Ethereum traders are increasingly confident that the altcoin’s price could soon see a significant recovery. This bullish sentiment is a follow-up reaction to what many have called a bottom for ETH.

In this analysis, BeInCrypto looks at the factors driving this bullish outlook and what it means for Ethereum’s short-term performance.

Ethereum Traders Make Big Bets

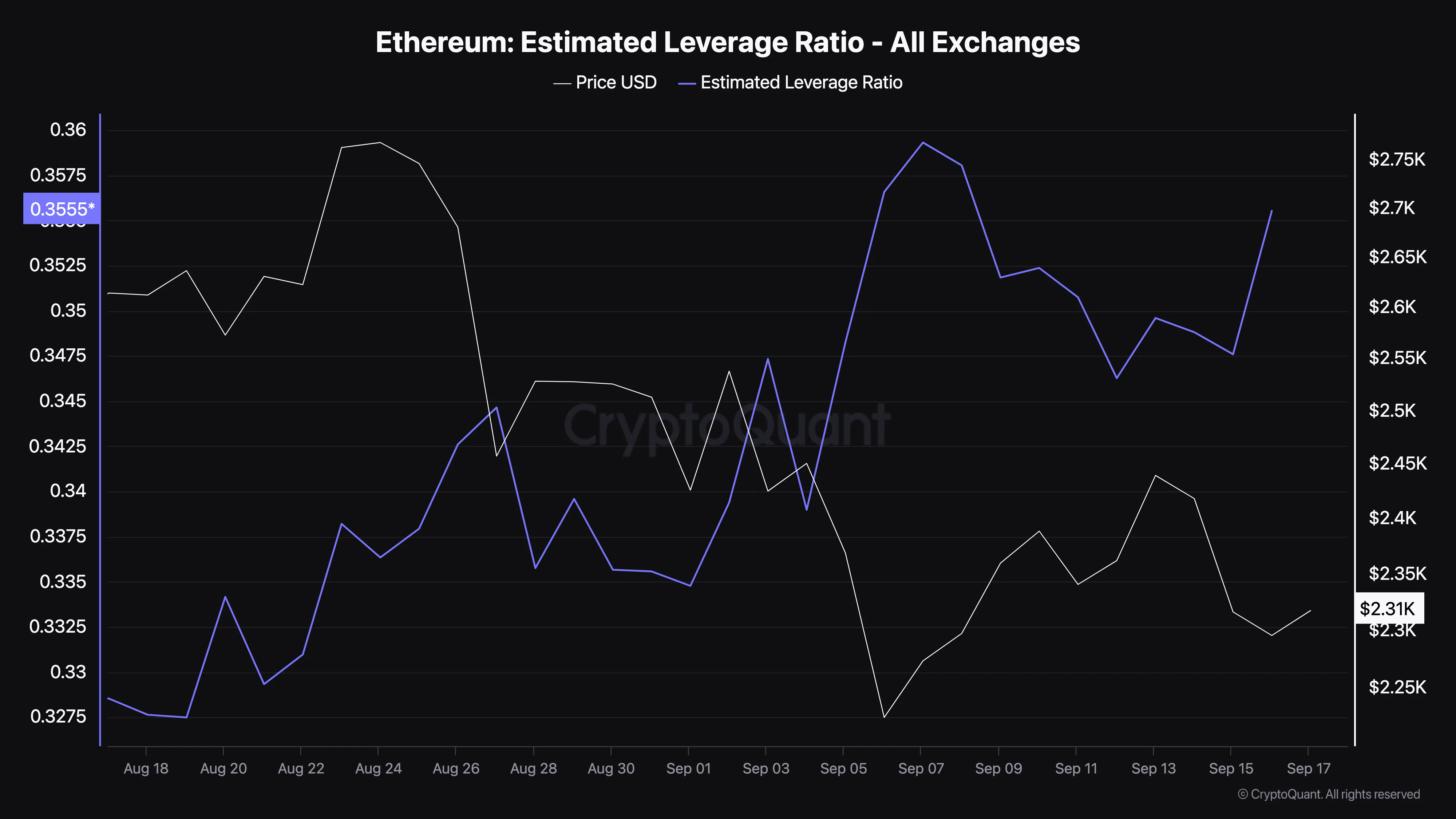

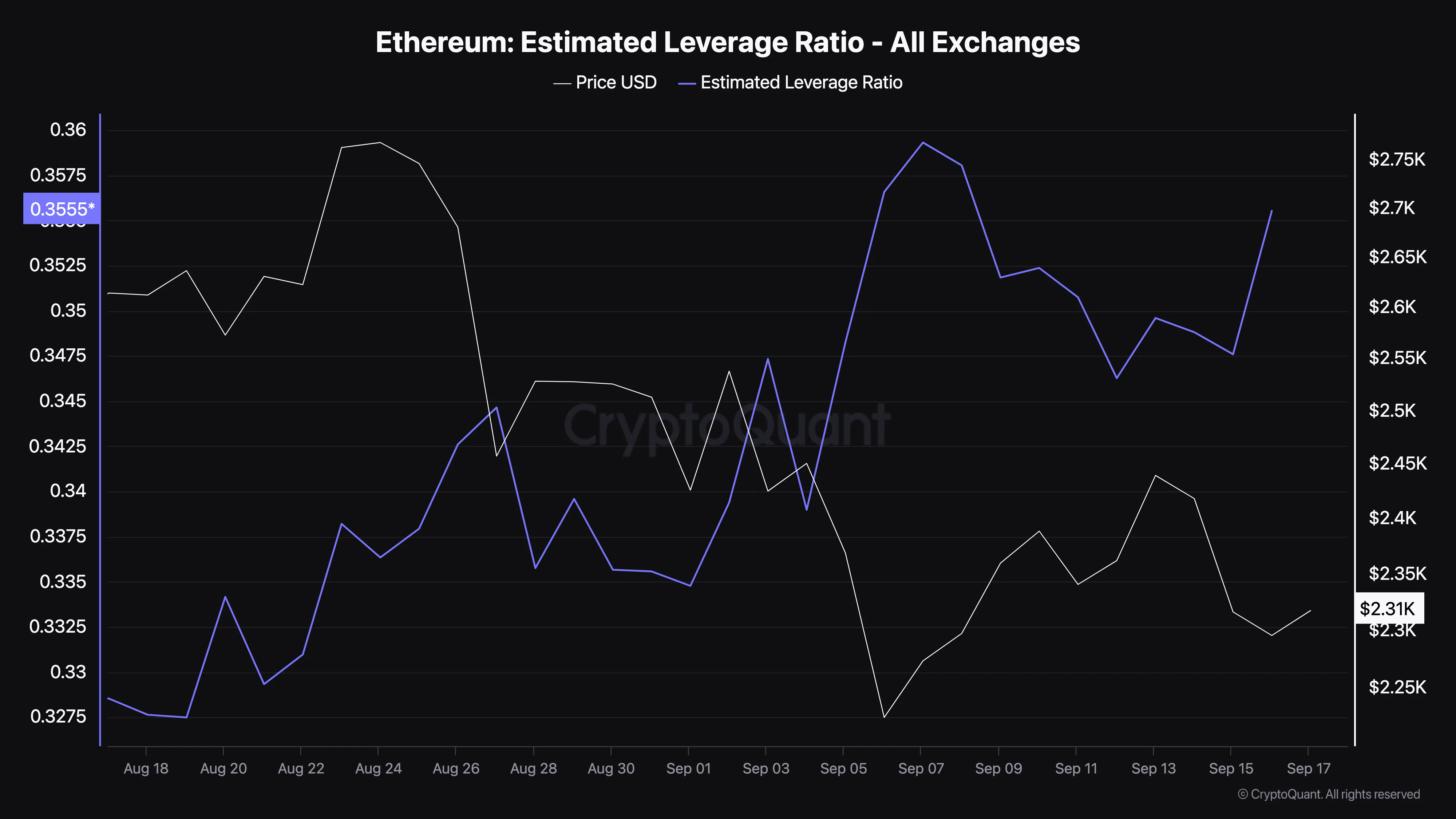

On September 15, the Ethereum estimated leverage ratio (ELR) — an indicator of whether traders are placing high bets in the derivatives market — dropped significantly, signaling cautious market behavior. However, on September 16, ELR spiked to its highest level in over a month, indicating a shift as traders began placing higher leverage bets.

But why are they raising the stakes at this point?

Based on our results, these risky bets may be related to the ETH/BTC pair hitting its lowest point in over three years. Crypto analyst and Into the Cryptoverse founder Benjamin Cowen suggests that this development may have brought Ethereum closer to its bottom.

“It’s almost over. I think ETH/BTC will probably bottom between 0.03-0.04 and then rally into 2025. It could bottom as early as this week or as late as December,” Cowen speak.

