Key Points:

- ETH gas fees have been under 2 Gwei since April, signalling a slowdown in network activity.

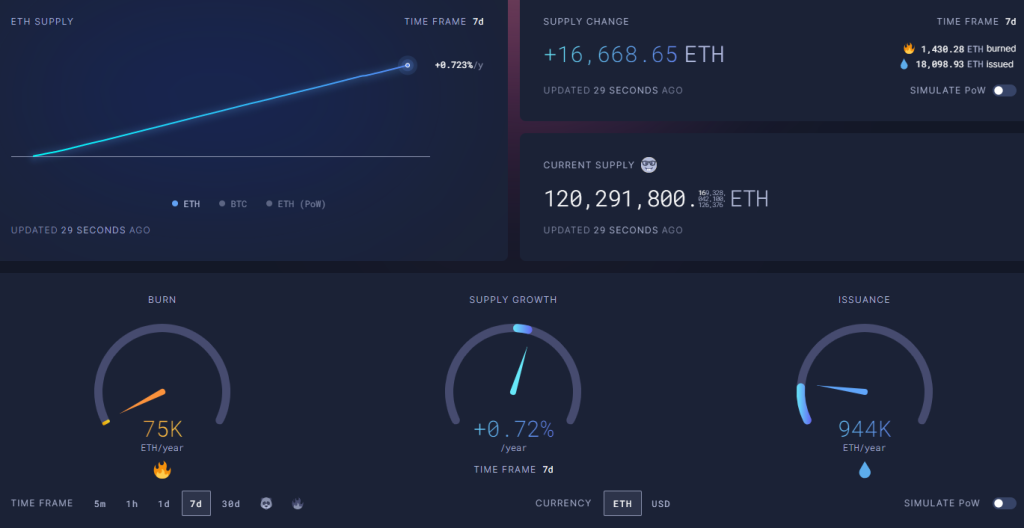

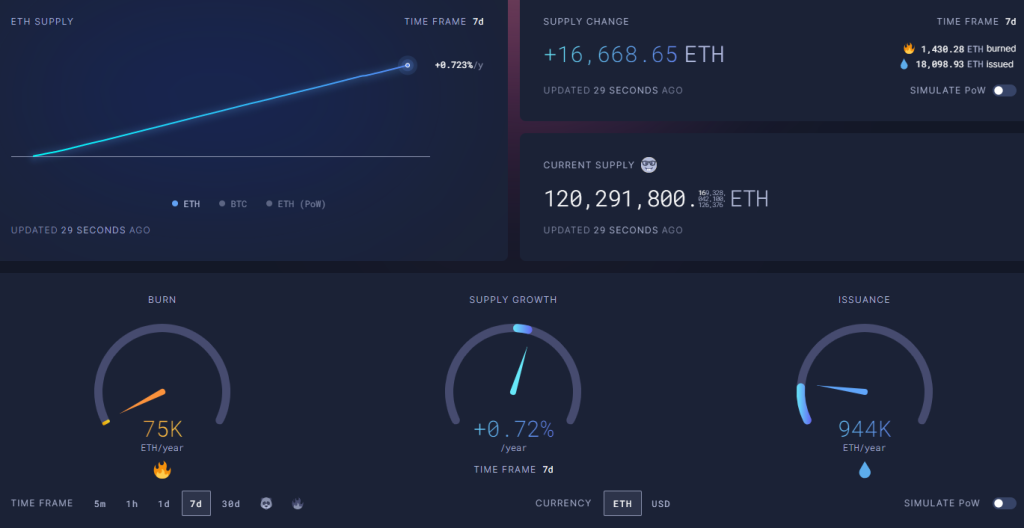

- The total ETH supply has risen from 120,063,605 to 120,291,622 in the past four months.

- With increased supply, Ethereum’s annual inflation is projected at 600,000 ETH, reflecting a 0.5% inflation rate.

ETH gas fees are sustaining below the 2 Gwei threshold, signalling a significant downtrend in on-chain activity.

ETH Gas Fees Drop Below 2 Gwei

Gas prices have been low for more than two months, confirming part of a larger Ethereum pattern of slowly moved transactions and a decrease in congestion.

In the last four and a half months, the entire supply of ETH increased from 120,063,605 to 120,291,622. This supply increase, equivalent to 228,000 ETH, probably means it kept issuing new issuance at a stable pace despite reduced activity.

Read more: ETHWarsaw 2024 Conference and Hackathon returns for its third edition

Annual Inflation Rate Reaches 0.5%

Ethereum’s inflation rate must, too, have increased accordingly. Annualized, it will bloat to 600,000 ETH. With the current supply and pace of issuance, this would mean an annual inflation rate of 0.5%.

| DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing. |

Visited 43 times, 1 visit(s) today

Source: Coincu