Ethereum, the leader among altcoins, has maintained the market downtrend, down 2% over the past 24 hours. This comes amid a continuous decline in demand for the currency.

As buying pressure decreases, ETH is at risk of falling below $3,000 soon. This analysis provides details.

Ethereum Demand Declines

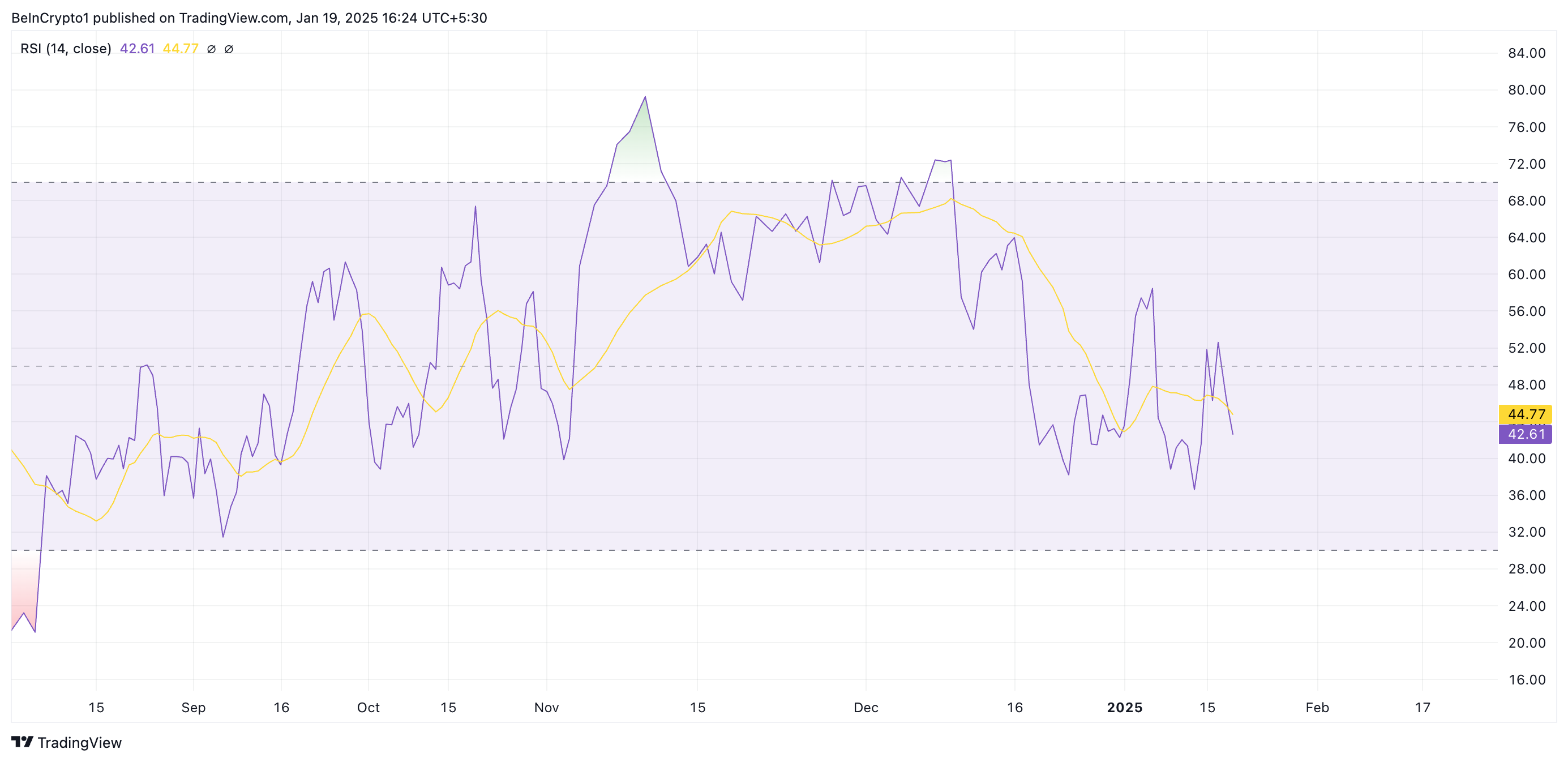

Analysis of ETH momentum indicators on the ETH/USD one-day chart shows that demand for the altcoin is decreasing. For example, its Relative Strength Index (RSI) is in a downtrend and below the neutral level of 50. At the time of writing, its value was 42.61.

An asset’s RSI measures its overbought and oversold market conditions. The range is from 0 to 100, with values above 70 suggesting the asset is overbought, while values below 30 suggest it is oversold.

