Almost two months following The Merge, Ethereum (ETH) burned all the ETH produced on the network by this update.

According to information from Ultrasound.dollars, on the morning of November 9 the Ethereum (ETH) network reached deflation for the initially time considering that The Merge update.

Specifically, the circulating provide of Ethereum this morning is 120,521,000 ETH, equal to the milestone of September 15th, the time of The Merge.

As reported by Coinlive, The merger This is the most essential update in Ethereum historical past to date. It modified the consensus algorithm of the world’s 2nd biggest cryptocurrency network from Proof-of-Work to Proof-of-Stake. This signifies that Ethereum will no longer will need miners, minimizing power consumption by up to 99% and minimizing the block reward for miners.

By way of comparison, devoid of The Merge and the network retaining an yearly inflation charge of all over three.six%, from mid-September to now, 649,000 new ETHs will be positioned on the market place.

With the decline of the new generation of ETH, in addition to the EIP-1559 mechanism burning ETH from transaction costs, Ethereum was ready to attain an inflationary state, which took place now.

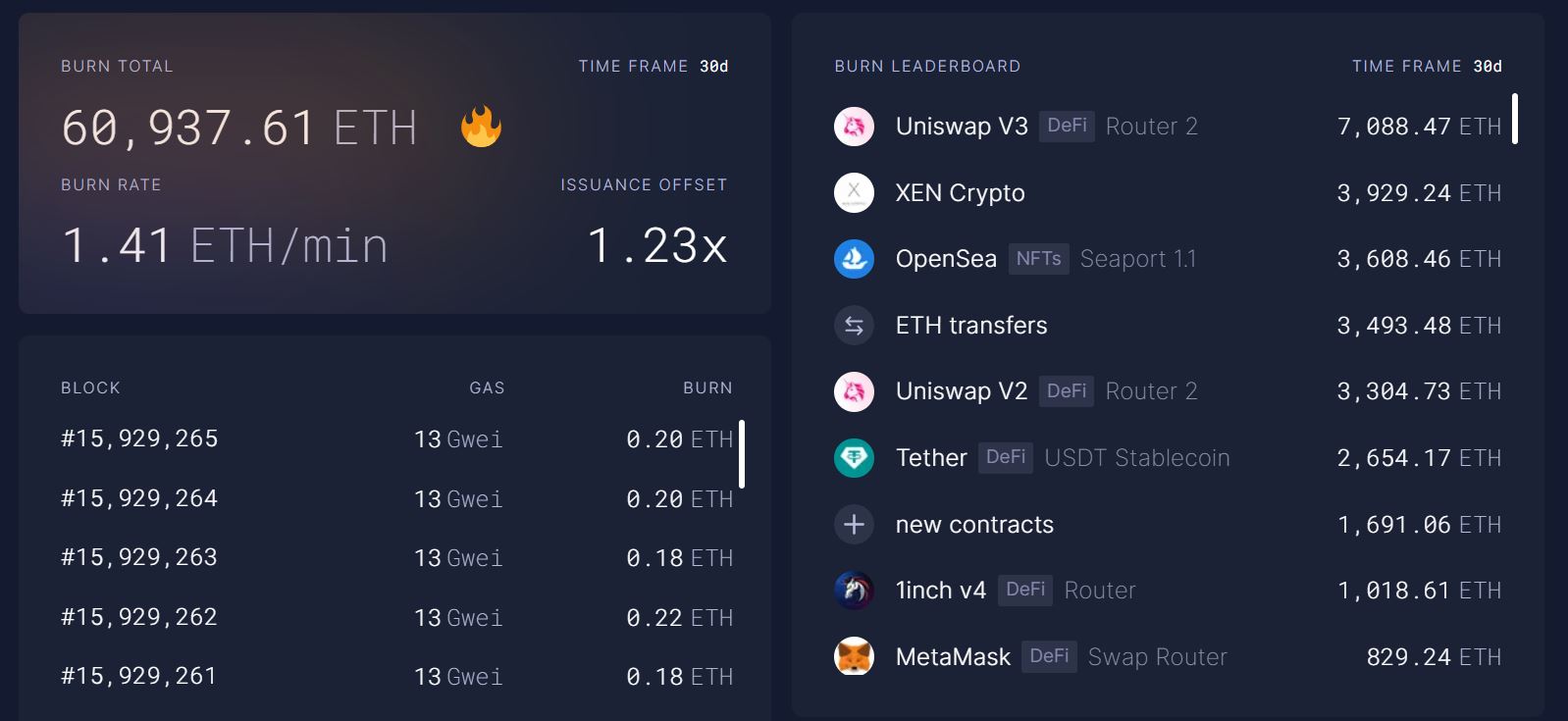

In the previous thirty days, Ethereum has burned almost 61,000 ETH, largely on DeFi apps like Uniswap, MetaMask, 1inch USDT and USDC stablecoins and NFT exchanges this kind of as OpenSea.

In complete, considering that the implementation of EIP-1559 in August 2021, extra than two.seven million ETH have been burned thanks to this strategy, displaying a massive influence on Ethereum.

In the close to potential, Ethereum will concentrate on testing the Shanghai improve to unlock above 14 million ETH locked in The Merge’s staking contract, as effectively as continuing to employ the new Ethereum growth roadmap announced by Vitalik Buterin.

The value of ETH has not had considerably response to the over information as it is nonetheless struggling to stabilize following the “terrible” morning dump of November 9th.

Synthetic currency 68

Maybe you are interested: