Today, Ethena Labs officially launched a new stablecoin called ‘USDtb.’ Nearly 90% of the reserves for this stablecoin are backed by BlackRock’s BUIDL Tokenization fund.

This new asset complements Ethena’s previous stablecoin, USDe, and helps Ethena Labs weather harsh market conditions.

Ethena Labs New Stablecoin Product

According to NotificationUSDtb is a “completely independent product” from USDe, Ethena’s first stablecoin. It clarified that this new product has a different risk profile than USDe thanks to strong backing from BlackRock funds.

“USDtb operates like a traditional stablecoin like USDC or USDT, using cash and cash equivalents as reserves to back each Token. Blackrock’s BUIDL represents the majority of USDtb’s backing, currently having the highest BUIDL allocation among stablecoins on the market,” Ethena Labs declare on social networks.

Ethena Labs first announced plans to introduce USDtb in September, and the token officially launched today, December 16. The excitement from the Crypto community is notable, as this is the first major stablecoin first backed by BlackRock’s Tokenization fund.

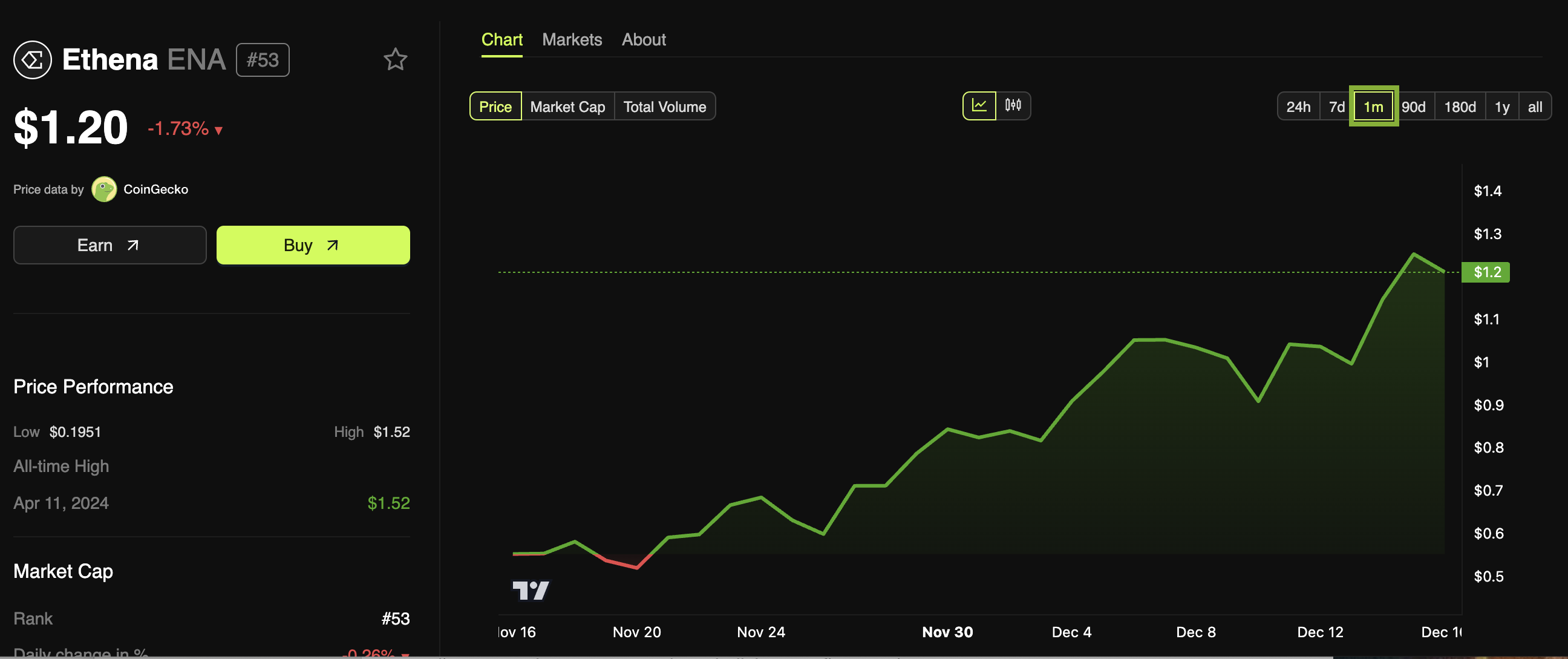

At the same time, the interest surrounding this launch event has been reflected in Ethena’s native token. After this information, ENA rose sharply to its highest price since April, reaching 1.32 USD. Since then, the price has corrected slightly and is currently trading at $1.20. This token has increased nearly 117% in the past month.

A New Competitor in the Stablecoin Market

With anticipation for USDtb since September, ENA has received many investments over the past few months. According to BinanceDonald Trump’s World Liberty Financial (WLFI) recently invested about 500K USD in this Token. The organization also invests in other altcoins such as LINK and AAVE.

Furthermore, Ethena Labs asserts that the stablecoin is scalable without any practical limitations thanks to backing from BUIDL, and users will benefit from free and unrestricted remittance transactions .

Although this new stablecoin is a completely different product than USDe, they will have a symbiotic relationship. As USDtb is a more stable asset with significant reserves, it can be used as a backing asset for USDe.

“Ethena’s Risk Committee approved a proposal last week to include USDtb as the asset backing USDe. During periods of negative funding rates, Ethena will be able to close USDe underlying hedging positions and reallocate its backing assets into USDtb to mitigate the associated risks,” the company said. write in the notice.

In other words, USDtb will enable Ethena to provide new options to consumers and secure its investment choices. With this launch, Ethena Labs is aiming to strengthen its position in the highly competitive stablecoin market.

While Tether’s USDT and Circles’ USDC have dominated the market for years, these new products could spur broader competition in the market. Ripple’s new stablecoin RLUSD is also scheduled to launch tomorrow. If these assets continue to attract interest, Tether’s long-term dominance in the market could diminish throughout 2025.