curve Finance. Convex Finance crossed the $twenty billion mark in complete locked worth (TVL) on January 2nd, days immediately after starting to be TVL’s 2nd biggest decentralized finance (DeFi) protocol, pointing to an enhance in Increase adoption and use of Ethereum as a Layer one protocol.

Can Ethereum flip away from the bearish cost action and break over the December downtrend line to initiate a bull run?

Ethereum Price Prediction: Bearish leg continues at US$three,500

Ethereum’s inability to break over the psychological $four,000 degree suggests that the bears are promoting in every single small rally. Ethereum’s recovery from the $three,617 to $three,577.68 assistance place has reached $three,800 exactly where the bears are posing a stiff challenge. The 50-day straightforward moving regular (SMA) is sloping down and the relative power index (RSI) is positioned at 41.45, suggesting an benefit above the bears.

ETH/USD Daily Chart

The place of the Moving Average Convergence Divergence (MACD) under the zero line in the adverse zone and reducing volume are indicators that the bears have the upper hand.

If the cost continues reduced, the bears will yet again try to drag Ethereum cost under the assistance zone. If they handle to do that, the cost of the clever contract giant’s token could get started its downward journey to tag the $three,200 assistance degree.

On the other hand, the bearish Ethereum cost prediction could be invalidated if the bulls push the cost over the downtrend line and then over the moving averages. If this takes place, it will present that the correction is above with a rally of $four,643 as the upcoming logical move.