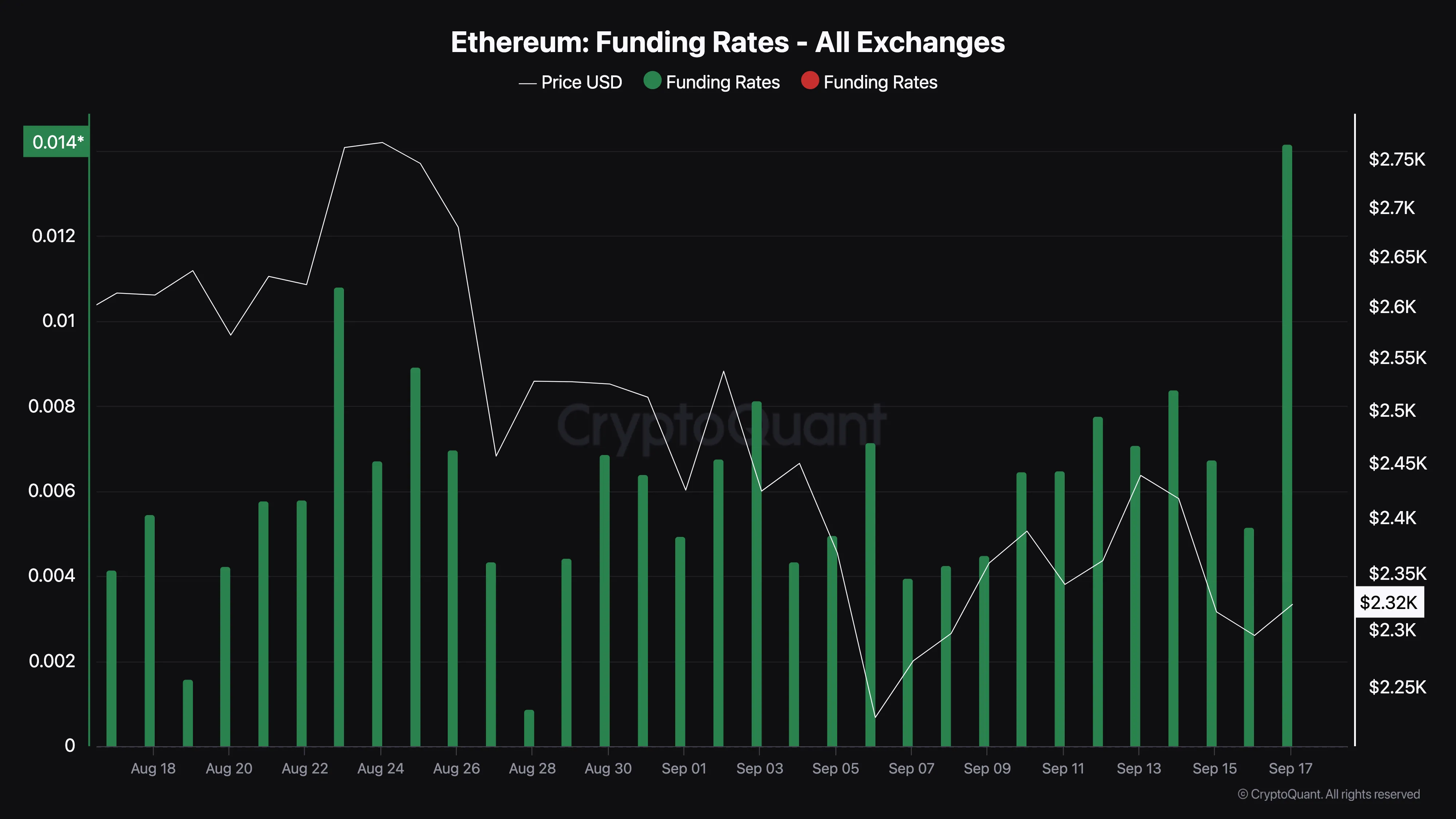

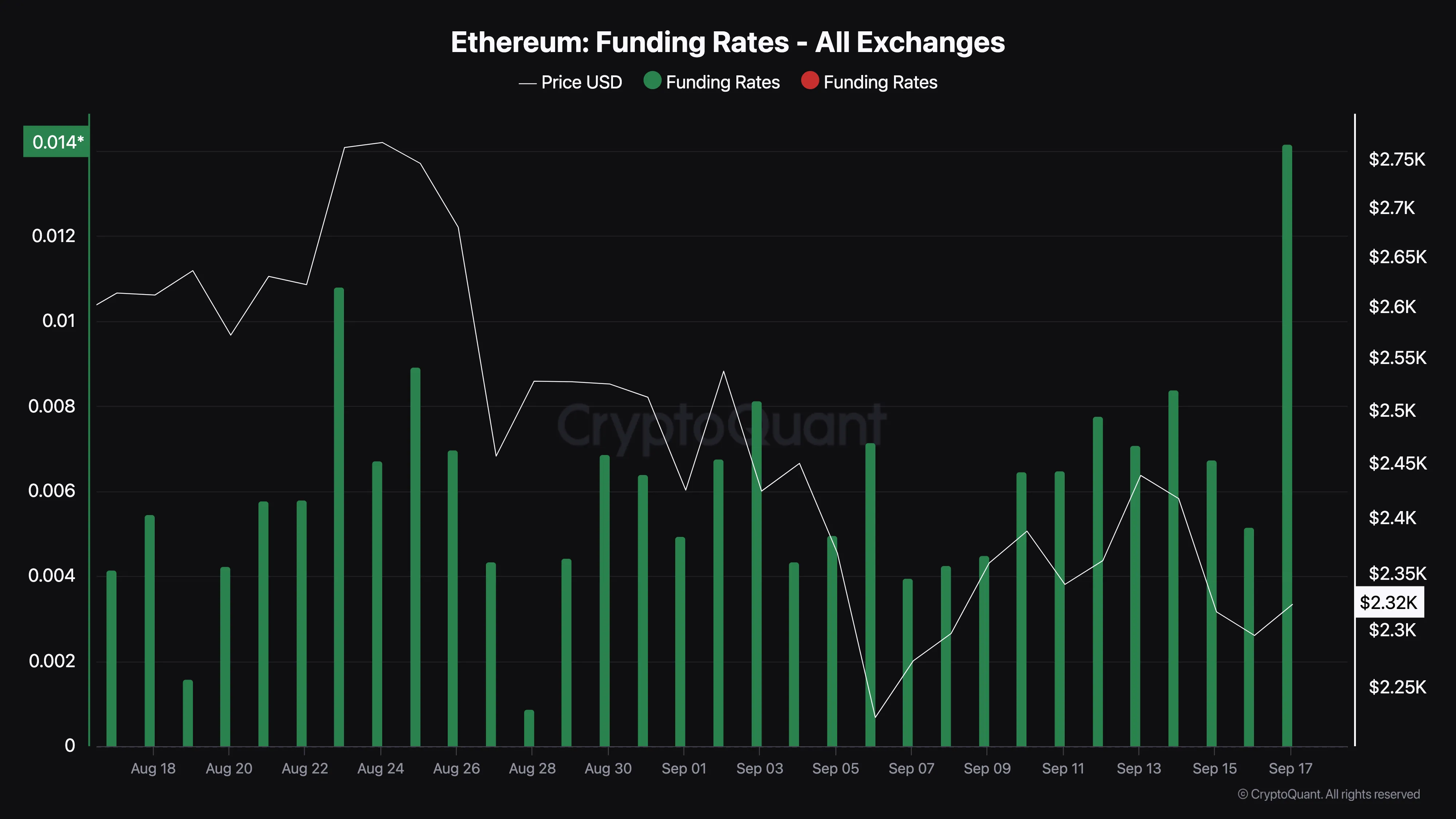

Current funding rates reflect this positive outlook. Negative funding rates signal bearish and short-selling sentiment, but ETH funding rates are very positive. This suggests that traders are willing to pay more to hold long positions, anticipating a rally to a record $2,800.

ETH Price Prediction: The Breakout Is Coming

Currently, Ethereum price is hovering around $2,310. On September 13, the altcoin attempted to break above $2,441 but was rejected. However, a bullish falling wedge pattern has formed on the daily chart, signaling a potential breakout.

A falling wedge occurs when the price forms lower highs and lower lows, creating a conical structure. If ETH breaks out of this pattern, it could suggest a strong rally.

The Balance of Power (BoP) indicator, which measures the strength of buyers versus sellers, supports a bullish outlook. The upward movement in the BoP suggests that buyers are currently in control, meaning the next target for Ethereum could be around $2,744.

In a strong bullish scenario, Ethereum could even surpass $2,800, reaching a high of $2,918. However, if bears regain control, the price could drop to $2,114, invalidating this optimistic forecast.