ETH’s RSI profile signals bearish momentum and suggests that the asset may be losing interest from buyers, which could lead to further price declines.

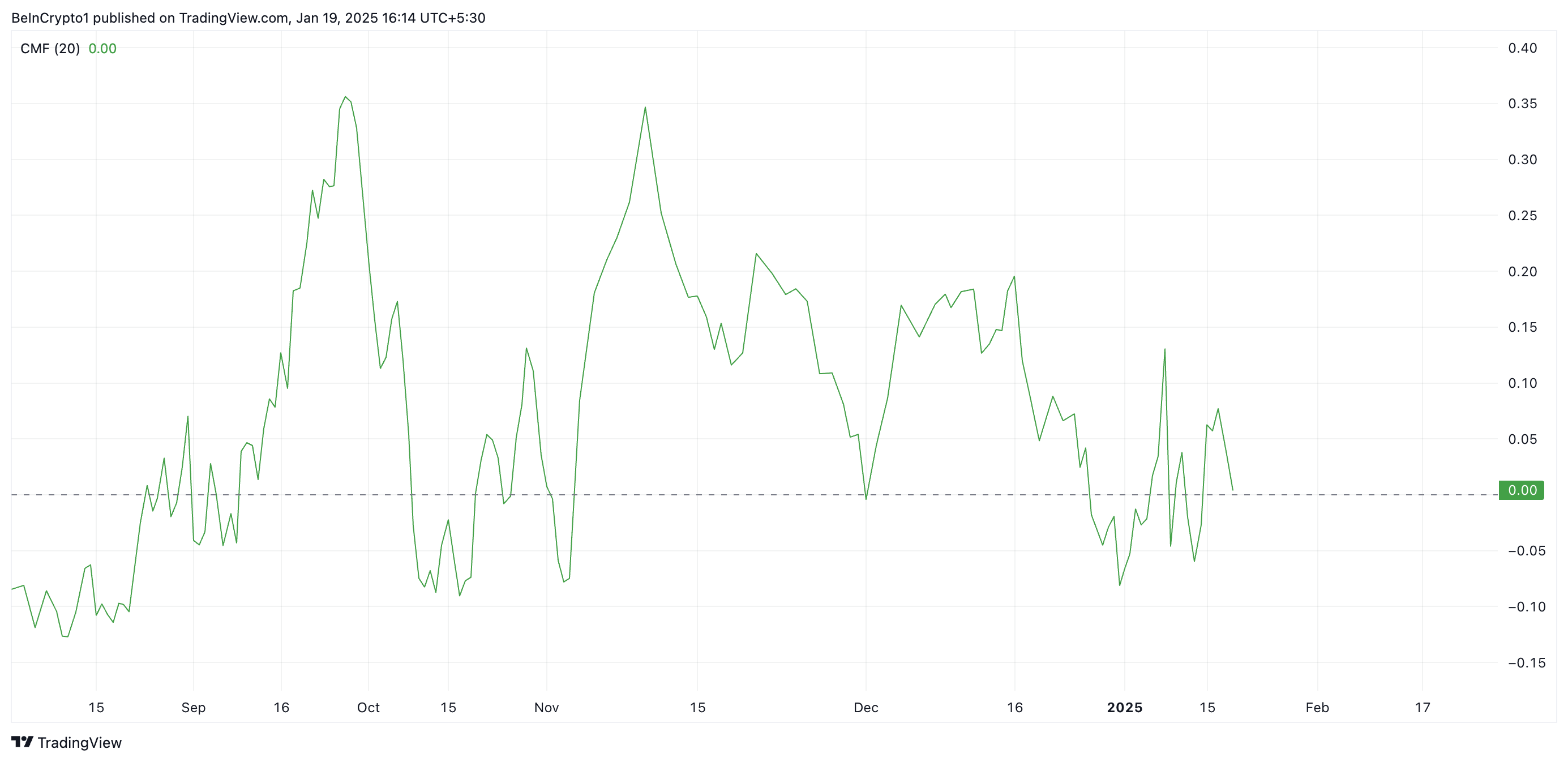

Furthermore, at the time of writing, the coin’s Chaikin Money Flow (CMF) indicator could fall below the zero line, confirming weakening demand for ETH.

The CMF indicator measures the amount of money flowing into or out of an asset over a certain period of time. As the CMF prepares to fall below the zero line, selling pressure increases, signaling potential bearish momentum and the possibility of a price drop.

ETH Price Prediction: Fall to 2,811 USD or Rise to 3,476 USD?

At press time, ETH trades at $3,175, below resistance forming at $3,249. With buying pressure weakening, the coin’s price could fall below $3,000 to trade at $2,811 in the short term.

However, if market sentiment improves, it could push ETH price above $3,249 towards $3,476.