[ad_1]

Investment banking giant Goldman Sachs says that the blockchain with the highest “real-life potential” is Ethereum, and that ETH could come to be the world’s dominant retail outlet of digital worth.

Based on this, Goldman Sachs predicts the market place capitalization of Ether (ETH) could surpass that of Bitcoin (BTC) in the coming many years, in accordance to a July six note to customers cited by Cointelegraph. Business Insider.

“[Ether] Currently like the cryptocurrency with the highest true-globe use prospective like Ethereum, its blockchain platform, is the most common advancement platform for good contract applications.”

Smart contracts incorporate program that permits the automated execution of digital contracts, with technological innovation that has facilitated the explosion of decentralized finance (DeFi) protocols and applications. decentralized application (DApp) primarily based on cryptocurrency.

The bank’s analysts emphasize that Bitcoin’s foremost edge has offered it a more powerful brand, but they feel it lacks some of the use scenarios that Ether has and its slow transaction speeds. . Due to its emphasis on tough dollars and network safety, Bitcoin has not however offered the very same functions as Ethereum.

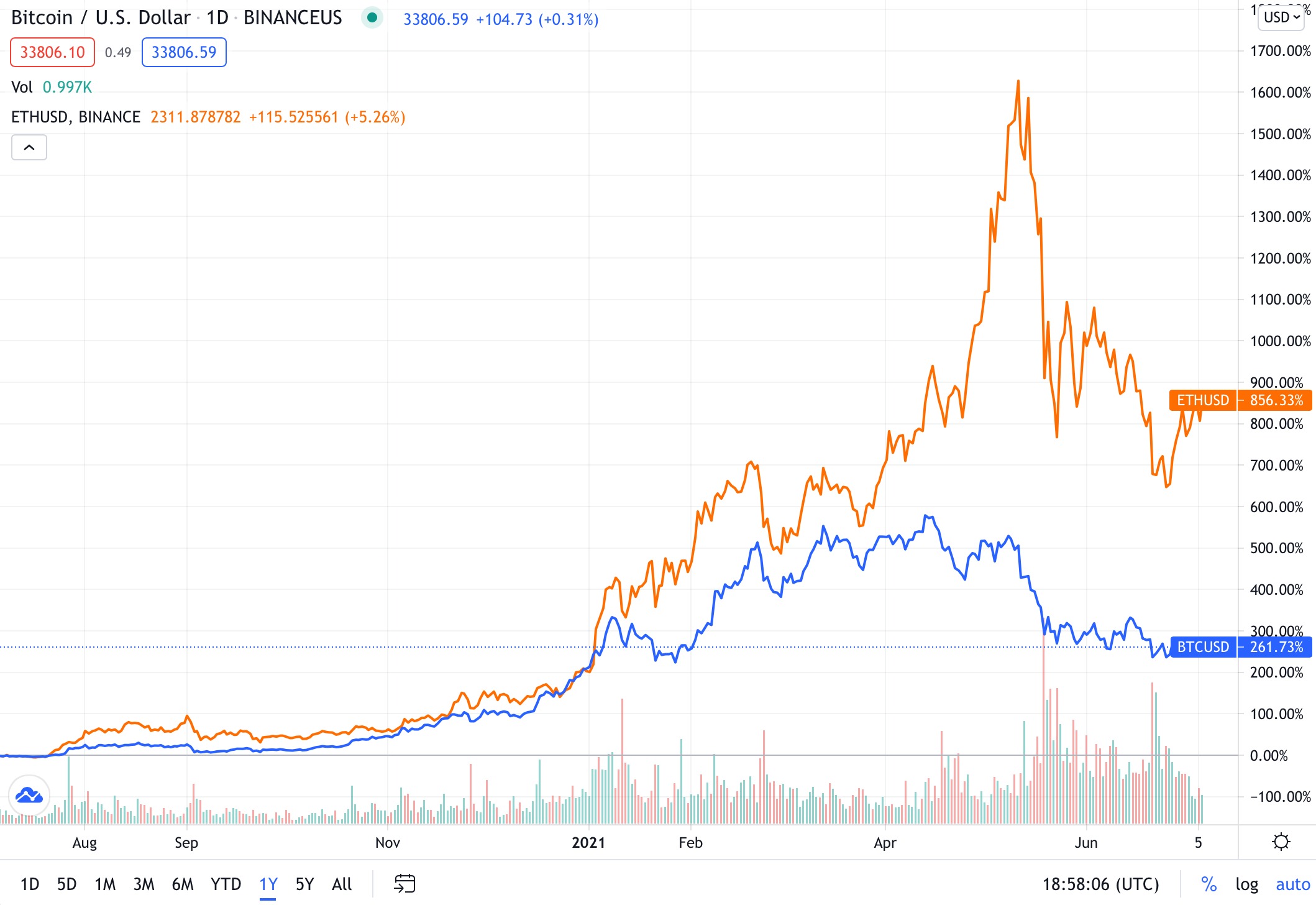

As a younger network, Ethereum can also expand at a a lot quicker price than Bitcoin. While Bitcoin is up 261% more than the previous 12 months, ETH has acquired 856% in the very same time period.

While leaning a lot more in the direction of Ethereum than Bitcoin, analysts also argue that gold is a superior retail outlet of worth to digital assets, describing gold as an “inflation hedge” and Cryptocurrencies are “inflationary hedges”.

“This competition between cryptocurrencies is a risk factor that prevents them from being safe haven assets at this stage.”

This evaluation comes not lengthy just after the Goldman Sachs Investment Strategy Team advised customers that cryptocurrencies are not even an “investable” asset class. Analysts explained:

“While the digital asset ecosystem could revolutionize the future of things, that does not mean that cryptocurrency is an investable asset class.”

Banks are not the only ones that see Ethereum as getting the prospective to overtake Bitcoin. The founder and CEO of Celsius Network, a significant crypto custody and lending organization, advised Kitco News on Monday that Ether has outperformed Bitcoin in terms of holdings amid the platform’s consumers. and feel this will proceed in the wider globe in 2022 or 2023.

Maybe you are interested:

Join our channel to update the most valuable information and information at:

According to CoinTelegraph

Compiled by ToiYeuBitcoin

.

[ad_2]